As per Insider Intelligence’s projections, online retail is anticipated to account for 24% of all purchases by 2026. Given the escalating competition in this arena, one crucial factor that sets brands apart in the e-commerce realm is their pricing strategy. The days of setting fixed prices and forgetting about them are long gone. Today, businesses must swiftly adapt their pricing tactics to remain competitive and optimize their earnings. This is where dynamic pricing solutions step in, and increasingly, they are tapping into the potential of machine learning to transform the pricing landscape.

In this blog post, we delve into how dynamic pricing solutions utilize machine learning to enhance sales performance.

What is a Dynamic Pricing Algorithm?

At its core, a dynamic pricing algorithm is the foundation of any dynamic pricing strategy. This algorithmic marvel is the digital brainpower that takes data inputs with instruction, understands the requirements, and transforms them into the optimal price for a product or service. All the while, skillfully managing the delicate equilibrium between boosting a retailer’s profits and ensuring the contentment of customers.

These dynamic pricing algorithms are data-driven powerhouses. They tap into an extensive reservoir of information, such as historical data on product prices, production costs, prevailing market trends, and even the intricate purchasing behaviors of customers. However, their prowess doesn’t stop there.

In today’s digital age, these algorithms have matured to include real time data from external and internal sources like competitors’ pricing, market sentiments and inventory stock levels. This real-time data is harvested from various online sources, facilitated by advanced tools such as web scrapers, web scraping APIs, and resourceful RPA bots.

The fundamental concept behind a dynamic pricing algorithm is encapsulated in the following formula, which aims to determine the best pricing of the product based on suggested rule:

P* = argmax p * d(p)

Breaking down this formula:

- p represents the price assigned to the product or service.

- d(p) signifies the level of demand for the product or service at the given price p. It quantifies how many units will be sold at that particular price point.

- argmax is a symbol denoting the argument that yields the maximum value for a function. In this context, it identifies the price that will maximize the product of the price itself and the corresponding demand (p * d(p)).

Why Dynamic Pricing Algorithms Matter

The adoption of dynamic pricing algorithms has become increasingly prevalent across various sectors, including e-commerce, hospitality, transportation, and more. Here’s why they matter:

Competitive Edge: In today’s cutthroat markets, businesses must stay agile. Dynamic pricing algorithms allow them to respond swiftly to changing market dynamics and outmaneuver competitors.

Optimized Revenue: These algorithms are designed to maximize revenue. By adjusting prices based on real-time demand and supply conditions, businesses can capture the full value of their products or services.

Improved Customer Experience: When done right, dynamic pricing can also benefit customers. Prices can be more aligned with market conditions, offering better value for consumers.

Data-Driven Decision Making: Dynamic pricing algorithms are data-driven. They provide insights into market trends, customer behavior, and the effectiveness of different pricing strategies, enabling businesses to make more informed decisions.

Must Read: 9 Dynamic pricing examples across industries

Rule-based Vs Machine Learning-based Dynamic Pricing: The Two Types

When it comes to dynamic pricing, there are two distinct approaches: rule-based and machine learning-based.

Rule-Based Dynamic Pricing

Rule-based dynamic pricing is a pricing strategy where pricing decisions are determined by a predefined set of rules, conditions, or algorithms. In rule-based dynamic pricing, the pricing system automatically adjusts product or service prices in response to specific triggers, such as changes in demand, inventory levels, competitor pricing, or time of day.

For example, a rule-based dynamic pricing strategy for an airline might include rules like increasing ticket prices as the departure date approaches or reducing prices during off-peak travel times.

Pros of Rule-Based Dynamic Pricing

Transparency: Rule-based pricing is easy to understand and explain. Businesses can clearly define the rules and logic behind their pricing decisions, which can help build trust with customers.

Control: Businesses have full control over the pricing rules and can easily make adjustments as needed. This can be especially useful in highly regulated industries or when specific pricing strategies need to be implemented.

Predictability: Since rule-based pricing relies on predefined rules, it is more predictable and stable compared to machine learning-based pricing.

Cons of Rule-Based Dynamic Pricing

Limited Adaptability: Rule-based pricing may not adapt well to rapidly changing market conditions or unexpected events. It may miss opportunities to optimize pricing based on real-time data.

Lack of Personalization: Rule-based pricing may not be as effective in personalizing pricing for individual customers, as it relies on generalized rules.

Machine Learning-based Dynamic Pricing

Machine learning-based dynamic pricing, on the other hand,leverages advanced algorithms and artificial intelligence to make real-time pricing decisions. This approach involves analyzing vast amounts of data, including historical sales, competitor prices, customer behavior, and market trends. Machine learning algorithms then use this data to identify patterns and correlations that guide pricing strategies. The model continuously learns and adapts, optimizing prices for maximum revenue and profitability.

