Table of Contents

- Customer-based Pricing

- What is Customer-based Pricing?

- Example of Customer Value-Based Pricing

- How Does Customer-based Pricing Differ from Cost-Based Models?

- What are the Key Strategies for Implementing Customer-based Pricing?

- Benefits of Customer-based Pricing

- Risks and Challenges of Customer-based Pricing

- Execute Customer-based Pricing Effectively With Flipkart Commerce Cloud

What is Customer-based Pricing?

Retailers often view pricing as a simple calculation in which production costs are set to achieve a desired profit margin. Market leaders recognize that effective pricing requires understanding consumer psychology and the specific value a buyer assigns to a product.

Customer-based pricing represents a strategic shift where the perceived worth of an item dictates its final cost. It is one of the most common pricing strategies that moves away from internal manufacturing expenses or rigid competitor indexing to focus entirely on consumer demand.

- Smart businesses adopt this model to capture consumer surplus and bridge the gap between shelf price and value.

- This strategy helps brands avoid leaving potential revenue on the table by correctly pricing high-demand premium products.

- Customer-driven pricing prevents sales volume loss that typically occurs when price-sensitive items carry artificially inflated or rigid price tags.

- Retailers use customer value-based pricing to align financial goals with the actual willingness of their target audience to pay.

Definition of Customer-Based Pricing

Customer-based pricing is a methodology where pricing decisions stem directly from how much your customers value what you sell. This type of pricing requires you to analyze customer data and behavioral patterns to set price points that align with their expectations, rather than relying solely on your internal expense ledgers.

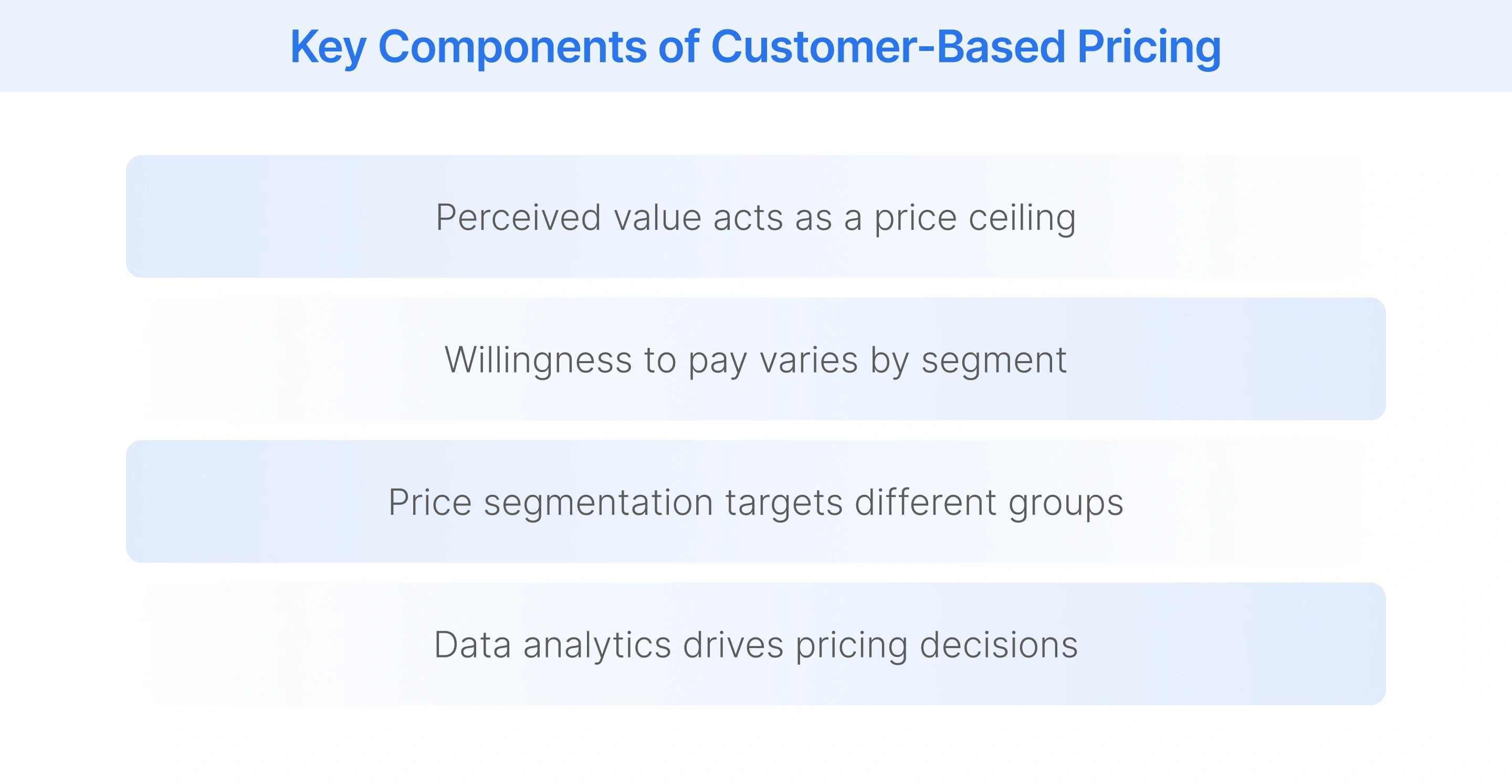

A customer value-based pricing strategy is based on the following key aspects:

