If you’ve ever found yourself checking the price of a flight ticket, only to witness a sudden surge in cost a few hours later, you’ve encountered the intriguing phenomenon known as dynamic pricing. In a world where the business dynamics are in a perpetual state of flux, the art of pricing has become a pivotal element for success. In this guide, we’ll take you through everything you need to know about dynamic pricing strategy for your business.

What is Dynamic Pricing?

Dynamic pricing, often referred to as surge pricing or real-time pricing, is a sophisticated pricing strategy that adapts product or service prices in real-time based on various factors. Instead of having fixed prices, businesses employing dynamic pricing use data-driven algorithms and technology to continuously adjust their prices to maximize revenue and stay competitive.

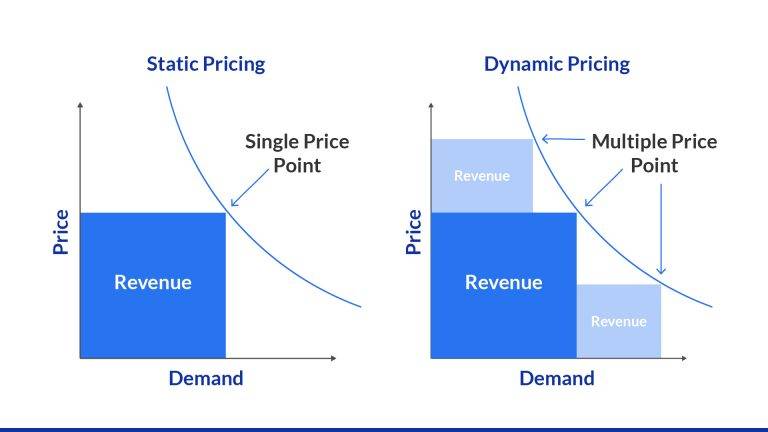

The below graph illustrates how dynamic pricing helps maximize revenue as compared to static pricing.

Types Of Dynamic Pricing Strategies

Dynamic pricing strategies offer a spectrum of techniques to optimize revenue and stay competitive. Let’s explore some of the most effective types of dynamic pricing strategies:

Time-based Pricing

Time-based pricing is a dynamic pricing strategy that involves adjusting prices based on specific time intervals. This strategy is particularly useful in industries where demand fluctuates throughout the day or season. Peak pricing is an intricate component of time-based pricing, coming into play during high-demand periods. Think of it as charging higher prices during holidays, events, or rush hours.

Imagine you’re an e-commerce retailer. During the holiday season, you might employ time-based pricing to offer discounts during non-peak hours and slightly raise prices during evenings and weekends when online shopping surges. This strategy not only caters to customer preferences but also optimizes revenue during peak shopping times.

Segmented Pricing

Segmented pricing is all about personalization. Businesses divide their customers into distinct segments based on various factors, including demographics, location, or purchasing history. Each segment is then presented with pricing that resonates with their preferences and purchasing power.

Consider a hotel chain using segmented pricing. They might offer discounts and special packages to loyal customers who frequently book rooms with them, while offering different rates to first-time guests. This tailored approach enhances customer loyalty and revenue simultaneously.

Price Discrimination

Price discrimination is the pinnacle of dynamic pricing, characterized by its ability to charge different prices to different customers for the same product or service. While this practice is illegal in some geographies, others have more permissive regulations surrounding price discrimination. Nevertheless, it is crucial to proceed prudently in order to uphold principles of fairness.

There are three degrees of price discrimination:

- First-degree price discrimination: This is the holy grail of personalized pricing, where businesses charge each customer the maximum price they are willing to pay. In practice, it’s rare due to the difficulty of determining individual price sensitivities.

- Second-degree price discrimination: Instead of customizing prices for individual customers, businesses offer various pricing tiers or packages. A classic example is streaming services like Netflix, where customers choose from different subscription plans based on their preferences.

