Table of Contents

- What is a Price Taker?

- Examples of price takers?

- What is a price maker?

- Price taker vs price maker

- What are the pros and cons of being a price taker?

- What is a price-taker behavior?

- Why a perfectly competitive market is unrealistic

- Conclusion

What is a Price Taker?

Price takers are companies that have little to no control over the prices of the goods or services they sell. Price takers must follow the market trends as they lack the influence or market share to dictate prices.

Price takers, also known as price followers are generally required to maintain their prices and production costs at relatively low levels to retain their customer base. This scenario is common in markets with numerous brands offering similar products, where product homogeneity drives retailers to differentiate themselves through pricing and enhancing product features.

In a perfectly competitive market, companies become price takers due to factors like:

- Identical products: All firms offer the exact same product, making price the primary factor in consumer choice.

- Numerous participants: With a vast number of sellers and buyers, no single entity can influence the market price.

- Transparent information: Consumers have easy access to price information from various sellers, ensuring competitive pricing.

- Free entry and exit: Barriers to entering or leaving the market are minimal, allowing new firms to compete and existing ones to exit if necessary.

What is an example of a Price Taker?

To understand the concept of price takers in real-world situations, a farmer’s market can be an excellent example. Vendors operating in a farmers' market are price takers because:

- The goods are homogenous: Many vendors sell similar products, such as fruits, vegetables, and handmade goods. For example, a basket of tomatoes sold by one vendor is virtually identical to a basket sold by another, making it difficult for vendors to differentiate their products based on quality or brand.

- There are a large number of buyers and sellers: Farmers' markets typically have many small-scale vendors selling similar items to a large number of customers. No single vendor can influence the overall market price. If one vendor tries to raise prices significantly above the market rate, customers will easily switch to another vendor offering the same product at a lower price.

- Buyers can access perfect information: Customers can quickly compare prices by walking around the market and seeing what each vendor is charging. This transparency ensures that vendors must keep their prices competitive to attract buyers.

- Ease of entry and exit: Compared to larger retail operations, joining or leaving a farmers' market generally involves minimal setup costs and regulatory requirements. This low barrier to entry means that new vendors can easily start selling, and existing ones can exit without significant financial loss.

What is a Price Maker?

A price maker is an entity, typically a firm, that possesses the power to influence the prices of the goods or services it sells. Unlike price takers, price makers operate in imperfectly competitive markets with little to no competition, often due to unique products or monopoly power. They can set prices above marginal cost to maximize profits, as their products lack perfect substitutes.

This pricing power allows them to maintain higher profit margins and control market dynamics. However, this can lead to regulatory scrutiny and potential antitrust issues due to the lack of competitive pricing.

Price Taker vs Price Maker

Price takers are firms that do not have any control over the prices of goods or services they sell and must accept the prevailing market price. They operate in highly competitive markets with many sellers offering similar products. Examples include agricultural markets where individual farmers cannot set prices independently.

Price makers, on the other hand, have the power to influence the price of their goods or services due to their market dominance or unique offerings. They can set prices above marginal cost to achieve profit maximization. Examples include monopolistic firms like Apple Inc., which can set their own prices for their innovative products. This contrast highlights the opposite of a price-taker scenario..

