Table of Contents

- What is a Price Maker?

- What are the Characteristics of a Price Maker?

- Price Maker vs. Price Taker

- Real-World Examples of Price Makers

- How to Become a Price Maker in E-commerce?

- Why Being a Price Maker Matters for Profitability?

- Streamline Your Pricing Decisions with Flipkart Commerce Cloud

Price Maker

A price maker functions as a dominant force within a specific market sector or industry vertical. As an influential market participant, this entity possesses the unique capability to dictate pricing structures for goods without strictly adhering to standard competitive pressures or immediate demand fluctuations.

These entities differ significantly from price takers who must accept prevailing market rates to survive. The ability to control costs usually stems from owning a large market share or offering a product that substitutes cannot easily replace.

- You maintain the leverage to set your own prices for consumers without seeing a proportional drop in your overall sales volume.

- The strategy relies heavily on product differentiation and distinct brand equity to justify the higher cost to the buyer.

- High barriers to entry often protect these businesses from competitors attempting to undercut their established pricing models.

- Consumers typically demonstrate low price sensitivity toward these brands due to perceived value and lack of viable alternatives.

What is a Price Maker?

A price maker is a retailer that can influence the market price due to its dominance. This concept usually links to a monopolist or oligopolies where limited competition exists. You set the cost based on profit goals rather than letting supply and demand dictate the margins entirely.

Essentially, you are the opposite of a price taker. While others scramble to match the lowest price, a price maker operates in imperfectly competitive markets where they have the breathing room to decide what their product is worth.

- Price Taker (Perfect Competition): The demand curve is horizontal. If you raise the price even slightly above the prevailing price, demand drops to zero.

- Price Maker (Imperfect Competition): The demand curve slopes downward. You can command higher prices, and while you might sell fewer units, the higher margin per unit leads to greater overall revenue.

What are the Characteristics of a Price Maker?

Achieving the status of a price maker requires you to possess specific market attributes that insulate you from competition. You must cultivate these characteristics to gain control over your pricing strategy.

- High Market Share: You need to control a significant share of total sales in your industry or niche. This dominance allows you to influence market trends and set price benchmarks that smaller competitors often struggle to match.

- Product Differentiation: You must offer products that appear unique or superior in quality compared to other available options. When customers perceive your goods as distinct they become less sensitive to price changes and more focused on the specific value you provide.

- High Barriers to Entry: Your position remains secure when new competitors find it difficult or expensive to enter your market. These barriers might include complex manufacturing processes or exclusive patents that prevent others from disrupting your established pricing structure.

- Customer Loyalty: You benefit from a dedicated customer base that prefers your brand regardless of price fluctuations. Strong emotional connections and trust ensure that your shoppers stick with you, even when cheaper alternatives are available.