- Third-degree price discrimination: This strategy involves segmenting customers into distinct groups based on observable characteristics such as age, income, or location. For instance, a theme park may offer lower admission prices for children and seniors, while charging higher rates for adults.

Demand-based Pricing

Demand-based pricing is the heartbeat of dynamic pricing. It involves adjusting prices in real-time based on market demand fluctuations. When demand surges, prices rise; when it wanes, prices drop.

For instance, picture an e-commerce platform during a flash sale. As interest surges for popular products, the platform subtly raises prices to align with the heightened demand. Once the event concludes, prices seamlessly revert to their standard levels, showcasing the agility and responsiveness that demand-based pricing offers.

The impact of elastic and inelastic demand on product pricing is profound. Demand-based pricing strategies prove most effective when applied to products with elastic demand, where changes in price significantly influence consumer buying behavior. In such cases, adjusting prices can lead to substantial shifts in demand, affecting overall revenue.

On the other hand, for products with inelastic demand, where price changes have minimal influence on consumer demand, demand-based pricing strategies are less effective as they may not result in significant revenue fluctuations. Instead, businesses often focus on optimizing prices through cost-based approaches or emphasizing product quality to maintain profitability in markets characterized by inelastic demand.

Dynamic Pricing Examples

Now that we’ve established the different types of dynamic pricing, let us dive into some examples of dynamic pricing.

Dynamic Pricing for Ride-sharing Services

The advent of ride-sharing platforms like Uber and Lyft has revolutionized urban transportation. These services heavily rely on dynamic pricing to manage the often unpredictable shifts in demand and supply. During peak hours or special events, prices for rides can surge significantly, encouraging more drivers to join the platform and cater to the increased demand. This surge pricing mechanism not only helps to ensure that rides are available when needed but also incentivizes drivers to operate during high-demand periods.

However, ride-sharing companies walk a fine line when implementing dynamic pricing. While it can boost profits during peak times, excessive pricing can lead to backlash from customers who perceive it as exploitative. Finding the right balance between maximizing revenue and maintaining customer satisfaction remains a continuous challenge in the ride-sharing industry.

Dynamic Pricing for Hotels and B&B Services

Hotels and BnB service providers also utilize dynamic pricing strategies to adjust room rates according to fluctuating demand. Different factors influence pricing decisions in hospitality industry, such as local events, holidays, seasonal variations, and even weather conditions. Dynamic pricing allows accommodation providers to cater to a diverse range of guests, from business travelers seeking last-minute rooms to vacationers planning ahead.

Additionally, these businesses often collaborate with online travel agencies and platforms to gather market data and insights. By analyzing booking patterns and competitor pricing, they can set optimal prices for their rooms, maximizing occupancy rates and revenue. While dynamic pricing presents an opportunity for increased profitability, it requires a thorough understanding of market dynamics and a willingness to adapt to changing circumstances.

Dynamic Pricing for Airlines

Airlines have long been pioneers in the dynamic pricing arena. The complex and highly competitive nature of the airline industry, coupled with fluctuating fuel costs and evolving consumer behaviors, makes dynamic pricing an essential strategy. Airlines adjust ticket prices based on factors like booking time, day of the week, route popularity, and seat availability.

Notably, airlines employ highly sophisticated revenue management systems that analyze vast amounts of data to optimize pricing strategies. These systems take into account historical data, seasonal trends, and predictive models to ensure that each flight’s seats are priced optimally. By dynamically pricing their offerings, airlines can achieve higher revenue and, paradoxically, offer more diverse price options to cater to different customer segments.

Dynamic Pricing for E-commerce Businesses

Dynamic pricing has become a cornerstone strategy for many ecommerce businesses aiming to optimize revenue while staying competitive. Here are some of the factors that can be considered when using dynamic pricing strategy in e-commerce:

- Supply and demand: The price of a product or service can be adjusted based on the supply and demand for that product or service. For example, if the demand for a product is high and the supply is low, the price can be raised.

- Competitor prices: The price of a product or service can also be adjusted based on the prices of competing businesses. For example, if a competitor lowers their prices, the business may lower its prices to match.

