FAQ

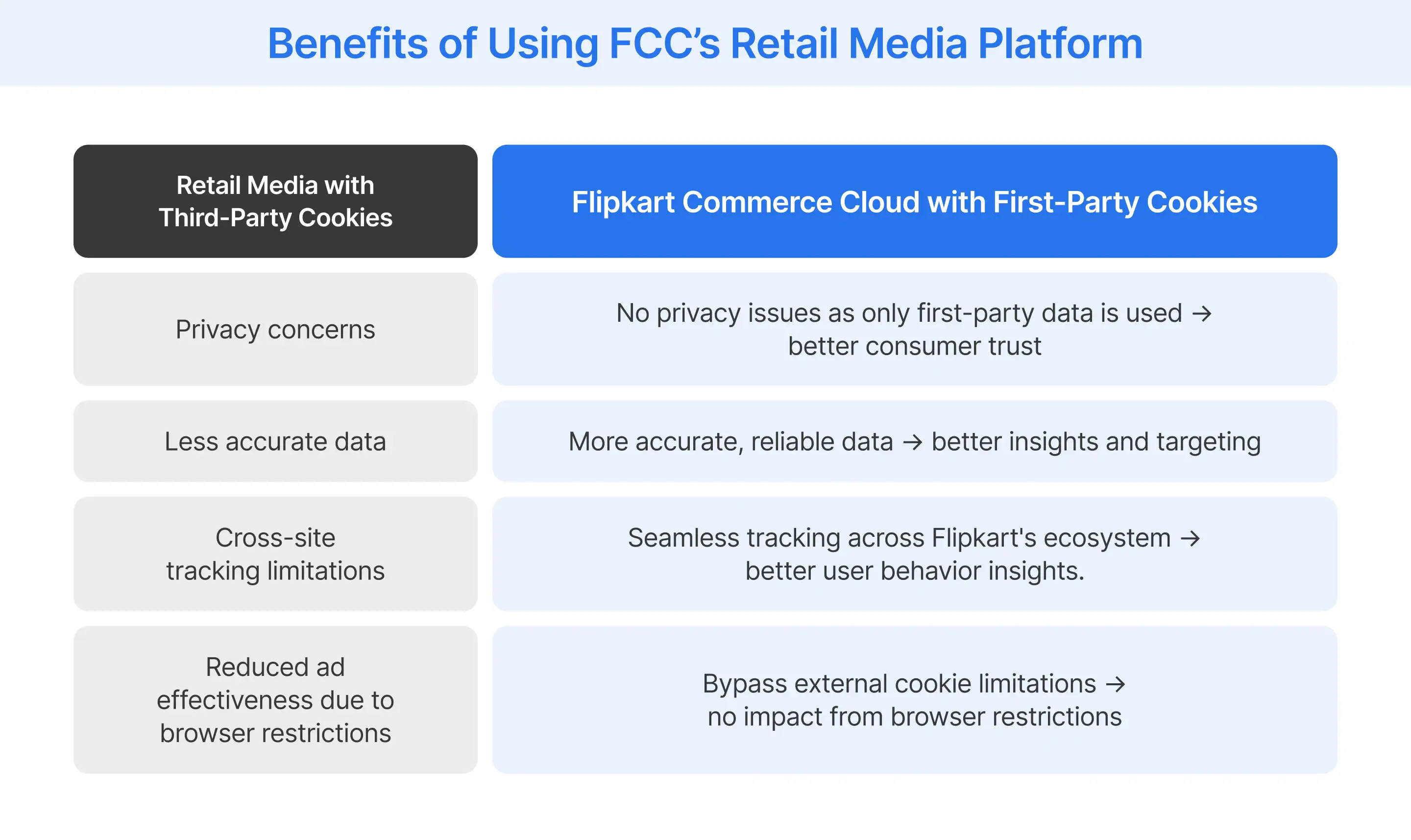

Retail media works for a retailer by effectively transforming its digital and physical storefronts into a high-value advertising platform, enabling the retailer to sell ad inventory to the brands whose products they carry. The retailer leverages its proprietary, highly valuable first-party shopper data to allow brands to target consumers at or near the point of purchase, generating a high-margin new revenue stream from the media spend and offering closed-loop attribution to the brands, a feature often built on technology solutions like FCC.

A retailer can offer a wide range of ad formats through retail media, which fall into three main categories: On-site formats like sponsored product listings within search results, display banners on the homepage and category pages, and video ads on product detail pages; Off-site formats, which use the retailer's first-party data for audience extension campaigns across the open web, social media, and Connected TV; and In-store formats, such as digital screens on aisles, at checkout, and on smart shelf labels.

Retail media does not apply only to online retail, but also to physical stores, as the strategy is rapidly evolving into an omnichannel offering. While digital retail media networks (RMNs) started online with sponsored search and display, the concept is being extended to brick-and-mortar locations through in-store retail media. This involves placing ads on digital screens, interactive kiosks, and smart carts, with targeting often linked back to a customer's loyalty program data for a closed-loop measurement of in-store sales lift.

Retail media can help improve inventory and demand planning for retailers by providing real-time, granular demand signals at the SKU level. Tracking which sponsored products or categories receive high engagement and cause rapid sales lift allows retailers to proactively adjust safety stock levels, prioritize replenishment of advertised items, and refine their overall demand forecasts by factoring in media-driven spikes, leading to fewer stockouts and reduced inventory carrying costs, especially when using predictive models built on platforms like FCC.

The kind of retailers that benefit most from building a retail media network are those with high transaction volumes, large numbers of endemic brand partners, and a robust first-party data asset, often solidified through a strong loyalty program. Grocers, big-box retailers, and large specialty retailers like home improvement or beauty stores fit this profile, as their scale and data richness make their audience segments highly attractive and valuable to advertisers.

Yes, Retail media could create conflicts of interest between retailers and brands, as the retailer is simultaneously a partner selling the brand's products and a competitor selling its own private-label products. This conflict arises if a retailer uses proprietary brand performance data to unfairly favor its own private labels or charges high ad prices to push out competition, necessitating strict transparency, clear operational rules, and ethical data governance to maintain advertiser trust.

Retailers should expect future trends in retail media to include the full convergence of online and in-store media via digital screens and smart devices; the massive adoption of AI and machine learning for automated targeting, bidding, and predictive optimization; and the expansion into off-site audience extension through more advanced partnerships with Demand-Side Platforms (DSPs) and Connected TV (CTV) providers to challenge the dominance of the major walled gardens.

More Blogs

See how retailers and brands are winning with FCC

Everything About Price Skimming Strategy Explained

Read More

What is a High-Low Pricing Strategy?

Read More

Ultimate Guide To Dynamic Pricing Strategy In 2026

Read More

Retail Pricing Strategies: Winning with Promotion Pricing in Competitive Markets

Read More

Ad Tags: Enhancing Ad Serving Efficiency in Large-Scale Campaigns

Read More