Table of Contents

- What is Price Optimization?

- Why are the Benefits of Price Optimization for E-commerce?

- How Does Price Optimization Work?

- What Are the Key Data Inputs for a Price Optimization Model?

- How Does Price Elasticity of Demand Affect Price Optimization?

- What Are the Most Common Price Optimization Strategies?

- What Common Pitfalls Should Retailers Avoid in Price Optimization?

- What is the Role of Software in Modern Price Optimization?

- Conclusion

What is Price Optimization?

Price optimization is a business strategy that involves using data analysis and artificial intelligence to find the most effective price points for products. It moves beyond traditional static pricing models by incorporating vast datasets to set prices that align with business objectives.

The primary goal of price optimization is to maximize profitability by balancing sales volume and profit margins. By analyzing market conditions, consumer demand, and competitor actions, businesses can adjust prices in real time to capitalize on opportunities and mitigate risks.

- It leverages artificial intelligence to analyze complex market variables.

- The software automates price adjustments based on predefined strategic goals.

- It provides predictive analytics to forecast the impact of price changes.

- The system offers real-time dashboards for monitoring key performance metrics.

- It integrates seamlessly with existing e-commerce and ERP platforms for efficiency.

Why are the Benefits of Price Optimization for E-commerce?

Implementing a robust price optimization strategy offers online retailers a significant competitive advantage and directly impacts their bottom line.

- Maximized Revenue: Advanced algorithms identify the optimal price points that balance consumer willingness to pay with demand, capturing the highest possible revenue from every transaction.

- Improved Profit Margins: By analyzing costs and market data, the system sets prices that ensure healthy margins without deterring customers, leading to enhanced overall profitability.

- Enhanced Competitive Edge: Real-time monitoring of competitor pricing allows businesses to react swiftly, positioning their products attractively to win market share and maintain a strong position.

- Efficient Inventory Management: Pricing strategies can be aligned with inventory levels, helping to clear overstocked items through promotions or increase prices for high-demand products with low stock.

- Increased Customer Loyalty: Fair and consistent pricing builds trust. Optimization helps avoid sudden, drastic price hikes, contributing to a stable and positive brand perception among consumers.

How Does Price Optimization Work?

Price optimization works by turning raw information into actionable pricing insights. The process starts with collecting structured internal data such as sales history, inventory levels, and cost figures, alongside external signals like competitor prices, market trends, and macroeconomic indicators. This integrated dataset provides the foundation for building accurate pricing models.

Once prepared, the data is processed through advanced algorithms that detect patterns and causal links invisible to manual analysis. Machine learning models estimate demand elasticity, showing how customers respond to pricing changes under different conditions such as promotions, seasonality, or product categories. These insights ensure forecasts reflect real-world retail dynamics.

Using these predictive models, retailers simulate potential outcomes across various pricing strategies. The system projects how adjustments affect revenue, profit margins, and sales volume, enabling businesses to evaluate multiple scenarios before committing to market changes. This proactive testing reduces risk while aligning pricing choices with organizational goals and customer expectations.

Finally, the optimization engine generates recommended price points within business guardrails. These recommendations may be reviewed manually or deployed automatically through e-commerce systems. The cycle is continuous, i.e., new data updates the models, outcomes are monitored, and pricing strategies are refined to remain effective in shifting market conditions.

What Are the Key Data Inputs for a Price Optimization Model?

A powerful price optimization model relies on a diverse and high-quality stream of data inputs to generate accurate and effective recommendations.

Internal Business Factors

Internal data provides the financial and operational baseline for pricing decisions, ensuring that every strategy aligns with core profitability and business goals.

- Historical sales performance data at various price points.

- Detailed product costs, including both manufacturing and logistics.

- Current inventory levels and overall stock turnover rates.

- Overarching business goals for revenue and gross margin growth.

External Market Factors

External market factors provide crucial competitive and economic context, allowing businesses to anticipate and proactively respond to shifts in the broader marketplace.

- Real-time tracking of competitor prices and promotional activities.

- Broader market trends and specific industry-wide demand shifts.

- Seasonal demand fluctuations and predictable consumer buying patterns.

- Key macroeconomic indicators influencing consumer spending power.

Customer Behavior Factors

Customer behavior factors are essential for understanding demand and perceived value, enabling the creation of targeted and effective pricing strategies that resonate.

- Customer segmentation data and detailed individual purchase histories.

- Calculated price elasticity of demand for different products.

- Website clickstream data revealing user intent and engagement.

- Key metrics related to perceived value and brand perception.

How Does Price Elasticity of Demand Affect Price Optimization?

Price elasticity of demand is a critical metric in price optimization that measures how responsive the quantity demanded of a good is to a change in its price. It is calculated as the percentage change in quantity demanded divided by the percentage change in price.

If a small price change leads to a large change in demand, the product is considered elastic. Conversely, if a price change has little effect on demand, the product is inelastic. Understanding elasticity is fundamental for predicting the revenue impact of a price adjustment.