- Customer behavior: The price of a product or service can also be adjusted based on customer behavior. For example, if a customer has previously purchased a product at a certain price, the business may be less likely to raise the price for that customer.

- Seasonality: The price of a product or service can also be adjusted based on seasonality. For example, the price of a winter coat may be higher in the winter than in the summer.

- Time of day: The price of a product or service can also be adjusted based on the time of day. For example, the price of a hotel room may be higher on weekends than on weekdays.

- Segment-based pricing: The pricing of the product can be adjusted based on various customer segments, such as purchasing history, geographical location or other behavioral data like website visits, product viewed or added in the cart.

Benefits of Dynamic Pricing

Dynamic pricing strategies offer a range of advantages to businesses. From improving operational efficiency to increasing revenue and market understanding, dynamic pricing has become a crucial tool in today’s competitive landscape.

Save Time

The time-saving aspect of dynamic pricing cannot be overstated. In a business environment where every minute counts, the automation of pricing adjustments is a game-changer. Consider e-commerce, where a vast product catalog demands constant price vigilance. Dynamic pricing algorithms meticulously handle this task, freeing up precious human resources for strategic endeavors. This efficiency is not just about saving time but also about redirecting human capital toward value-adding activities, such as customer engagement and innovation.

Increased Revenue & Profit

Dynamic pricing is not merely about reacting to market changes; it’s about precision in pricing. It allows businesses to optimize revenue by setting prices that align with the ever-changing supply and demand dynamics. During peak demand periods, prices can be adjusted upwards, maximizing profitability. Conversely, during off-peak times, competitive pricing can be maintained to capture a broader customer base. The result is a substantial boost in the bottom line—a testament to the power of data-driven decision-making.

Better Market Understanding

Dynamic pricing thrives on data analysis. The constant flow of data from sales, competitors, historical data (3-4 years) and market trends offers businesses a deeper understanding of their ecosystem. This real-time market intelligence is invaluable. It not only informs pricing decisions but also shapes product development and marketing strategies.

Furthermore, robust dynamic pricing software lets businesses A/B test on different pricing models. These experimentations help businesses gain actionable insights into how different pricing approaches impact customer behavior and ultimately sales and revenue. By staying attuned to consumer behavior, industry trends and competitor movements, businesses can pivot proactively, transforming insights into actionable strategies.

Respond Dynamically to Market Changes

Market conditions are increasingly unpredictable, requiring businesses to be agile and adaptable. Dynamic pricing is the embodiment of this agility. When a competitor drops their prices, a business employing dynamic pricing can respond in real-time to remain competitive. During periods of high demand, prices can be elevated, capitalizing on increased revenue potential. This ability to pivot swiftly is a distinct advantage in a world where change is the only constant.

Disadvantages of Dynamic Pricing and Strategic Mitigations

While dynamic pricing has its benefits, it is not without its challenges and potential drawbacks. A nuanced understanding of these issues is essential, along with strategic mitigations to ensure that the benefits outweigh the risks.

Customers Perception Might Get Affected

Dynamic pricing can trigger concerns of unfairness or exploitation among some customers. The perception that prices are constantly in flux can be unsettling. To address this, transparency is key. Businesses should communicate their pricing strategies clearly, providing customers with context for price fluctuations. Offering discounts during off-peak times and emphasizing the value customers receive can help alleviate these concerns, fostering trust.

Furthermore, using advanced pricing optimization software like FCC’s Pricing Manager will help you mitigate these drawbacks of dynamic pricing. The software allows businesses to set KVCs, the most valuable categories, and KVIs, the products in these categories driving the most perceived value. Businesses can then set pricing rules to manage these high-value items and ensure customers’ preferences for KVI products remain intact.

