On June 7, 2022, World Bank predicted a rather ominous economic year for the world.

Global growth is expected to slump from 5.7 per cent in 2021 to 2.9 per cent in 2022— significantly lower than the 4.1 per cent that was anticipated in January.

This announcement further emphasised the fears of economists and consumers around the world. Some major developed economies had their own share of fuel costs crisis and commodity shortages flagging the fear of a food crisis in Europe.

The American Shipper reported an all-time high peak in fuel prices during the Russia – Ukraine war. It doesn’t matter which side of the world you belong to as a retailer, rising fuel costs mean one thing for business – a higher cost of doing business.

And if the economic bodies are to be believed, we are in for another recession.

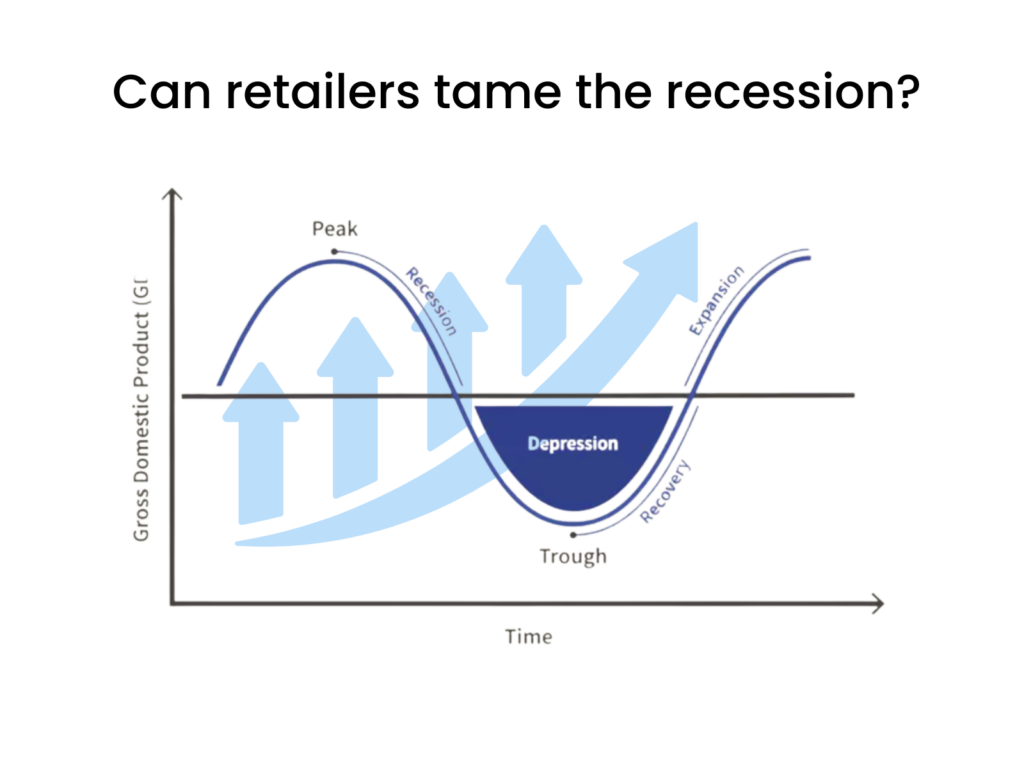

Higher costs and lower economic productivity has an ominous one-term description – Stagflation, a situation that the US economy is experiencing currently. Historically, such downturns have loomed on consumer goods and intermediate goods trade since the great depression, intermittently. The effects have been most pronounced in a post-globalisation world. Interdependent economies have led to an international impact as was observed during the downturn of 2007 – 2009. Retailers around the world are keeping an eye on the crashing markets and adapting to the economic situation. Here are some mitigating steps and useful information that retailers across the globe can include in their long-term retail strategy to cushion themselves from the impact of the predicted recession.

Tailored Retail Strategy: Inflation will Hit Different Regions Differently

The current economic situation is the consequence of various world crises: incumbent and new. Economies were still reeling under the supply chain disruption caused by the pandemic. The Ukraine war intensified the situation, causing geopolitical disparities between different consumer geographies. The SEA, Europe and North America are all inflation hit. But not all inflations are the same.

Manufacturing, Agricultural economies & Consumer hubs like India and China will have stocks of intermediate goods and capital goods but consumer goods and brands may become sparse due to higher import duties.

Retailers in each geography will have to customise their own action plans. Depending on if they are dealing with higher costs in fuel prices and local transport or if they have a problem in procuring finished goods. Each market will see different trends in supply and demand.

Customer data will also be key to deciding the behaviour of the customers.