- Perceived Value: The maximum monetary value a shopper believes your product is worth, based on its benefits. It acts as the absolute ceiling for your final price and dictates how much profit you can extract from a specific transaction without losing the sale.

- Willingness to Pay (WTP): WTP fluctuates significantly across different segments and purchasing contexts. A business traveler often has a high WTP for urgent flights, while a leisure traveler has a low WTP and waits for discounts or promotions to finalize their booking.

- Price Segmentation: Customer-driven pricing involves charging unique prices to distinct customer groups for identical or slightly modified products. You utilize segmentation to capture maximum value from high-value customers while simultaneously attracting price-sensitive shoppers with more affordable options or basic versions.

Example of customer value-based pricing

To better understand the concept of customer value-based pricing, let’s consider a retailer selling winter coats.

The business might sell a standard coat for $100 under a cost-plus margin model. However, customer analysis reveals that shoppers value the brand reputation and warmth highly. By applying customer value-based pricing, the retailer priced the coat at $150 for early adopters who value style.

Later, they offer discounts to value-seekers. This strategy helps capture the maximum amount that different segments are willing to pay.

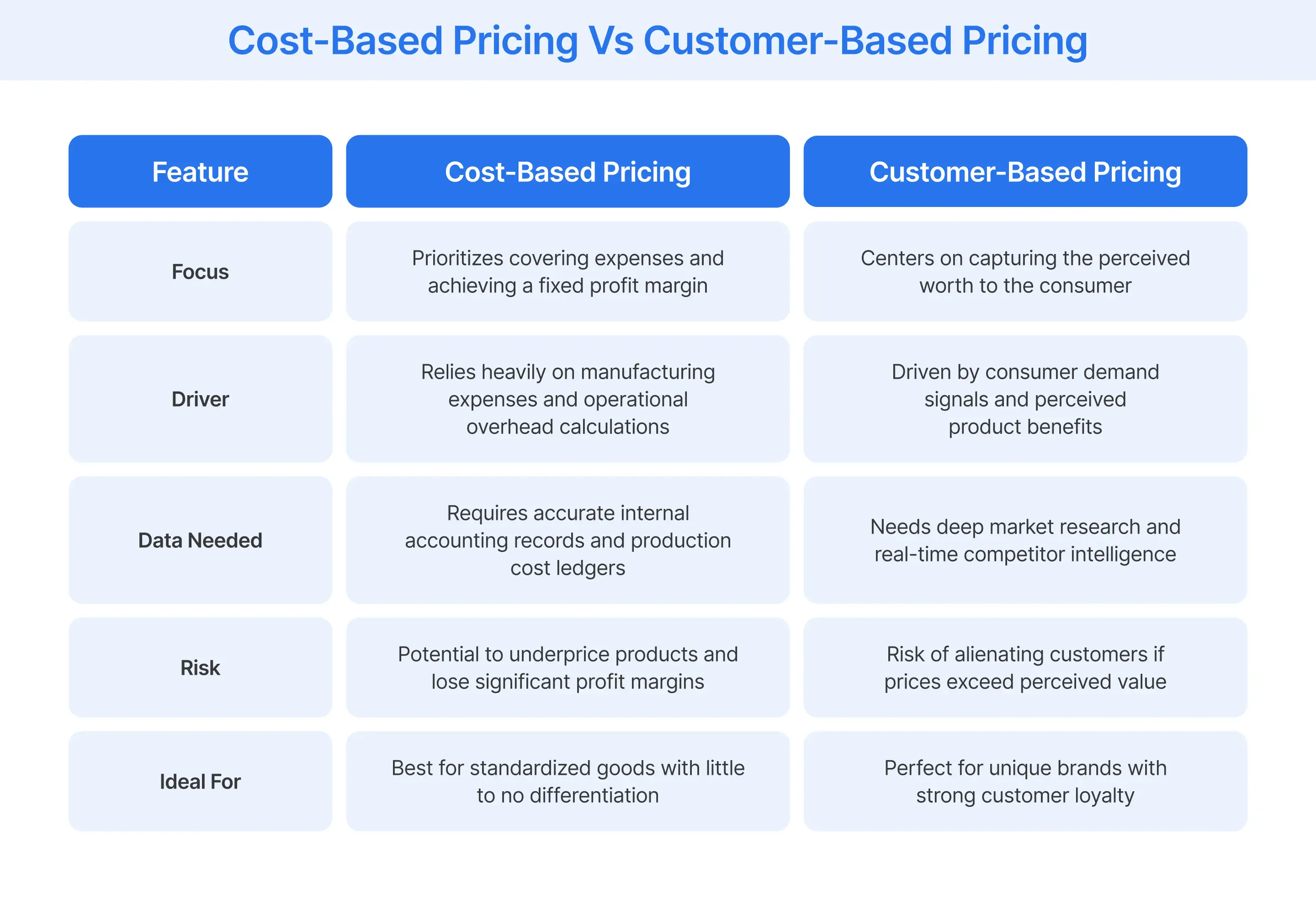

How Does Customer-Based Pricing Differ from Cost-Based Models?

While cost-based models look inward at expenses to determine value, customer-driven pricing looks outward at the consumer. By adopting customer value-based pricing, you shift from protecting margins to maximizing the value you capture from every sale.

Key Strategies for Implementation of Customer-based Pricing?

Implementing customer value-based pricing requires you to adopt specific tactics that align with consumer behavior.

- Price Skimming: Launching a new product at a high price point captures value from early adopters. Once demand from this group saturates, lowering the price attracts price-sensitive segments, maximizing total sales volume over the product's lifecycle.

- Penetration Pricing: Enter the market with a low introductory price to quickly gain share and attract a large customer base. This volume-reliant pricing model establishes early brand loyalty and creates a foundation to eventually increase prices once a foothold is secured.

- Psychological Pricing: The use of visual cues like ending prices in .99 leverages consumer cognitive biases by creating a subconscious perception of a better value or a bargain for the shopper.

- Dynamic Pricing: Adjusting prices in real-time based on demand and competitor activity is crucial for modern retail. This data-driven pricing method turns market volatility into an advantage, ensuring your pricing always aligns with exactly what your current shoppers are ready to pay.

What are the Benefits of Customer-based Pricing?

Here are the benefits of using customer value-based pricing:

- Charging exactly what customers are willing to pay eliminates revenue loss and ensures maximum profit extraction.