May Lead to Price Wars

In intensely competitive markets, dynamic pricing can inadvertently spark price wars as competitors engage in a relentless race to the bottom. To avoid this scenario, businesses should engage in vigilant monitoring of competitor pricing and consider setting price floors to maintain profitability. Collaboration through pricing agreements with competitors, although a fine line to tread legally, may also help stabilize prices.

Can Be Difficult to Implement

The implementation of dynamic pricing requires a sophisticated infrastructure, access to market data trends, robust data analytics capabilities, and advanced pricing algorithms. Smaller businesses with limited resources may find this a daunting task. The solution lies in leveraging third-party pricing software solutions or consulting services specialized in dynamic pricing strategies. Collaboration with experts can make this powerful tool accessible to a wider range of businesses.

The Crucial Role of Machine Learning-Based Pricing Software

As businesses look beyond traditional approaches to pricing, advanced solutions like FCC’s pricing engine help them maximize their efforts. These advanced tools leverage intricate machine learning algorithms to uncover optimal pricing strategies, a feat that would be nearly impossible to achieve through manual means alone. By tapping into a wealth of data and deciphering complex patterns, machine learning algorithms can precisely measure customers’ willingness to pay, a fundamental aspect of pricing strategy.

Here’s how ML-based pricing helps businesses:

Personalized Pricing: Machine learning algorithms can analyze vast amounts of customer data, including past purchasing behavior, demographics, and browsing history. With this information, businesses can create highly personalized pricing strategies. This means offering discounts or promotions that are specifically tailored to individual customers, increasing the likelihood of conversion and customer loyalty.

Real-time Market Response: Unlike traditional pricing models that rely on historical data, machine learning pricing systems can adjust prices in real-time based on market conditions. This allows businesses to respond swiftly to changes in demand, supply, or competitor pricing. For example, during sudden spikes in demand, prices can be adjusted upwards to maximize revenue.

Dynamic Inventory Management: Machine learning can help optimize inventory management by predicting demand for specific products. When combined with pricing algorithms, businesses can strategically adjust prices to clear excess inventory or maximize profits during periods of high demand. This prevents overstocking or stockouts, reducing carrying costs and lost sales.

Competitor Price Tracking: Machine learning-based pricing can continuously monitor competitor prices across multiple channels and adjust prices accordingly. This competitive pricing intelligence helps businesses maintain competitiveness while avoiding price wars. By intelligently pricing products just below or above competitors, companies can capture market share and protect profit margins.

A/B Testing and Experimentation: Machine learning enables businesses to conduct A/B testing and experimentation with pricing strategies at a large scale. This means trying out different pricing approaches with subsets of customers and quickly identifying which strategies yield the best results. It’s a data-driven way to fine-tune pricing strategies for maximum effectiveness.

However, relying on only Machine Learning techniques to set optimal pricing is not enough, manual interventions are needed to tackle unexpected circumstances. Human interventions are required to ensure long-term business goals are appropriately met.

At Flipkart Commerce Cloud, we understand the nitty-gritty of building a holistic pricing strategy; that’s why we offer a hybrid solution with rule-based control on top of the advanced ML solution, ensuring your business objectives are never compromised. – more on this in our next section.

How Does FCC’s Dynamic Pricing Engine Work?

