Are you considering dynamic pricing as your go-to for revenue optimization? Think again. While it promises transformative results, dynamic pricing, when poorly executed, can turn into a liability from an asset. Let’s understand why.

When relying solely on dynamic pricing algorithms with limited factors to set prices, you must be aware of the potential risks. Prices can spike or fluctuate unexpectedly, which could result in public outrage and negative media attention. It will confuse customers and make them lose trust in your brand as they switch to competitors with more reliable pricing, ultimately impacting your short-term profits and long-term success.

However, when implemented correctly, dynamic pricing offers many advantages. In this blog, we will explore the pros and cons of dynamic pricing models and help you decide if this is the right retail pricing strategy for you. Read along!

Dynamic pricing explained

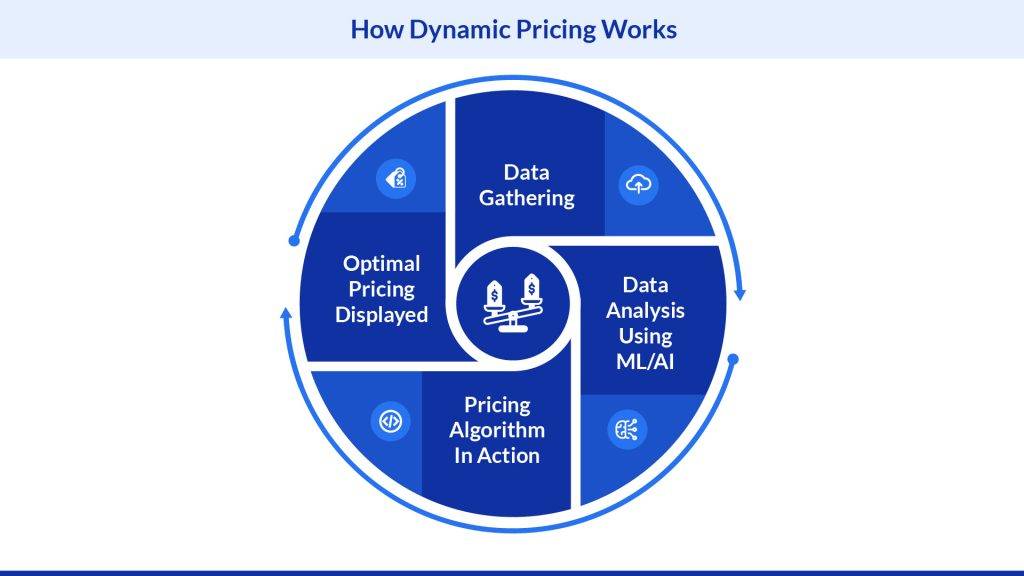

At its heart, dynamic pricing isn’t merely about shifting from fixed to fluctuating prices—it’s a strategic tool designed to optimize profit through continuous adaptation. But how does it adapt? Using data-driven analysis to continuously adjust prices based on various factors, such as customer behavior, competitor pricing, inventory levels, and market trends, to determine the optimal price for a product or service at any given time.

Dynamic pricing strategies generally fall into two main categories: target-oriented and time-oriented.

The target-oriented pricing approach focuses on understanding different customer groups to find out the maximum price they are willing to pay. This helps companies adjust their prices based on customer preferences, thus increasing potential profits.

Time-oriented pricing leverages temporal factors to maximize profits. Companies adjust prices based on seasonal trends or periods of high demand, taking advantage of time-sensitive opportunities.

Apart from looking at the demand, dynamic pricing also considers the competitive landscape and inventory level to suggest price changes and help retailers make informed decisions. By dynamically adjusting prices, businesses can optimize their pricing strategy and achieve better profitability.

Must Read: How Dynamic Pricing Solutions Leverage Machine Learning?

Benefits of dynamic pricing

Dynamic pricing strategies have become critical in the modern competitive landscape, providing businesses with many advantages. These include enhanced operational efficiency, increased profitability, and a better understanding of markets.

Dynamic pricing helps you optimize scenarios

At its core, dynamic pricing synergizes insights from product demand and consumer behavior, enabling prices to adjust in real-time. Industries that experience fluctuating demand can benefit from dynamic pricing. This way, businesses can raise prices in moments of high demand and reduce them during periods of low sales or increased competition. But it’s not just about responding to external market factors; it’s about understanding customers’ preferences to surpass competitors, offering superior experiences at more competitive prices.

