Rule Based Pricing Engines

By Flipkart Commerce Cloud

Share On:

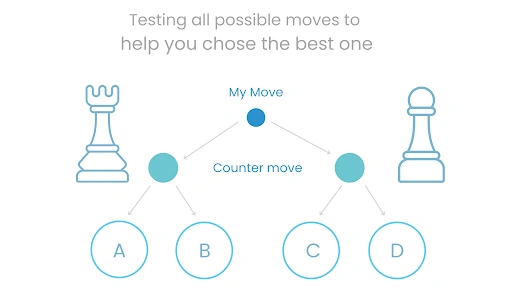

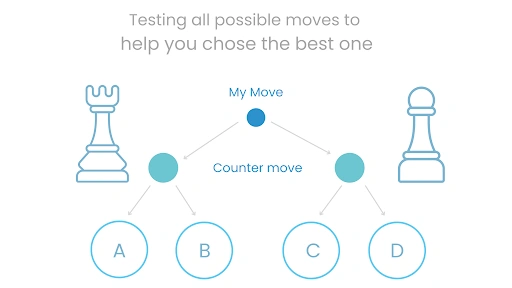

Pricing in eCommerce is like playing chess. You have to defend your pieces by playing out on your strengths (exclusive merchandise & listings, KVIs & KVCs) , you have to attack the opponents weakness, & you have to reiterate your strategy or change it often..

The sets of possible moves on the chess board get more & more complex as the game progresses. Analogously pricing becomes more and more complex as you scale and expand your business .

On the chessboard, trading a piece for an advantage that shows up later in the grand scheme is for the pros. Clinical games do not match the excitement of tables turning. There is no eureka moment but if done right and with no counter surprises you will win.

But when have opponents, markets, life and humans in general been predictable? Much like life and your worthy opponent, the markets throw at you surprises and chances. With incomplete information and uncertain payoffs the only means of optimizing is either to repeat decisions that have worked before (exploit) or make novel decisions (explore).

This principle of ‘Exploration Vs Exploitation’ applies to both chess, and retail pricing. With uncertainties of the route your opponent takes or some new demand trend that derails your estimates, you can only aim for a greater win. We reveal the retail pricing strategy that will help you optimize for greater wins in the game.

Playing The Board

A brilliant example of “exploration vs exploitation” tactics is an anecdotal chess game.

Gary Kasparov’s Sacrifice of the Queen- during a world championship match between Vladimir Kramnik & Garry Kasparov. This game took place 6 years before their World Chess Championship 2000 match but Vladimir Kramnik was already one of the strongest upcoming chess players in the world and considered a major threat to Garry Kasparov’s crown – even by Kasparov himself. Garry Kasparov with his long drawn experience decided to teach the young genius a lesson and he employed an early queen sacrifice, which Kramnik willingly took over as an exploitation of the opponent’s mistake, what ensued was a minor trade off – pawns and a bishop against the queen, giving the optics of Kramnik taking a lead over Kasparov. Further into the game, the trade off led to a collapse of a whole diagonal and Kramnik got an elegant check-mate and a taste of modesty. Kasparov, with insights into the game and having gone through several possible outcomes in his head, explored the one he knew had the best chance of working out well.

In pricing, domain experts play a similar game. An ideal pricing strategy would help them balance between short term gains, and long term goals. It is safe to say if we had to devise a winning formula for a state dependent process like pricing: Frequency, Flexibility and Foresight would be the major dependencies.

The two most popular methods of strategizing pricing in retail, currently, are :

1.) Rule Based Pricing

2.) AI/ML based Price Optimisation.

Each comes with its own advantages & drawbacks.

The rule based pricing engine

Rules based engines as the name suggests are algorithms that approach the pricing use case, following explicitly fed conditions for every state. They will require manual interventions and tweaks at critical junctures when the tried and tested conditions become irrelevant.

As an example : A key value category on your platform or retail store is luxury brands. You have a signed contract on MAP. You have fed the guardrail price at the beginning of the season. The algorithm will continue to work on the decided pattern and price, factoring in data from competition, sales, and monthly profits. The rule based engine keeps the machinery running.

Let’s introduce a surprise : it’s almost the end of the season and you need to bring in fresh season stock. The inventory is now overstocked and nobody is buying merchandise from the retreating season. Can a rule based engine adapt? It cannot but the domain experts can intervene and help it adapt.

Experienced ecommerce experts would advise clearance discounts to clear out old merchandise and bring in the new stocks to keep up with market trends and demands.