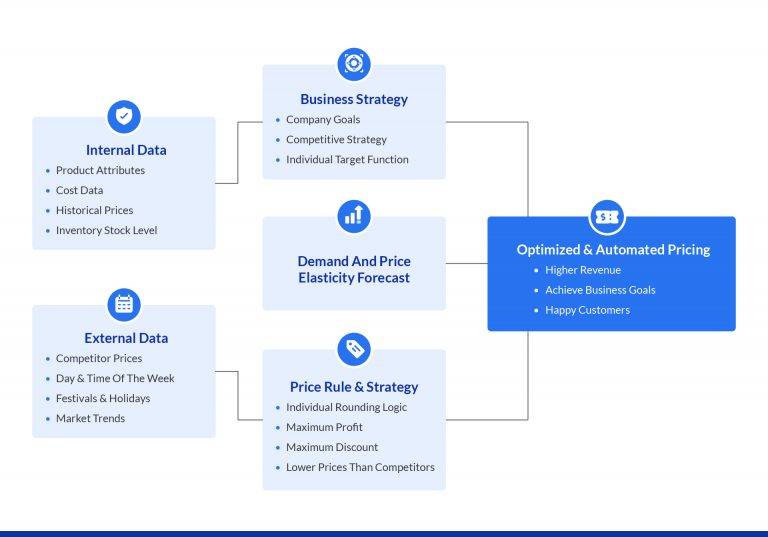

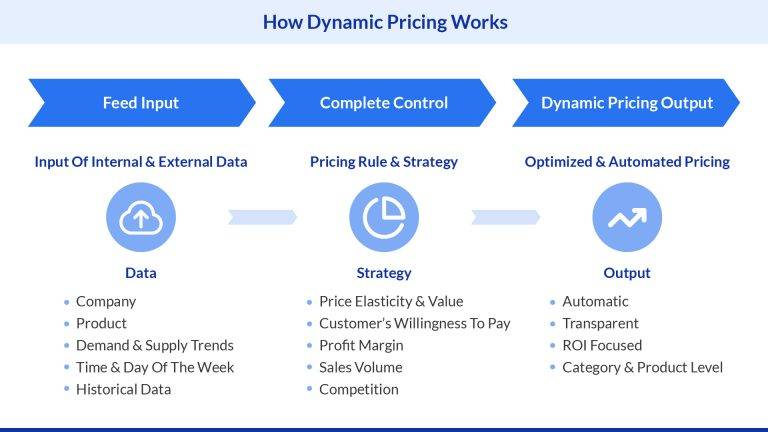

Dynamic pricing relies on a complex interplay of data analysis, market conditions, and customer behavior. Here’s a simplified breakdown of how it works:

- Data Collection: Businesses gather a vast amount of data, including historical sales data, competitor pricing, demand patterns, customer demographics, and even external factors like weather or events.

- Algorithmic Analysis: Advanced algorithms analyze this data in real-time. They identify trends, seasonality, and factors that influence purchasing decisions.

- Pricing Adjustments: Based on the insights gained from data analysis, the pricing algorithm adjusts prices accordingly. Prices can be increased or decreased, and discounts or promotions can be applied, all in real time.

- Continuous Monitoring: The dynamic pricing system continuously monitors market conditions, competitor pricing, and customer responses to refine pricing strategies further.

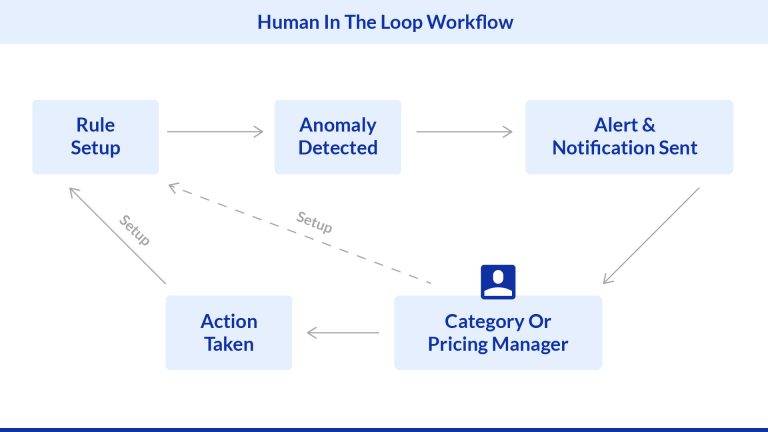

- Anomaly detection and alerts: The software detects anomalies in pricing and raises alerts to category managers to investigate promptly, ensuring pricing accuracy and integrity.

- Human-in-the-loop interventions: The businesses can set up guardrails and approval flows to tackle sudden changes in pricing that do not align with their long-term business goals. This involves human interventions to review and approve pricing adjustments in certain cases.