Pros of Machine Learning Dynamic Pricing

Adaptability: Machine learning algorithms can quickly adapt to changing market conditions, making them more effective in optimizing prices in real-time.

Personalization: Machine learning can analyze customer data to provide personalized pricing, increasing the likelihood of conversion and customer satisfaction.

Accuracy: Machine learning algorithms can identify subtle pricing patterns and correlations that may be missed by rule-based systems, leading to more accurate pricing decisions.

Cons of Machine Learning Dynamic Pricing

Complexity: Machine learning-based pricing can be complex to implement and may require significant data and computational resources.

Initial Investment: Implementing machine learning-based pricing may require a higher initial investment in technology and expertise.

Here’s a quick look at the difference between rule-based and machine learning-based dynamic pricing:

Aspect

Rule-Based Dynamic Pricing

Machine Learning Dynamic Pricing

Pricing Approach

Relies on predefined rules and algorithms for pricing decisions.

Uses advanced algorithms and AI to make real-time pricing decisions.

Transparency

Transparent and easy to understand.

May lack transparency due to complex algorithms, requiring education.

Adaptability

Limited adaptability to changing market conditions and real-time data.

Highly adaptable, quickly adjusting to market changes and customer behavior.

Personalization

Limited personalization, as it follows generalized rules.

Offers personalized pricing based on customer behavior and preferences.

Accuracy

Less accurate in capturing subtle pricing patterns and correlations.

Accurately identifies pricing patterns and correlations for optimal pricing decisions.

Initial Investment

Generally requires lower initial investment in technology and expertise.

Requires higher initial investment in technology and expertise.

Data Dependency

Less dependent on large amounts of real-time data for decision-making.

Relies on extensive data for accurate predictions and real-time decisions.

Control

Businesses have full control over pricing rules and adjustments.

May require more monitoring and management due to autonomous nature.

Market Predictability

More predictable and stable, as it follows predefined rules.

Rapidly adapts to changing market conditions for better predictions.

FCC’s dynamic pricing engine combines the power of machine learning with human pricing expertise. Through well-defined internal rules, pricing experts can ensure that algorithmic outputs are precise, effective, and in line with business strategy. This feature enables businesses to optimize pricing using both human insights and efficient algorithms, achieving adaptable pricing decisions that match market changes and business objectives.

Now that we have looked at the differences between the two types of dynamic pricing approaches, let us dive deeper into the different models used in the ML approach.

Dynamic Pricing Algorithm Models

In the dynamic pricing landscape, three notable models have garnered significant attention: the Bayesian model, the reinforcement learning model, and the decision tree model. Let’s dive deeper into the intricacies of these dynamic pricing models to gain a more profound understanding of their inner workings and the strategic advantages they offer.

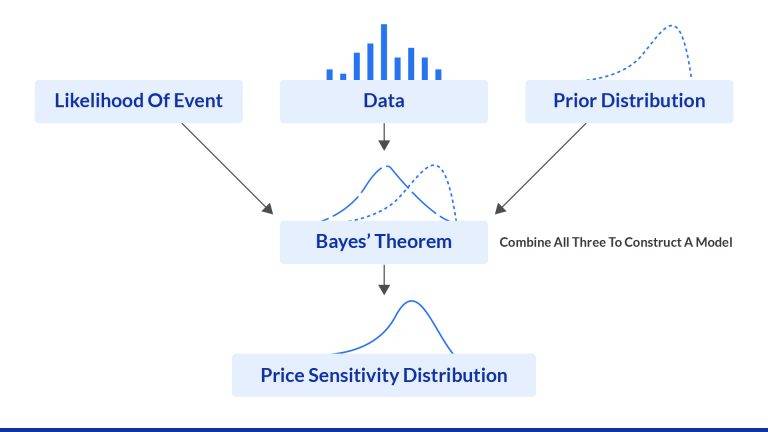

Bayesian Model: Navigating Uncertainty with Probability

The Bayesian model, deeply rooted in probability theory, stands out as a dynamic pricing algorithm adept at handling uncertainty. Its core strength lies in its continuous adaptation to evolving circumstances. By constantly updating its beliefs based on new data, it equips businesses with a reliable framework for pricing decisions that mirror the ever-shifting dynamics of the market.