- Aligning prices directly with perceived value builds trust and significantly increases the likelihood of repeat purchases.

- Premium pricing signals quality and exclusivity, while strategic entry-level pricing maintains accessibility without diluting the brand image.

Risks and Challenges of Customer-based Pricing

Here are the key challenges associated with customer value-based pricing:

- Accurate execution demands sophisticated tools and expertise to gather the vast data needed to understand willingness to pay.

- Determining exact customer value is difficult because perception varies, often leading to lost sales or missed revenue opportunities.

- Rapid changes in consumer preferences and economic conditions require constant monitoring to ensure prices remain competitive and relevant.

Execute Customer-based Pricing Effectively With Flipkart Commerce Cloud

At Flipkart Commerce Cloud (FCC), we understand that customer-based pricing is the gold standard for profitability, yet requires deep insight into the customer psyche. Our pricing solutions move retail from a cost-recovery model to a value-capture model, ensuring every sale contributes the maximum margin.

We know that manually guessing a value is a risk you cannot afford in a competitive market. Our AI-driven tools analyze millions of data points to determine the precise willingness-to-pay for every segment of your audience in real time.

We empower you to automate pricing decisions that reflect true customer value without the heavy lifting. Partner with us to transform your pricing strategy into a dynamic engine that drives sustainable growth and keeps you ahead of market changes.

Schedule a demo with Flipkart Commerce Cloud today.

FAQ

Yes, these terms are often used interchangeably in the retail industry. Both strategies focus on setting prices based on the perceived worth of the product to the consumer rather than the cost of production.

It is challenging to apply customer-based pricing to pure commodities because customers perceive little differentiation between brands. However, you can still use it if you add value through convenience or service. If you cannot differentiate your product, customers will likely default to the lowest price option.

You measure WTP by analyzing historical sales data and conducting market research. You can also run A/B testing on your website to see how conversion rates change at different price points. Advanced retailers use AI algorithms to track browsing behavior and competitor pricing simultaneously. This data helps you construct a demand curve that reveals the maximum price different customer segments are willing to pay for your goods.

The four main strategies you can employ include cost-plus pricing, competitor-based pricing, value-based pricing, and dynamic pricing. Cost-plus adds a markup to your expenses while competitor-based looks at market rivals. Value-based pricing aligns with customer perception and dynamic pricing adjusts in real-time based on demand. You should choose the strategy that best fits your business goals and the specific nature of the products you sell to your customers.