A category expert may not make an exploitative decision of keeping the prices in a valid range for short term P&L but try to explore optimisation by selling the stagnant old merchandise and bringing in fresh stock. A small tweak in the rules will help achieve better results.

In summary :

Rule-based Engines are based on a Knowledge Base containing rules – facts about a problem based on a domain expert’s knowledge.

-

Rules are represented in the form of if-then-else statements.

-

The software detects the pattern in data.

-

An inference engine of the software defines the relationship between the rules and facts.

-

The rule is executed and the software acts accordingly.

-

Rule-based systems rely solely on the built-in knowledge to respond to the current state of the environment in which they work.

-

Rule-based solutions are organization-centric. Hence it cannot adjust, add, delete rules in response to a changing environment to be adaptive to unusual or unpredictable events.

-

Manual maintenance is needed for such cases to add new rules, modify existing rules, and ensure no duplication and align with the business goals. The dynamic pricing strategy has the same issues.

The advantage of the rule based engines is a highly customized and controlled environment. The disadvantages – latency in reactions to state changes, and the lack of adaptability due to explicitly set guidelines.

Most eCommerce and Retail firms work on pricing with manual inputs and rule based automation & analytics. Between endless excel sheets and manually defined functions frequency & flexibility go for a toss. Dynamic Pricing Engines if left to rule based programs alone will also need tweaks and case wise intervention which is time consuming.

ML algorithms allow a highly automated, flexible and adaptable strategy.

Machine learning algorithms applied to pricing models

Machine Learning based models factor in the various data points, learn from patterns, predict outcomes & act on and adapt to situations born out of consequent states, thus allowing the retail pricing teams to operate at scale and speed.

For machines it’s all about optimizing at every state, including all the relevant data points.Machine Learning based pricing software gain knowledge from data and find the approach to solve the problems without intervention from direct programming. The more the data, the more the learning from it and ML performance. This kind of automation does not need instructions or details on decision making in a given situation.

The Clear Advantages :

- Pricing problems can be solved at its best by flexible machine learning and AI in contrast to the rigid rule-based engines that cannot measure state wise changes in a system that depends on counter action from external entities.

- Use cases that benefit: Large amounts of daily transactions; demand fluctuates and consumers are willing to pay a dynamic price.

- AI-ML allows for extensive data analysis which results in richer solution functionality.

Pricing software with built-in machine learning pricing models have the following features and capabilities:

- Granular customer segmentation with cluster analysis: relate data points representing customer characteristics – behavior patterns and determine customer persona groups with high accuracy.

- N variables are considered for M items. Competitor and attribute-based pricing are the influential factors behind a price recommendation. External attributes: Industry trends, seasonality, weather, location, etc. Internal: product cost, customer information – search, booking history, demographics, income, device, willingness to pay.

- KPI-driven pricing: Price recommendation can be aligned with Business KPI – Margin, turnover, profit maximization, inventory optimizations.

- Real Time market data analysis with no complex rules: to optimize prices to changing demand and market conditions in real-time with no pricing rules.

- Price elasticity calculation: The capability to define price elasticity to predict whether the price will be accepted. Business rules can be considered as additional settings.

So would an ML based Optimisation strategy factor in every detail and plan for five moves ahead? The simple answer : ML alone cannot do that. The answer that factors in foresight is : coupled with reinforcement learning ( pattern loops and learning from those loops) we may someday have pricing automation that is sensitive to a long term strategy & learns from experience. But since we are a few steps away from RL in pricing, let’s discuss how to make the most of what you have as options – A hybrid strategy.