One intriguing facet of the Bayesian model is its capacity to assign probabilities to different pricing scenarios. This unique feature not only allows businesses to flexibly adjust to changing market conditions but also enables them to gauge the confidence level in each pricing decision. Think of it as akin to a seasoned financial portfolio manager meticulously weighing the risks and returns of various investments. In the realm of dynamic pricing, this model not only embraces uncertainty but harnesses it to calculate the odds, implementing pricing optimization strategies with precision.

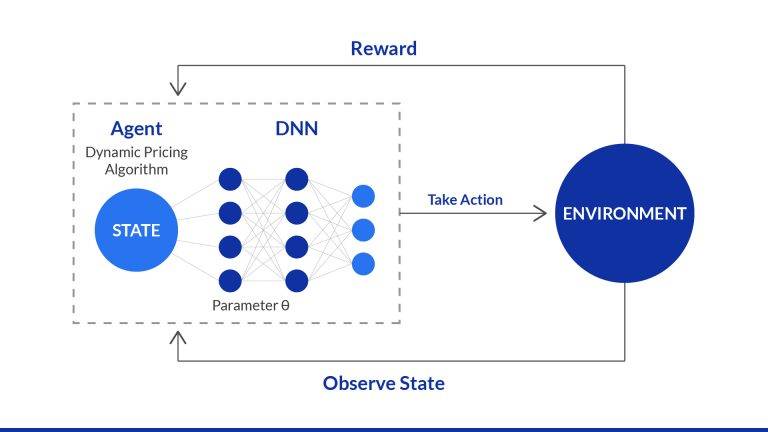

Reinforcement Learning Model: Learning from Customer Behavior

Reinforcement learning is a type of unsupervised learning where the machine learns to make decisions through repeated experimentation. When it comes to dynamic pricing, the reinforcement learning algorithm simulates various price changes and identifies those that result in more favorable outcomes, such as higher profit margins, customer loyalty, reduced churn, and increased long-term revenue.

Decision Tree Model: Transparency in Complexity

Decision tree models bring a refreshing level of transparency to dynamic pricing. By utilizing a series of if-then rules, they offer a more straightforward, interpretable approach to pricing decisions.

One insightful observation about decision tree models is their ability to maintain simplicity in a complex landscape. While they may not adapt as swiftly to rapidly changing market conditions, they shine in scenarios where transparency is paramount. It’s akin to choosing a straightforward path through a dense forest rather than navigating through a maze. These models provide businesses with a clear and understandable pricing strategy, which can be crucial for building trust with customers and stakeholders.

