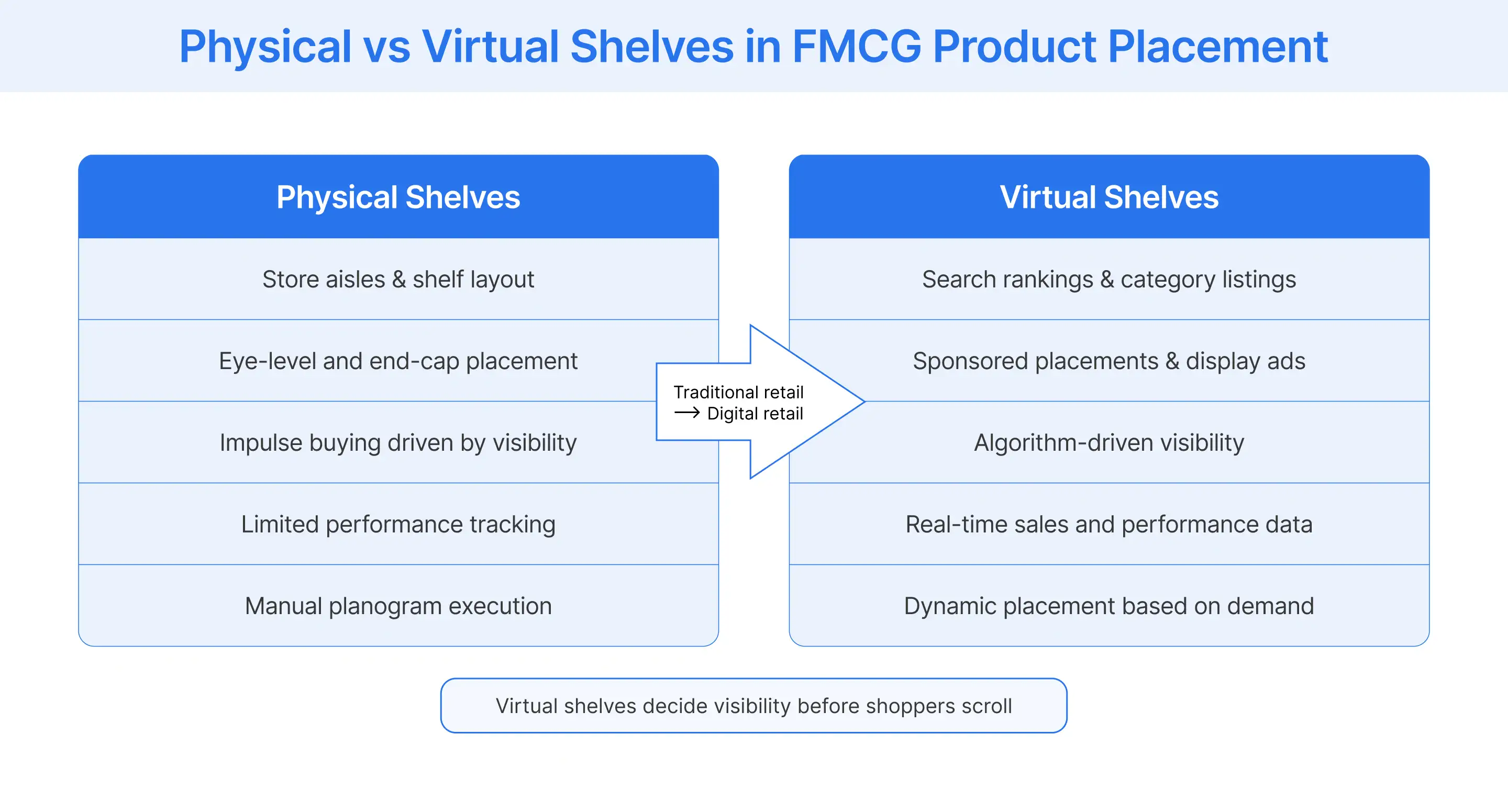

In today’s digital-first world, the consumer space is no longer defined solely by brick-and-mortar retail stores. A growing share of FMCG purchases now happens across digital retail environments, where virtual shelves play the same crucial role as physical ones, determining visibility, influencing customer behavior, and shaping buying decisions.

In 2021 alone, India’s FMCG market reached $68 billion, with steady growth expected as e-commerce becomes the preferred shopping channel for everyday essentials. According to market reports, e-commerce’s role in FMCG is only set to grow, driving more brands to optimize their virtual shelf presence and digital strategies. This shift has forced FMCG brands to rethink how product placement on shelves works in a digital context, where competition for retail space is algorithm-driven rather than aisle-based.

As physical stores see fewer queues and faster shopping cycles, effective product placement on virtual shelves has become a powerful tool to drive sales, boost brand visibility, and support long-term sales growth across the FMCG sector.