For elastic products, a price decrease can lead to a proportionally larger increase in demand, resulting in higher overall revenue. For inelastic products, a price increase may not significantly reduce demand, thus boosting both revenue and profit margins.

Price optimization software uses historical sales data to calculate elasticity for each product, enabling it to forecast the financial outcome of potential price changes with a high degree of accuracy and recommend the best course of action.

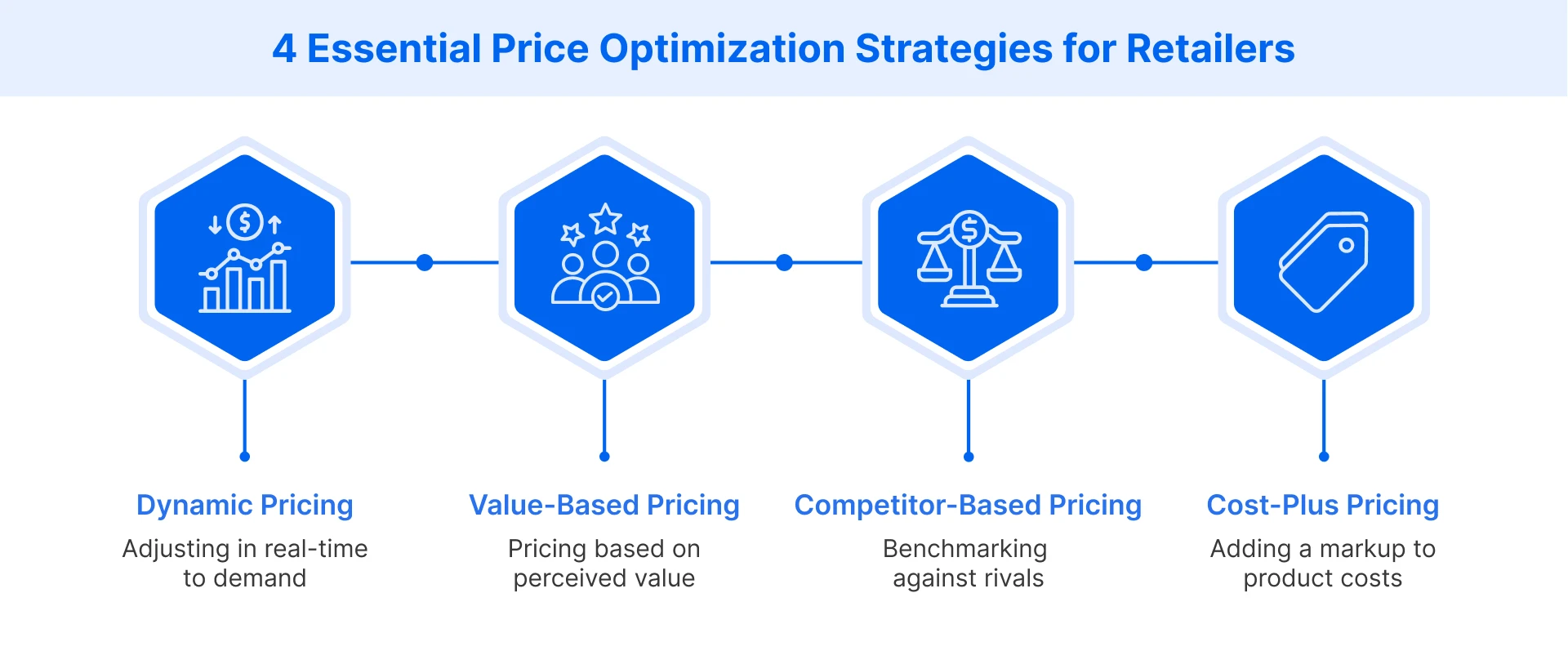

What Are the Most Common Price Optimization Strategies?

Retailers can apply several price optimization strategies, each designed to achieve specific goals and align with unique market conditions.

Dynamic Pricing

Dynamic pricing adjusts product prices in real-time based on shifts in demand, competitor activity, and stock levels. Algorithms process multiple data inputs, such as traffic or conversion rates, to instantly recommend price changes. This ensures margins remain protected while retailers stay competitive across fast-moving e-commerce channels and seasonal demand peaks.

Value-Based Pricing

Value-based pricing relies on customer perception rather than cost or competitor references. By analyzing product features, brand equity, and customer willingness to pay, retailers identify perceived value. Market research and analytics help quantify this perception, enabling companies to set prices that capture higher margins while reinforcing customer trust and product differentiation.

Competitor-Based Pricing

Competitor-based pricing benchmarks prices against rivals in the same market. This may involve pricing lower to gain share, equal for parity, or higher for premium positioning. Advanced approaches incorporate brand strength, feature comparison, and inventory signals, ensuring products are strategically placed without eroding margins in destructive price wars.