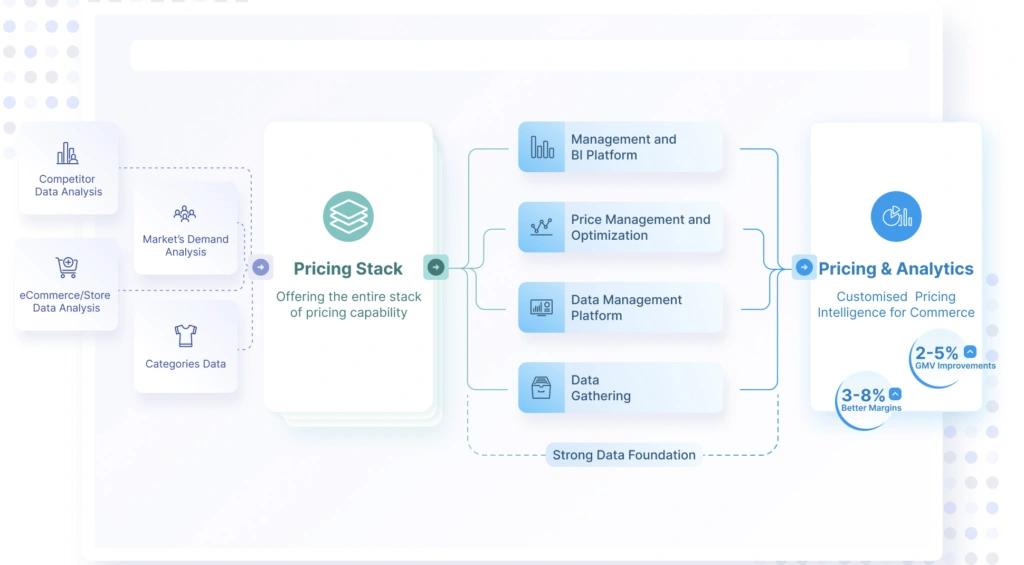

The Hybrid Model : Rule based feedback for long term strategy & statewise optimisation with AI/ML

The only thing outdated about manual intervention and rule based analytical engines is the difficulty of executing at speed and the very cumbersome Excel Sheets! Analytics teams around the world executed on sheets, converging data from all intelligence sources described in the diagram below (on the left):

However, domain knowledge, experience and sensitivity to long term goals is very important for making exploratory decisions. Till the machines start to factor experience, anomalies and deviations manual intervention will be required. Manual interventions are needed at inflexions, and to tackle unexpected circumstances.

As an example let’s take the case of this algorithmic pricing fiasco with Uber during the London Bridge attack in 2017.. During the attack, the algorithm sensed people’s panic to leave the streets as a rise in demand for cabs in London ( It’s an algorithm, it doesn’t include news flashes as learning data). Blocked lanes and panicked customers caused the prices to skyrocket to 200%. Uber’s cannibalistic pricing surge has been criticized by many of its users and has brought it bad reputation for exploiting lurched customers.

The customer does notice a very sudden or frequent change in your product pricing especially when it comes to key categories, or during specific sale events. Unsurprisingly, pricing is considered a make or break factor for users to convert into buyers. 60% of online shoppers worldwide consider e-commerce pricing as their very first criteria affecting their buying decisions.

What can help in such cases? Rule based engines that allow experienced retailers to set guardrails. These guardrails can be set as frequently with an easy to use graphical user interface and does not need manual calculations and implementation. The only input required is domain expertise based guidelines and the algorithm quickly adapts to the situation, automates the rest of the process. This helps the whole pricing system to explore maximum output from the added inputs.

At Flipkart we understood these nitty – gritty of building a foolproof and holistic pricing strategy. Having operated & succeeded in a price sensitive geography like India, for the last fifteen years has sensitied us to consumers. A hybrid strategy has worked well for a scale of 300Mn+ users, more than 80 categories and 150 Mn+ product listings. Our experts will be keen on exploring your issues in pricing and customizing a strategy for your business.

We’ll be happy to hear from you on problems specific to your use case and suggest an ensemble of solutions to solve end to end pricing for your platform, physical retail chain or omnichannel retail.

More Blogs

See how retailers and brands are winning with FCC

What is a High-Low Pricing Strategy?

Read More

Ultimate Guide To Dynamic Pricing Strategy In 2025

Read More

Retail Pricing Strategies: Winning with Promotion Pricing in Competitive Markets

Read More

Ad Tags: Enhancing Ad Serving Efficiency in Large-Scale Campaigns

Read More

Everything About Price Skimming Strategy Explained

Read More

What is a High-Low Pricing Strategy?

Read More

Ultimate Guide To Dynamic Pricing Strategy In 2025

Read More

Retail Pricing Strategies: Winning with Promotion Pricing in Competitive Markets

Read More

Ad Tags: Enhancing Ad Serving Efficiency in Large-Scale Campaigns

Read More

Everything About Price Skimming Strategy Explained

Read More

What is a High-Low Pricing Strategy?

Read More

Ultimate Guide To Dynamic Pricing Strategy In 2025

Read More

Retail Pricing Strategies: Winning with Promotion Pricing in Competitive Markets

Read More

Ad Tags: Enhancing Ad Serving Efficiency in Large-Scale Campaigns

Read More