- Optimization: The ultimate goal is to find the sweet spot where prices are maximized while still appealing to customers. This often involves testing different price points to find the optimal balance.

The Do’s & Don’ts of Dynamic Pricing Strategy

Dynamic pricing is a powerful tool, but to wield it effectively, businesses must navigate a careful path. Here are the key do’s and don’ts to consider when implementing a dynamic pricing strategy.

Do’s:

- Analyze Data Thoroughly: Utilize data analytics to gather insights into customer behavior, market trends, and competitor pricing. A deep understanding of your market is essential for effective dynamic pricing. FCC’s dynamic pricing engine collects data from diverse sources, conducts thorough data hygiene and utilizes advanced analytics to gain pricing insights.

- Set Clear Objectives: Define your pricing goals. Whether it’s maximizing revenue, increasing market share, or clearing inventory, having clear objectives will guide your pricing decisions. Category wise goals have to be defined to help build a granular strategy.

- Segment Your Customers: Create customer segments based on factors like demographics, purchase history, and behavior. Tailor your pricing strategies to each segment to maximize their perceived value.

- Monitor Competitor Pricing: Keep a close eye on your competitors’ pricing strategies. Dynamic pricing should not be a reaction but a proactive approach to stay competitive.

- Use Real-Time Data: Implement pricing updates in real-time or as close to real-time as possible. Market conditions can change rapidly, so timely adjustments are crucial.

- Implement Price Testing: A/B test different pricing strategies to see which ones yield the best results. Experimentation can help you fine-tune your dynamic pricing approach.

- Communicate Changes Transparently: If prices fluctuate frequently, be transparent with your customers. Explain the reasons behind price changes to build trust.

Don’ts:

- Overcomplicate Pricing: Avoid overly complex pricing algorithms that are difficult to manage or understand. Simplicity often leads to more effective dynamic pricing.

- Ignore Legal and Ethical Considerations: Be mindful of legal and ethical considerations when implementing dynamic pricing. Understand pricing regulations in your industry and region, avoiding practices that could harm your brand’s reputation. Note that while most dynamic pricing applications are legal and widely accepted, there are legal limits, such as the prohibition of price hikes during emergencies in the U.S. and restrictions on exploiting dominant market positions.

In Europe, compliance with data protection laws like the GDPR is crucial, requiring customer consent for personalized pricing based on personal data. Always ensure your dynamic pricing strategy operates within legal and ethical boundaries to maintain trust and credibility. - Discount Too Aggressively: Continuous deep discounting can devalue your products or services. Reserve heavy discounts for strategic occasions.

- Neglect Customer Perception: Consider how price changes affect customer perception. Rapid and frequent price fluctuations can confuse and alienate customers.

- Lose Focus on Quality: Don’t sacrifice product or service quality for the sake of lower prices. Value should always be part of the equation.

- Ignore Customer Feedback: Pay attention to customer feedback and adjust your pricing strategy accordingly. Customer satisfaction should be a priority.

Use FCC’s Dynamic Pricing Engine

FCC’s Dynamic Pricing Engine stands as a sophisticated solution that equips businesses with a comprehensive set of tools for optimizing their dynamic pricing strategies. At its core, the engine leverages advanced AI and machine learning algorithms to meticulously analyze market data, providing invaluable insights into demand patterns. This empowers businesses to make well-informed pricing decisions that align with market dynamics. One of its notable features is the ability to implement real-time price updates, ensuring that product prices remain accurate and competitive.

Furthermore, FCC’s offering distinguishes itself by providing businesses with customizable pricing rules, granting them greater control and flexibility in shaping their pricing strategies. The user-friendly dashboards and insightful analytics reports are easy to use and can be scaled to an unlimited number of products and categories, which allow businesses to continuously evaluate pricing performance and make strategic refinements.

With the FCC Retail Media Solutions, businesses are poised to increase sales by staying agile and responsive in an ever-changing marketplace.

Need help with your dynamic pricing? Talk to our experts today!