Cost-Plus Pricing

Cost-plus pricing calculates the total production and fulfillment costs, then adds a markup percentage. Though simple, it often overlooks demand or competition. Enhanced systems can apply dynamic markups responsive to real-time market conditions. This modernized approach ensures the model remains simplewhile achieving stronger profitability outcomes for retailers.

What Common Pitfalls Should Retailers Avoid in Price Optimization?

While price optimization is a powerful tool, retailers must be mindful of common pitfalls to ensure its successful and sustainable implementation.

- Using Inaccurate or Incomplete Data: Basing decisions on flawed data leads to flawed outcomes. Ensure data from all sources is clean, accurate, and comprehensive before feeding it into your optimization models.

- Ignoring Brand Perception: Aggressive or frequent price changes can erode customer trust and devalue your brand. Pricing strategies should always align with your desired brand positioning in the market.

- Overlooking Price Elasticity: Setting prices without a clear understanding of customer price sensitivity can backfire. A price increase on an elastic product could cause a significant drop in sales.

- Focusing Solely on Competitors: While competitor pricing is an important data point, blindly following their lead can trigger price wars and erode profits for everyone. Always consider your own costs and value proposition.

What is the Role of Software in Modern Price Optimization?

In modern retail, manual pricing cannot keep pace with massive data flows, shifting consumer behavior, and real-time competitive dynamics. Specialized software makes price optimization scalable, accurate, and responsive, transforming pricing into a powerful engine for growth rather than an operational burden.

Software automates the full optimization workflow, from integrating diverse data streams to analyzing demand signals and deploying recommended prices. It processes millions of data points rapidly, enabling accurate insights in seconds. This automation reduces errors, saves time, and ensures decisions reflect the latest market and business realities.

At Flipkart Commerce Cloud, we deliver solutions that extend beyond basic pricing. Our machine learning models capture elasticity, forecast demand, and simulate pricing outcomes. Retailers can test multiple strategies virtually before execution, allowing informed decisions that align with goals such as revenue growth, margin protection, or competitive positioning.

Our platform also emphasizes flexibility and governance. Clear business rules, margin floors, and brand constraints are built directly into automated recommendations. By combining intelligent algorithms with easy integration, FCC empowers businesses to transform pricing from reactive adjustments into strategic initiatives that drive sustainable profitability and long-term customer trust.

Conclusion

Price optimization is a continuous, data-driven process that empowers e-commerce businesses to make smarter and more profitable decisions. By leveraging AI and machine learning, retailers can move beyond static, one-size-fits-all pricing to a dynamic model that responds intelligently to market conditions, ensuring they achieve the right price for every product, every time.

FAQ

Price optimization benefits both large and small retailers. While enterprises often deploy advanced systems, smaller businesses can start with scaled-down tools. Cloud-based solutions offer affordability and accessibility, allowing retailers of all sizes to improve revenue, protect margins, and compete effectively in dynamic markets.

The frequency depends on industry, competition, and product lifecycle. Fast-moving categories like electronics may require daily updates, while others adjust seasonally. Advanced platforms continuously monitor data, enabling dynamic optimization cycles that maintain competitive positioning and ensure prices remain aligned with evolving market conditions and demand.

Ethical concerns arise when frequent or personalized pricing creates perceptions of unfairness. Retailers must balance profitability with transparency, consistency, and customer trust. Establishing clear rules, avoiding discriminatory practices, and maintaining brand integrity ensures dynamic pricing strategies remain responsible while delivering long-term value for consumers.

Start by collecting accurate internal and competitor data to understand costs, demand patterns, and market benchmarks. Small businesses can then adopt affordable cloud-based pricing tools, gradually testing strategies. Establishing clear goals, monitoring outcomes, and refining models helps build scalable, effective optimization practices over time.

A/B testing compares two fixed price points to measure performance, whereas price optimization uses advanced data models, algorithms, and market signals to evaluate multiple scenarios. It delivers continuous, dynamic pricing recommendations aligned with demand, competition, and business rules across all retail channels simultaneously.

Price optimization is the process of determining the ideal price point for a product or service to maximize profitability. It involves analyzing market and consumer data to find a balance between value and profit. By considering factors like costs, competition, and customer willingness to pay, businesses can set prices that attract customers and enhance revenue.

Price optimization is a legal practice in many industries, but its legality can vary depending on the sector and region. For example, in the insurance industry, price optimization is illegal in some states in the US due to concerns about unfair discrimination. It's important to check local regulations to ensure compliance.

To optimize a pricing strategy, gather data on customer behavior, market trends, and competitor prices. Create customer segments based on their preferences and willingness to pay. Analyze how price changes affect demand. Set clear pricing objectives, such as increasing revenue or market share.

Test different pricing models and adjust your strategy based on the results. By following these steps, you can ensure that your pricing strategy maximizes profitability and aligns with your business goals.