What Makes Product Placement on Shelves Crucial for FMCG Brands?

In physical retail stores, shoppers often browse shelves, compare alternatives, and make impulse buys influenced by store layouts and visual merchandising. Online shopping, however, is more intentional. Customers arrive with specific needs, actively searching for products, brands, or categories.

This makes shelf placement in the digital retail space even more valuable. Products that occupy prime real estate, top search results, category listings, or sponsored placements are more likely to draw attention and influence purchase decisions. In crowded retail environments, appearing first often determines who wins the sale.

For FMCG brands, strategic placement on virtual shelves directly affects brand awareness, product availability, and customer experiences.

Key Benefits of Product Placement on Shelves for FMCG Brands

Better Monitoring and Data-Driven Decisions

Traditional shelf placement offers limited visibility once products hit the store. Virtual shelves, on the other hand, provide access to real-time sales data and valuable insights into customer behavior. Brands can evaluate sales performance, track demand shifts, and refine placement strategies using data analytics.

Increased Brand Visibility Across the Shopping Experience

Effective product placement on shelves ensures consistent exposure throughout the shopping experience. Strategic placement across platforms strengthens brand recognition and keeps key products visible at critical decision points.

Improved Brand Recall and Brand Perception

Repeated exposure through digital touchpoints reinforces brand perception. For new products and emerging FMCG brands, strong shelf placement helps accelerate brand awareness and build trust faster.

Catering to Consumer Needs and Preferences

By aligning shelf placement with consumer psychology and buying patterns, brands can improve customer satisfaction and encourage repeat purchases, key drivers of brand loyalty.

Higher Customer Engagement

Online shelves allow brands to interact with consumers and engage with them on a personal level. By leveraging key consumer trends and data, brands can learn more about their target audience and create a better user experience.

Using Digital Retail Media and Display Ads to Maximize Shelf Visibility

Digital retail media advertising strengthens product placement strategy by extending shelf visibility beyond organic listings. Sponsored products, display ads, and promotional placements help FMCG brands secure competitive shelf positions within digital retail space.

For example, a display ad on a shopping platform can place a product directly in front of customers searching for related products, while influencer content builds brand awareness before shoppers even enter a retail store environment.

When aligned with broader marketing efforts, digital retail media enhances customer engagement, supports sales growth, and reinforces shelf placement across the buyer journey.

To maximize impact, brands should focus on: When using digital retail media, it is important to keep the following in mind:

-

Identify your target audience: Who are you trying to reach with your product?

-

Aligning objectives with sales performance goals: What do you want to achieve with your digital retail campaign?

-

Consider the touchpoints that match consumer needs: What are the best ways to reach your target audience at each stage of their purchase journey?

-

Create a budget: How much are you willing to spend on your digital retail campaign?

-

Measure outcomes using sales data and engagement metrics: How will you know if your digital retail campaign is successful?

By keeping the above in mind, you can maximize your brand exposure and achieve your objectives.

Why Shelf Location Still Matters in Product Placement FMCG

Whether physical or virtual, shelf location plays a crucial role in FMCG sales. In retail stores, eye-level placement and end caps represent prime real estate because they naturally capture attention. Online, top-ranked listings and featured placements serve the same purpose.

Products positioned in these high-visibility zones experience higher click-through rates, stronger customer engagement, and increased impulse buys. Poor shelf placement, on the other hand, can limit sales regardless of pricing strategy or product quality.

Winning shelf space is not accidental; it is a deliberate retail marketing decision rooted in performance data and consumer behavior.