Dynamic Pricing is a Multi-model Problem

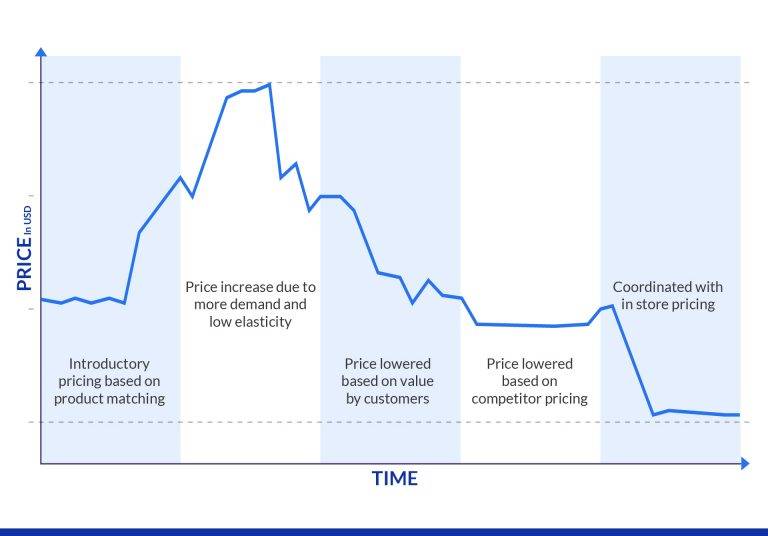

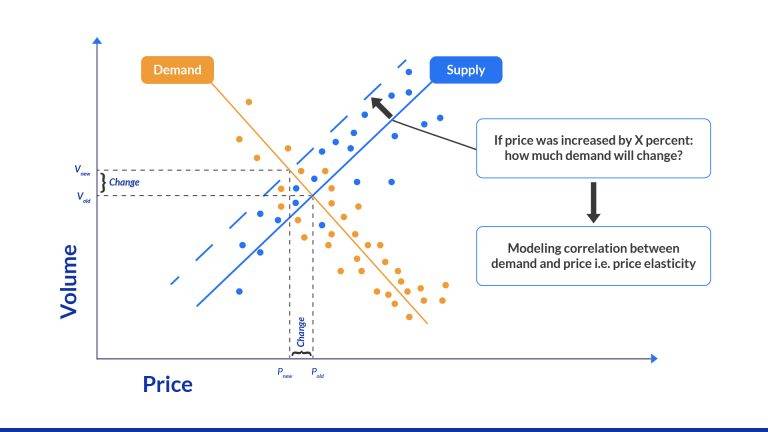

Dynamic pricing is undeniably a multi-model problem, as pricing teams grapple with a myriad of factors that influence customer behavior and sales volume. In this intricate landscape, models are essential to estimate price sensitivity, striking a delicate balance between per-unit profit and overall sales volume to maximize revenue. These models encompass various dimensions, such as customer segments, product types, availability, competition, and more. Moreover, external factors like seasonal demand, environmental conditions, and marketing initiatives further complicate the equation.

To optimize prices effectively and swiftly, multiple models come into play, including elasticity models, supply and demand forecasts, competition model and customer segmentation. Each model serves a unique purpose and may require distinct expertise, retraining schedules, and interdependence with other models in the pricing stack. Consequently, any adjustments to one model can trigger a ripple effect across the entire pricing strategy, demanding careful evaluation and A/B testing. Additionally, the granularity of pricing can vary from region to region, store to store, or even product to product, leading to an extensive array of models in use. This complexity underscores the need for coordinated efforts among data scientists and pricing teams to manage, deploy, and monitor thousands of models effectively.

Things To Consider While Implementing Dynamic Pricing Algorithms

While implementing dynamic pricing algorithms has a multitude of benefits, their successful implementation relies on several critical factors. Let’s explore some key considerations that businesses should keep in mind when embarking on the dynamic pricing journey.

Feasibility and Understanding Price Elasticity

Before diving into dynamic pricing, it’s essential to assess the feasibility of implementing such algorithms within your business model. Understanding price elasticity is fundamental. Price elasticity measures how sensitive customer demand is to changes in price. In other words, it helps you gauge how likely customers are to buy more or less of your product when prices change.

A deep understanding of price elasticity empowers businesses to set optimal pricing strategies. Some products may have inelastic demand, meaning that customers are less responsive to price changes. Others may have elastic demand, where small price adjustments can significantly impact sales volume. By comprehending price elasticity, you can tailor your dynamic pricing algorithms to specific products or services effectively.

Comprehensive High-Quality Data

Dynamic pricing algorithms heavily rely on data. To make informed pricing decisions, you need comprehensive, high-quality data. This includes historical sales data, customer behavior data, competitor pricing data, and even external factors like market trends and economic indicators.

Access to clean, up-to-date data is crucial for accurate predictions. Without it, your dynamic pricing algorithms may struggle to adapt to changing market conditions. Ensure that your data collection and processing systems are robust, as the quality of input data directly impacts the effectiveness of your pricing strategies.

Ability to Add Pricing Boundaries in Existing Models

Dynamic pricing doesn’t mean setting prices without constraints. It’s essential to establish pricing boundaries within your dynamic pricing algorithms. These boundaries prevent prices from reaching levels that could alienate customers or harm your brand reputation.

While dynamic pricing aims to optimize revenue, it should also align with your business values and customer expectations. Being able to implement pricing boundaries, whether it’s setting a minimum or maximum price, safeguards your brand’s integrity and prevents undesirable price fluctuations.

Performance Tracking with Pricing Adjustments

Dynamic pricing is an ongoing process that requires continuous monitoring and adjustment. Implement a robust system for tracking the performance of your pricing strategies. Assess how changes in pricing affect sales volume, revenue, and customer satisfaction.

Regularly analyze the data generated by your dynamic pricing algorithms and use it to refine your strategies. Be prepared to make pricing adjustments as needed to maintain a balance between profitability and customer loyalty. A dynamic pricing approach is dynamic in its truest sense – it evolves as market conditions and customer behaviors change.

Dynamic Pricing Model Management With FCC

FCC’s dynamic pricing engine stands at the forefront of modern pricing strategies, offering a powerful cloud-based solution for businesses. Leveraging cutting-edge machine learning technology based on proprietary game-theory based algorithm, our dynamic pricing engine examines historical data and real-time market dynamics to craft optimal pricing strategies for products and services.

What truly sets it apart is its ability to adapt to customer behavior, tailoring prices based on factors like purchase history and browsing patterns.

In a world where agility and precision are paramount, FCC’s retail media solutions empowers businesses to stay competitive and maximize profitability with ease.

Need help with your pricing strategies? Talk to us today!