The outcome? Enhanced sales, even in saturated markets. However, the true potential of dynamic pricing is maximized when historical customer data is combined with real-time pricing insights to determine the perfect price for each customer segment.

For instance, the dynamic pricing software by Flipkart Commerce Cloud uses ML algorithms and game theory principles to uncover intricate correlations between people’s purchasing decisions and specific market variables. The cutting-edge technology empowers businesses to craft highly effective dynamic pricing strategies.

Dynamic pricing lets you adjust pricing quickly

Dynamic pricing, driven by real-time algorithms, taps into the ever-changing market conditions and quickly adjusts prices to match demand. By taking advantage of this agility, companies can ensure they are always competitively priced for any given situation, avoiding too high or too low pricing errors and maximizing potential sales opportunities in the long run.

Dynamic pricing is a crucial tool for businesses that strike a balance between capitalizing on high-demand periods and stimulating sales during low demand. It can also help with rapid cost management, allowing companies to elevate prices when demand is high to offset production costs while lowering prices during downtrends to prevent overstocking and excess inventory.

Dynamic pricing gives you flexibility and control over your pricing

Changing climate, geopolitical conditions, and rapid technological advancements have all had a massive impact on the way consumers buy and what they expect. This has caused traditional supply chains to adapt quickly or become obsolete. With dynamic pricing, businesses can remain agile and adjust their focus to meet the ever-changing demands of consumers.

Dynamic pricing gives businesses the agility to focus on the most important elements to remain successful. Machine learning takes it a step further, where companies no longer have to guess what works best; instead, they can rely on sophisticated models that analyze market conditions and adjust prices with minimal effort. Operating in real-time dynamic pricing software allows businesses to optimize profitability without the burden of labor-intensive manual adjustments.

Dynamic pricing capitalizes on the market's ups and downs

Businesses often face the challenge of setting prices that are reasonable yet competitive. Dynamic pricing can help them overcome this obstacle by offering a solution that can adjust to market rhythms and changes. This helps businesses protect their margins and gain an edge over their competitors. With dynamic pricing, businesses can easily take advantage of special promotions, seasonal spikes, and sudden surges in demand – allowing them to capture increased sales and maximize profits.

Look at the airline or ride-sharing platforms like Uber, for example. Their pricing might be inconsistent, with ticket and ride costs sometimes dropping significantly. But this isn’t a coincidence – these are precise decisions based on complex algorithms that use data to find the perfect balance between price and demand. This differs from traditional pricing models, which don’t always hit the mark and could miss out on potential profits.

But with the right tools, such as FCC’s Dynamic Pricing solution, businesses gain better visibility into their pricing strategies, set intelligent business rules, access data more easily, and tailor prices to specific regions and markets.

Dynamic pricing helps manage inventory better

In the ever-changing world of commerce, effective inventory management is crucial, and dynamic pricing is a precise solution that businesses can use to balance their supply and demand.

For instance, if a particular product is experiencing high demand, businesses can increase its price to balance supply and demand, preventing stockouts and ensuring that customers are willing to pay the optimal price. On the other hand, if a product is not selling well, businesses can lower its price to stimulate demand and clear excess inventory.

This proactive approach to inventory management helps businesses reduce holding costs, minimize stockouts, and maintain a healthy balance between supply and demand.

Disadvantages of Dynamic Pricing

While dynamic pricing has its benefits, it is not without its challenges and potential drawbacks. A nuanced understanding of these issues is essential, along with strategic mitigations, to ensure that the benefits outweigh the risks.

Can be difficult to implement

Dynamic pricing is a great way to optimize profit and enhance competitiveness, but it isn’t easy. It requires sophisticated infrastructure, access to market trends, data analysis capabilities, and precise pricing algorithms. Without these, there is a chance of miscalculating key elements, which could negatively impact sales. Unfortunately, these resources may be out of reach for smaller businesses with limited resources. Fortunately, there are software solutions that can help bridge this gap so that dynamic pricing is accessible for all types of businesses.

With FCC’s guidance, businesses have access to valuable historical data and current market trends and benefit from customized strategies that help them transition from manual to automated, data-driven pricing. This ensures that every quote is competitive in the market and optimized for maximum profit.