Price Maker vs. Price Taker: Detailed Comparison

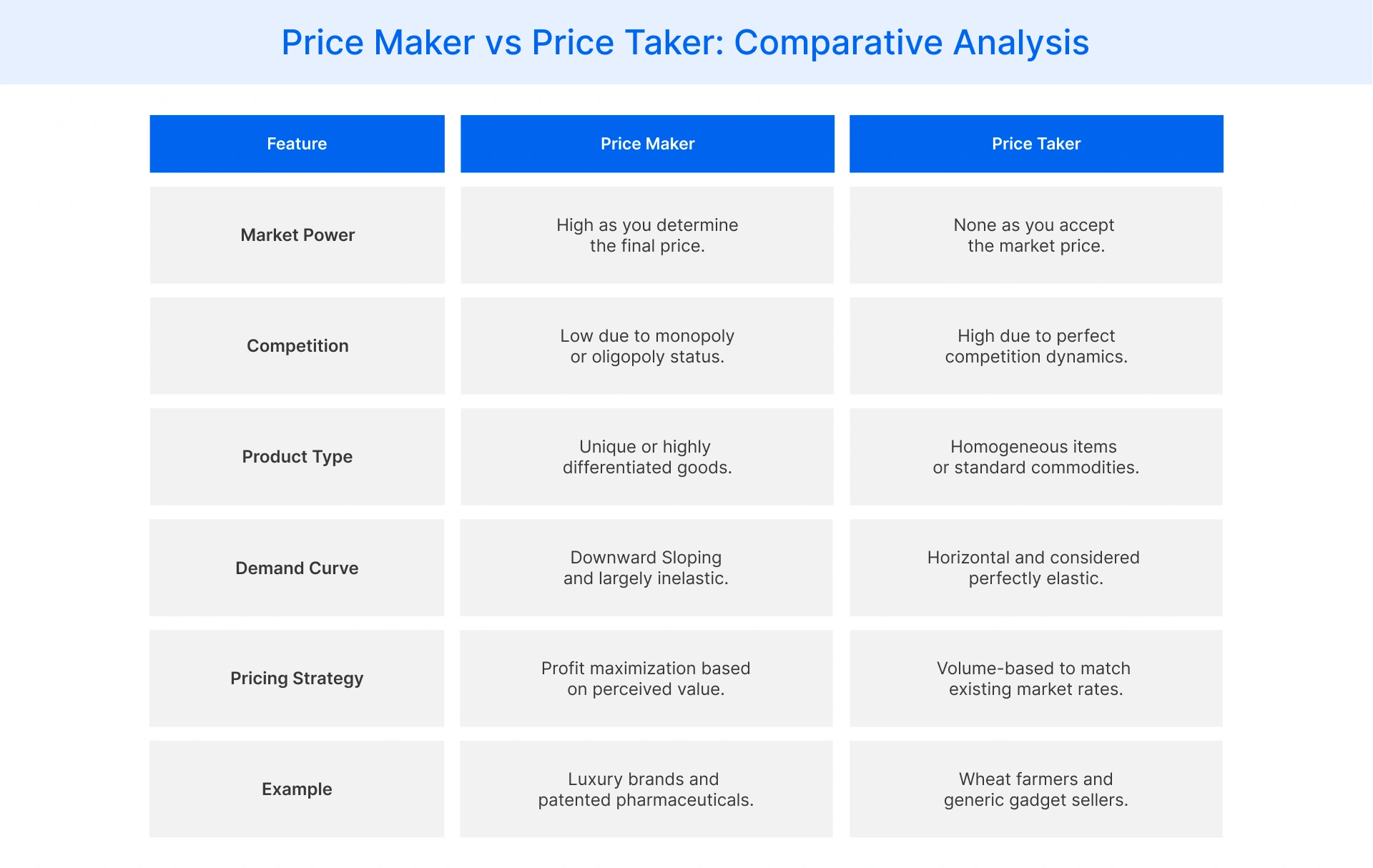

Understanding the distinction between these roles helps you identify your current market position and potential for growth. While a price taker reacts to the market a price maker shapes it. You shift from passively accepting low margins to actively managing your profitability through strategic control.

Real-World Examples of Price Makers

Here are some examples that demonstrate how diverse industries utilize market power to maintain their status as a price maker.

Apple

Apple acts as a definitive price maker in the consumer electronics sector due to intense brand loyalty. They set high prices for iPhones and MacBooks because customers perceive their ecosystem and design as irreplaceable. This allows them to maintain wide margins despite the availability of cheaper functional alternatives.

Pharmaceutical Companies

A pharmaceutical firm holding a patent for a life-saving drug operates as a monopoly for that specific treatment. They determine the price based on research costs and value rather than production expenses. No direct competitors can legally sell the same formulation until the patent protection eventually expires.

Luxury Retail

Brands like Rolex or Louis Vuitton maintain high prices to signal exclusivity and superior craftsmanship. They essentially sell status alongside the physical product which makes demand relatively inelastic. Reducing the price would actually harm their brand equity and reduce the perceived value of their goods.

Utility Companies

Local utility providers often function as natural monopolies within a specific geographic region due to infrastructure requirements. They set prices for electricity and water because it is impractical for competitors to build parallel grids. Regulators often oversee their pricing to prevent abuse of this immense market power.

How to Become a Price Maker in E-commerce?

Transitioning from a price taker to a price maker requires you to focus on creating unique value propositions that set your store apart from the crowd.

- Develop Private Labels: Creating your own private label brand gives you total control over the product design and exclusivity. You eliminate direct price comparisons because no other retailer sells that exact item.

- Leverage Pricing Intelligence: Understand competitor movements and customer behavior to identify opportunities for price increases. Using advanced data analytics allows you to spot segments where you have pricing power.

- Build a Moat with Loyalty: Construct a robust loyalty program to lock customers into your ecosystem and reduce their likelihood of switching. When shoppers earn points or receive exclusive perks, they become less price sensitive.

- Focus on Niche Markets: Targeting a specific niche allows you to become the dominant player in a smaller pond. You face fewer competitors and can tailor your offering to meet precise customer needs.

Why Being a Price Maker Matters for Profitability?

Achieving this status transforms your financial outlook and stabilizes your long-term business growth. You gain the ability to prioritize healthy margins over the constant struggle for sales volume.

- Higher Margins: You enjoy significantly better profit margins because you are not forced to engage in price wars. This extra revenue provides the capital needed to reinvest in better products and marketing.

- Sustainability: Your business becomes more resilient to economic downturns when you have control over your pricing strategy. You can adjust margins to absorb supply chain costs without immediately passing them to consumers.

- Brand Equity: Acting as a price maker reinforces your reputation as a market leader rather than a follower. Consistent pricing signals confidence and quality to potential buyers.

Streamline Your Pricing Decisions with Flipkart Commerce Cloud

At Flipkart Commerce Cloud (FCC), we understand that becoming a price maker is the ultimate goal for retailers aiming for sustainable growth. Relying on manual spreadsheets to guess the right price often results in leaving significant money on the table.

FCC’s intelligent pricing solutions provide the deep market insights you need to identify differentiation opportunities. We help you analyze customer behavior and competitor data to find the sweet spot where you can dictate terms.

FCC Pricing Manager empowers you to shift from reacting to market changes to driving them with confidence and precision. Our platform ensures your pricing strategy aligns perfectly with your business goals and customer expectations for maximum profitability.

FAQ

Yes, you can become a price maker even as a small business by dominating a niche. If you offer a specialized product or exceptional service that locals cannot find elsewhere, you gain pricing power. Customers will pay for convenience and unique expertise regardless of size.

You determine the optimal price by analyzing the maximum amount your customers are willing to pay. You must balance profit margins against the potential volume loss from higher rates. Market research and demand elasticity data are essential tools for finding this profitable equilibrium.

Yes, you can use price discrimination strategies to charge different rates to different customer segments. This maximizes revenue by capturing the consumer surplus from those willing to pay more. You might offer student discounts or dynamic pricing to book flights effectively.

Price elasticity is crucial because it measures how sensitive your demand is to price changes. As a price maker, you want to operate where demand is inelastic. This means you can raise prices and revenue will increase because the drop in sales volume is minimal.