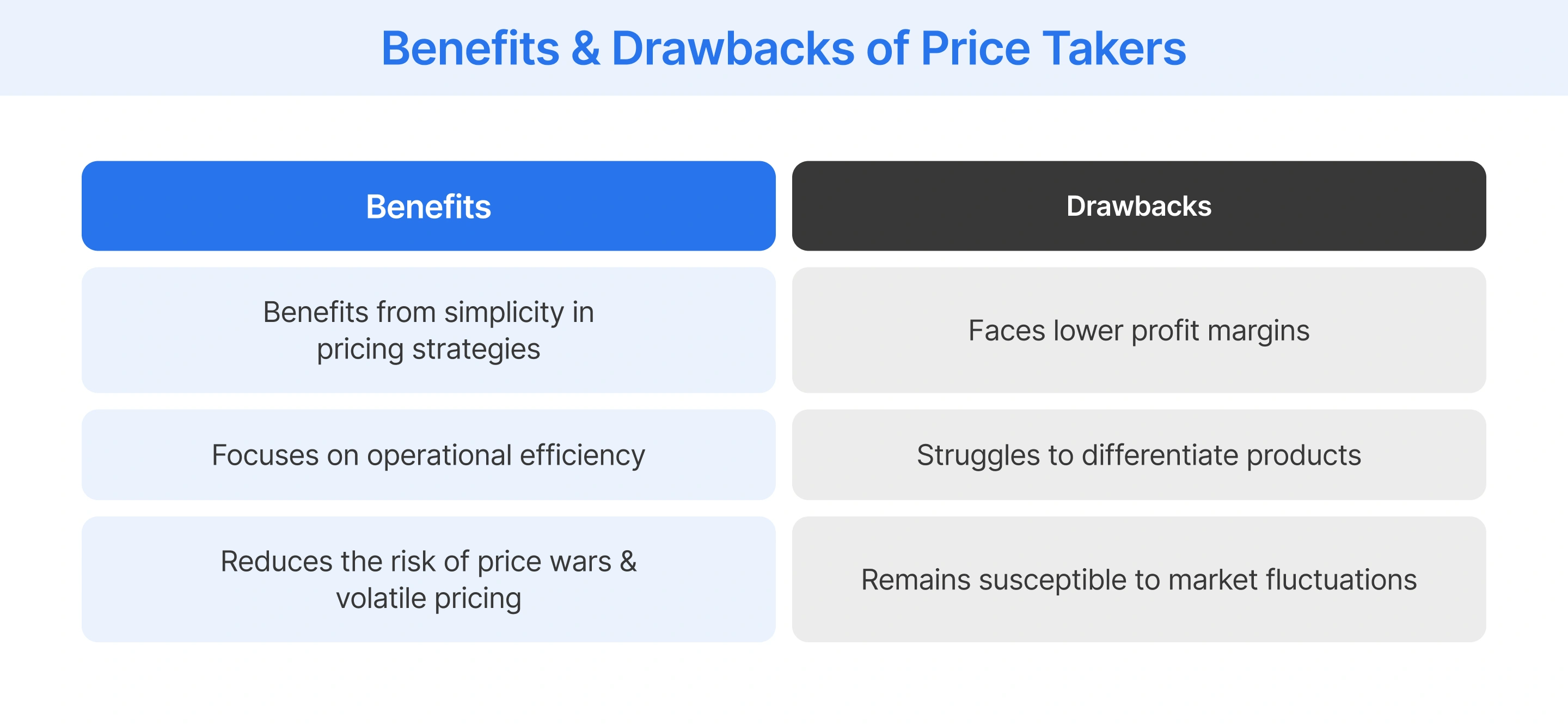

What are the pros and cons of being a price taker?

Understanding the pros and cons of being a price taker can help retailers navigate competitive markets and make informed strategic decisions to maintain profitability.

Pros of price taker

- Simplicity in Pricing: Price takers benefit from the simplicity of pricing strategies. They do not need to invest heavily in market research or complex pricing models, as they must accept the prevailing market prices.

- Focus on Efficiency: Since price takers cannot influence prices, they are compelled to focus on operational efficiency and cost reduction to maintain profitability.

- Market Stability: Operating in a competitive market with standardized prices can provide a stable business environment, reducing the risk of price wars and volatile pricing.

Cons of price taker

- Limited Profit Margins: Price takers often face lower profit margins as they cannot set prices above the market rate. This can reduce their flexibility to invest in innovation and growth.

- Lack of Differentiation: In markets with many price takers, products are often similar, making it challenging to differentiate based on price. This can lead to intense competition and reduced customer loyalty.

- Vulnerability to Market Fluctuations: Price takers are highly susceptible to market fluctuations and changes in supply and demand. They must adapt quickly to maintain their market position.

What is a price-taker behavior?

Price takers focus on maximizing efficiency and minimizing costs to remain profitable. They adjust their production levels to align with market prices, ensuring that marginal costs equal marginal revenue. This behavior is typical in markets such as agriculture, where numerous sellers offer identical products, and buyers have full information about prices.

Why a perfectly competitive market is unrealistic?