It would be wise to take a stock of the situation at a micro-scale rather than jumping to conclusions. Planning is key. Planning with insightful expertise & predictive technology will make a huge difference to the top line and bottom lin

Some Local Brands & D2C Brands may Flourish

Direct-to-consumer (or D2C) companies manufacture and ship their products directly to buyers without relying on traditional stores/ aggregators. This allows D2C companies to sell their products at lower costs than traditional consumer brands, or marketplaces and retailers, and to maintain end-to-end control over the making, marketing, and distribution of products.

Since D2C brands tend to source locally and sell locally to reduce costs and find loyal customer groups, the changing freight prices may make little or no difference to them.

D2C brands could see more traction during the downturn. Direct-to-consumer brands have a very personalised audience set, owing to the limitations and the benefits of the D2C model. Lifestyle brands and consumer goods may see a segment of ‘Well to do’ and ‘Live for today’ customers flocking to them even in the hard times. Their GTM is virtually immune to the recession, so are the customer groups they target. The purchasing power of their target groups is not affected by the downturn in the markets. Also, lower costs than traditional retail give them the competitive edge to do better.

Retail Pricing Matters: Raising Prices Without Price Skimming

When retailers raise prices, they are choosing short-term profits over customer loyalty but in times of crisis, customers do understand a reasonable and transparent rise in prices. The Caveat ‘ Pricing Perception’. Price skimming does not establish trust with your customers, thus it’s advisable to apply data and analytics to your pricing management and strategy execution and reduce the experimentation especially if it comes at the cost of your customers.

As fuel prices rise and shipping companies optimise the costs, some stocks become rare. The onus then falls on the Planning & Pricing teams to figure if they want to raise prices as demands increase and supplies run drab or if they want to hold on to the erstwhile marked and advertised prices. This is a tricky situation and requires insights into the bigger picture that includes market trends, competitive intelligence and risk calculation by domain experts or advanced pricing and planning tools. It is a good time to have your data and data management teams secure, robust and instantly accessible. Raising prices should work fine with customers when you understand the segments targeted and category-wise dynamics. But remember, being upfront and straightforward is key. Let all your experimentation be replaced by smart strategic moves ( using automation, domain expertise or both.).

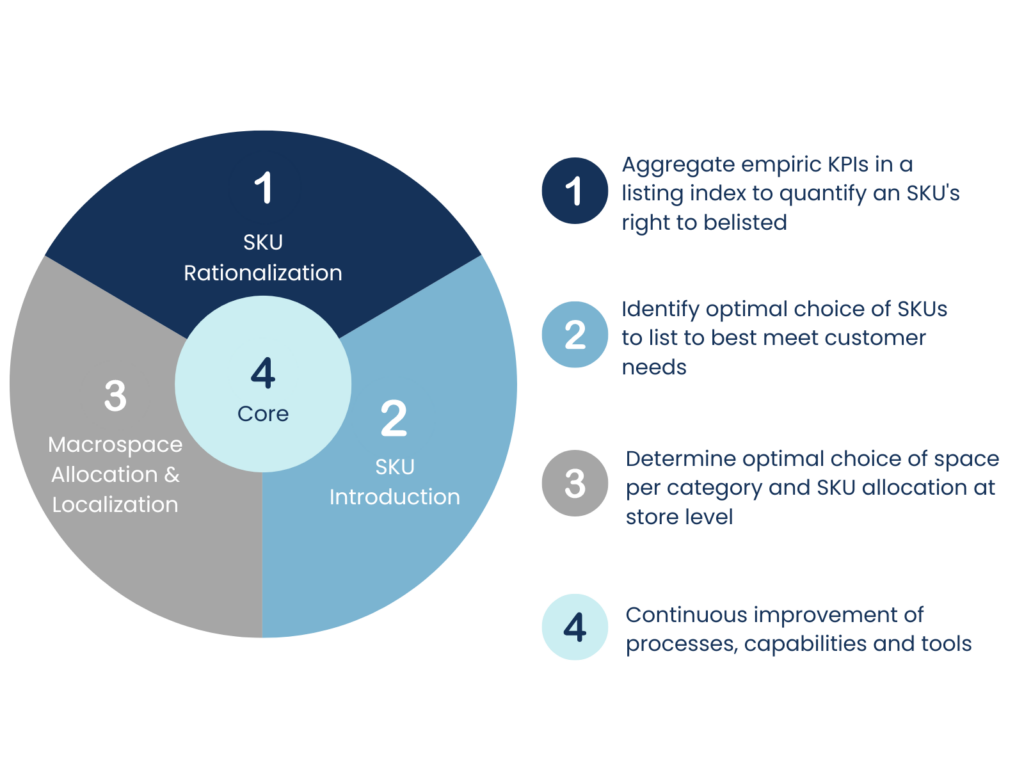

Traditional Assortment Planning – Using Modern Tools

When the demand is declining, one of the crucial elements is to increase focus on key product lines and reduce complexity by cleaning up non-performing or trivial differential products. This would not only help to save on marketing costs but also improve working capital as at times slow-moving inventory becomes the biggest hurdle.