Could cause customer dissatisfaction

Dynamic pricing can be both a blessing and a curse for businesses. It allows customers to get the best deal possible at any given time. It can win over loyal customers, but if customers feel they are being overcharged, it could hurt a business’s reputation. Customers may feel like they’re at the mercy of an unpredictable system, which can lead to concerns of unfairness or exploitation. To combat this, businesses must be transparent about price changes and showcase the associated benefits— such as discounts during off-peak times.

Yet, transparency alone isn’t the solution. Tools like The FCC’s dynamic pricing come with a highly customizable rule engine that takes inputs in terms of targets and guardrails to tailor the best pricing strategy for your business. With this, businesses can manage multiple categories and thousands of SKUs while adhering to clear pricing rules around high-value items to maintain customer trust and loyalty.

Extreme price fluctuations

In highly competitive markets, dynamic pricing can be a double-edged sword, leading to price wars. Companies should closely watch the competition and set minimum prices to protect their profits. Lowering prices too much may lead to competitors drastically reducing theirs and further cutting any potential margin. Raising prices may also prove unwise if competitors choose to raise their own or lower them even more, negating the anticipated increased profit margin.

Lastly, before introducing dynamic pricing, it’s important that businesses conduct thorough research to understand the market’s attractiveness towards such a model. Dynamic pricing can be a powerful tool for businesses selling first-need products with steady demand but might be risky for businesses where trust and price transparency are crucial for business success.

Crucial Factors every pricing manager must know about dynamic pricing

As a pricing manager, it is crucial to have a deep understanding of how dynamic pricing works and the factors that influence its effectiveness:

Supply and demand

Dynamic pricing is a key economic concept that links the cost of a product or service to the forces of supply and demand. When demand rises, and supply is limited, prices can be adjusted accordingly. This gives businesses more precise control over their prices in response to changing market conditions. Dynamic pricing is the cornerstone of FCC. For instance, when a flash sale on an eCommerce platform and interest in popular products increases, the platform gradually raises the prices to match the surge in demand (known as surge pricing).

Customer behavior

Customer behavior analysis is an important part of dynamic pricing that entails how customers interact with your offerings. FCC emphasizes segment-based pricing, adjusting the pricing of products based on various customer segments, such as purchasing history, geographical location, or other behavioral data.

Competitive pricing

Retailers need to remain competitive in the marketplace, and as such, they need a way to be aware of their competitors’ pricing strategies. FCC offers a custom solution for tracking and analyzing competitors, allowing retailers to adjust their prices quickly. This solution provides insights through triggers and alerts that can inform better pricing decisions with urgency, allowing retailers to create effective strategies in response to market changes.

Must Read: How To Use Competitive Pricing Strategy To Protect Your Margins?

Seasonality

Seasonal pricing is a great way to adjust the costs of products and services based on demand. Items like winter coats may be more expensive when the weather gets colder and cheaper during summer. FCC utilizes time-based pricing as a strategic measure to cope with varying demand patterns.

This pricing strategy is especially beneficial for industries that experience fluctuations in demand throughout the day or season. An eCommerce store, for example, could employ this technique to offer discounts during non-peak hours and increase prices slightly during evenings and weekends when online shopping increases.

Regulatory compliance

Adhering to local and international regulations is becoming increasingly important for retailers. Customer data must be safeguarded and used ethically to ensure compliance with industry standards. FCC provides a centralized platform that acts as a unified source of truth for all pricing processes, allowing teams to collaborate effectively while preserving knowledge and data integrity.

Elevate Your Pricing Strategy with FCC AI/ML Solution

Pricing Manager solution by Flipkart Commerce Cloud is a revolutionary AI/ML-backed solution that empowers businesses with unparalleled pricing insights and capabilities. Our pricing software analyzes vast data sets, including past sales records, market dynamics, competitor pricing strategies, and consumer patterns, and leverages AI algorithms and game theory techniques to suggest the best SKU-level and category-level prices. Here are some of the ways you can use our platform for product pricing:

- Use demand elasticity-based algorithms for optimizing margins & GMV.

- Scan for price & brand violations

- Optimize channel pricing and promotion strategies

- Compare assortment, exposure, and pricing to competitors’ offerings on various channels

- Deploy and manage multi-channel pricing strategies from a central solution

Our pricing algorithms have been built and improved over 14 years and are used by Flipkart and dozens of other retailers and brands worldwide. Businesses using FCC’s end-to-end price management have reported a 3-8% higher margin and a 2-5% improvement in GMV across categories.

Need help with your dynamic pricing? Talk to our experts today!