A perfectly competitive market is considered unrealistic as the assumption that all firms sell identical products is rarely met, as product differentiation is common. Also, perfect competition requires numerous small firms with no market power, which is impractical in industries with high entry barriers and significant economies of scale.

Additionally, perfect information among buyers and sellers is seldom achievable, leading to information asymmetry. Lastly, the assumption of free entry and exit is often hampered by regulatory and financial constraints.

Conclusion

A price taker operates in a highly competitive market where they must accept prevailing prices without influencing them. This position necessitates a focus on efficiency and cost reduction to maintain profitability. While price takers benefit from pricing simplicity and market stability, they face challenges such as limited profit margins, lack of differentiation, and vulnerability to market fluctuations. Understanding the dynamics of being a price taker helps businesses navigate competitive environments and make informed strategic decisions.

FAQ

A price taker can be either a buyer or a seller, depending on the specific dynamics of the market in question. In economics, this term refers to any individual or firm that must accept the prevailing market price because they lack the power to influence it through their own actions. Most individual consumers are price takers at the grocery store, just as small-scale producers are price takers when selling standardized goods in a massive global market. FCC supports these entities by providing data-driven insights that help them navigate these fixed-price environments with greater operational efficiency and strategic clarity.

Firms in a perfectly competitive market are considered price takers because the market consists of a very large number of sellers offering a homogeneous or identical product. In this structure, there are no barriers to entry or exit, and all participants have perfect information regarding prices and production methods. Because each firm’s output is so small relative to the total market, any attempt by a single business to alter the price would be unsuccessful, as buyers would immediately switch to a different provider.

Price takers operate in competitive markets by focusing entirely on cost management and production volume rather than pricing strategy. Since they cannot change what they charge, their only way to increase profit is to find more efficient ways to produce their goods or services at a lower cost than the market average. Many such firms turn to FCC for advanced technical solutions that streamline their operations, allowing them to remain profitable even when market prices fluctuate or margins are thin.

A price taker in economics is an economic actor that possesses zero market power and must therefore accept the market price as a given. This concept is a fundamental building block of the theory of the firm, particularly when discussing perfectly competitive industries where the demand curve for an individual seller's product is perfectly elastic. Understanding the role of a price taker helps businesses realize when they should focus on internal efficiencies, and FCC often assists these organizations in identifying the best digital tools to maximize their output under these rigid pricing conditions.

The implications of being a price taker on a firm's short-run production decisions are that the firm will produce the quantity of goods where the marginal cost equals the market price. In the short run, the firm must decide whether to continue operating or shut down based on whether the market price covers its average variable costs. Since the price is fixed by the market, the firm has no incentive to spend on traditional price-based marketing, instead choosing to invest in efficiency-focused technology like that offered by FCC to ensure they are producing as cost-effectively as possible.

Price takers operate within a perfectly competitive market structure by acting as passive recipients of the equilibrium price determined by the intersection of total market supply and demand. They take the current price as a signal for how much they should produce to maximize their own returns without trying to negotiate or lead the market. To succeed in this environment, firms often rely on the precise data analytics provided by FCC to monitor market trends and ensure their internal processes are perfectly aligned with the current economic reality.

The price taker concept is relevant for markets that deal in commodities, such as agriculture, oil, and precious metals, as well as highly standardized financial markets like the stock exchange. It also applies to many digital advertising landscapes where the cost of impressions is determined by massive real-time auctions involving millions of participants. By understanding these dynamics, FCC helps participants in these markets use contextual and automated tools to find value and maintain a competitive presence even when they do not have the power to set the price themselves.

A price taker is a firm that operates in a perfectly competitive market. This type of market features many small firms, similar products, perfect information, and easy entry and exit. Because there are so many identical firms selling the same product, no single firm can influence the market price. Therefore, each firm must accept the prevailing market price as given and adjust its output level to maximize profits.

Monopoly firms are price makers because they are the sole producers of a product or service with no close substitutes, giving them significant market power. This allows them to set prices based on their desired profit margins rather than accepting a market-determined price.

Unlike price takers in competitive markets, monopolies can influence the price by adjusting supply or setting strategic prices, as consumers have limited alternatives to turn to.