One of the things to keep in mind while reducing product lines is to ensure that we do not remove or rather close the innovation pipeline. Innovative products and improvements grab customer attention and drive purchases.

Striking the right balance is easy with some insights from modern planning tools that take a stock of multiple factors and data points to devise the best retail strategy, specific to concerned retail value chains. You can implement Selection Management tools or use a team of risk analysts and planners for the same.

Building Trust With Customers

Fortunately, despite current times customers still feel connected to known and trusted brands. They present as safe choices. Thus, rekindling this comfort zone is the need of the hour by demonstrating empathy, reassuring messaging, and reinforcing the point that we’re all in this together and will come out of it together as well. Quite a few brands have, in fact, pivoted their print ads to resonate with every customer segment showcasing that their products are ideal for anyone in any kind of economy. Rewarding frequent customers for their loyalty instead of reducing the quality of products in the face of declining sales is the smarter move. Remind customers why going with your brand is the trusted and safe choice. Building trust and retaining customers is a smart decision considering the overall retail strategy.

Surviving the Recession and the Path to Recovery

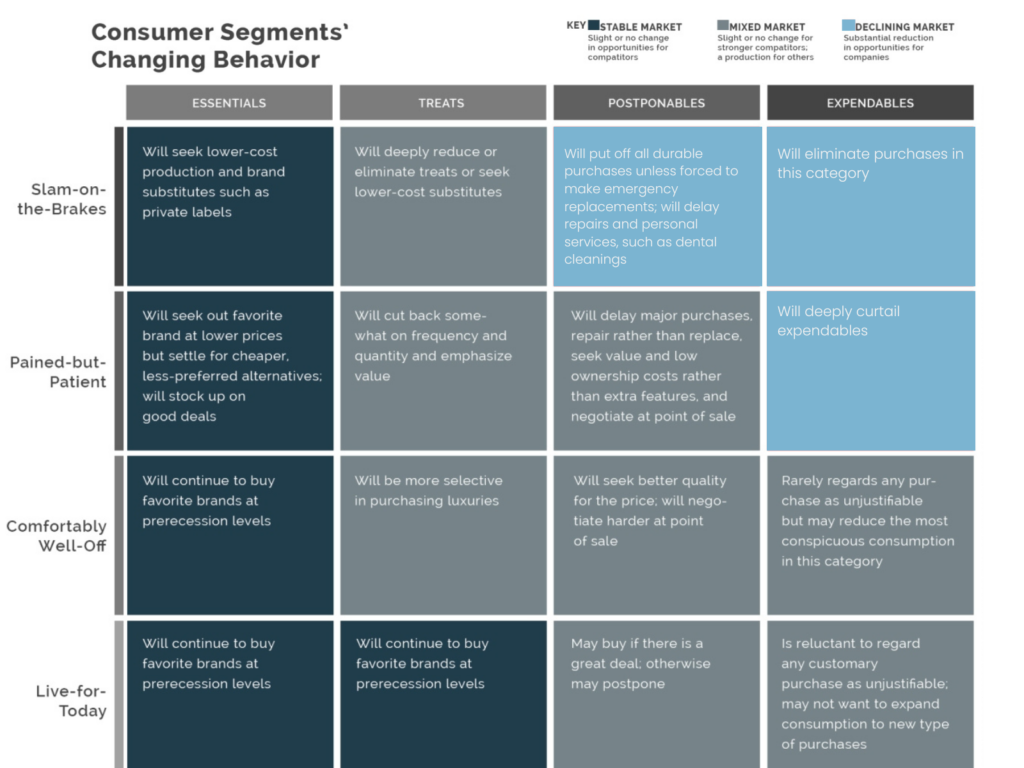

Brands and consumers alike will not come through this recession unscathed. Naturally, consumers are bound to undergo a drastic behavioural change. It would behove companies to monitor and understand these changes and offer products through messaging that resonates with the revised needs of consumer segments.

However, companies should also note that consumer behaviour is likely to bounce back to normal in some time. This time period can range from 1-2 years to almost a decade depending on how pervasive and transformative the recession has been. Unfortunately, the current recession has been uncharacteristically severe and ravaging. It can be safely presumed that consumer needs and behaviour, especially for the less well-off segments, are unlikely to revert to normal any time soon nor will their fear of economic vulnerability dissipate in a short span of time. Thus, they may tend to distrust businesses under the impression that they are only looking to make a quick buck at their expense. Trust is to be retained along with revenue and a well-formulated retail strategy will help you do exactly that.

The prudent move will be to prepare for a long shift of base in consumer behaviour. This can be done in multiple ways. Fortunately, this recession has taught businesses to respond quickly to unforeseen changes in demand. This adaptability and perception will also guide businesses’ post-economic recovery.

Stay optimistic retailers, we will get through!