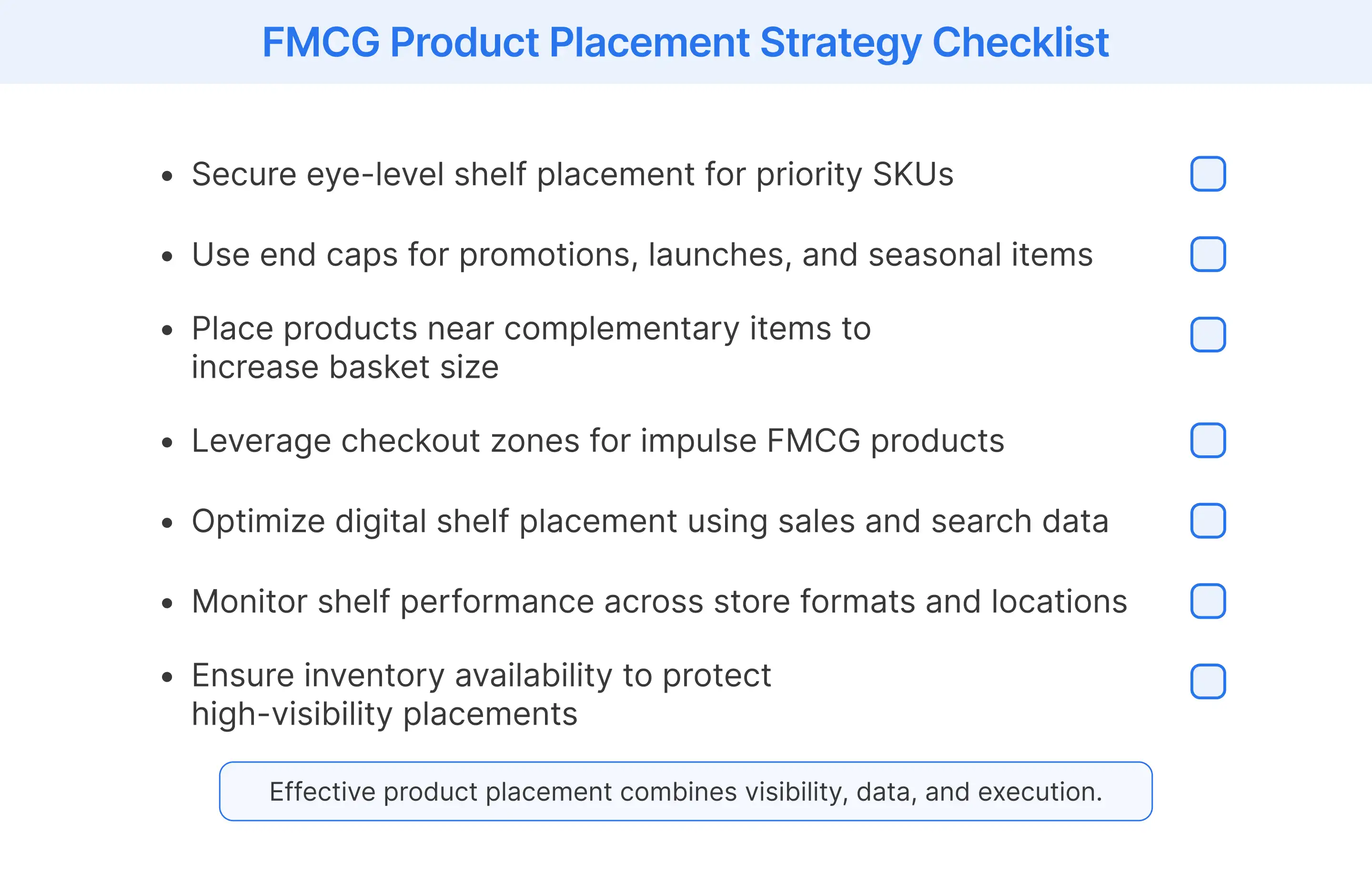

Effective Strategies for Product Placement in Retail Stores

Successful FMCG product placement in retail stores depends on how well brands align shelf placement with customer behavior, store layouts, and buying intent. The goal is not just visibility, but consistent sales performance across different retail environments.

1. Eye-Level Product Placement

Eye-level placement is one of the most reliable shelf placement strategies in the FMCG industry. Products positioned at eye level are easier to notice and are often perceived as more popular and trustworthy. This placement reduces decision effort for shoppers and increases the likelihood of impulse buys, especially in high-traffic aisles.

Retailers usually reserve eye-level shelf space for key products, seasonal displays, and high-performing SKUs because of their direct impact on sales growth and inventory turnover.

2. End Caps and Promotional Displays

End caps function as prime real estate within retail space. Positioned at the end of aisles, they naturally draw attention and create a sense of urgency. FMCG brands use end caps to highlight promotions, new products, or limited-time offers, making them a powerful tool for boosting short-term sales without altering pricing strategy across the store.

3. Placement Near Complementary Products

Placing related products together encourages cross-selling and increases basket size. For example, positioning personal care items near complementary products such as razors, wipes, or travel-size essentials simplifies decision-making and improves the shopping experience.

This strategy leverages consumer psychology by aligning product placement with natural usage patterns.

4. Checkout and Impulse Zones

Checkout areas are designed for quick decisions. FMCG products placed here benefit from high visibility and minimal comparison, making them ideal for impulse buys. Small, frequently used items perform especially well in these zones due to their low price point and convenience.

5. Data-Driven Shelf Optimization

Effective FMCG shelf placement relies on sales data and data analytics rather than assumptions. Brands that monitor sales performance by shelf position gain valuable insights into what works across different store layouts. These insights support better inventory management, improve product availability, and help brands defend or grow market share over time.

How Consumer Psychology Shapes Product Placement Decisions

Product placement FMCG strategies succeed because they align with how customers shop. Consumers prefer convenience, familiarity, and clarity. Placing complementary products together, such as personal care items near grooming accessories, encourages impulse buys and increases basket size.

This approach uses consumer psychology to reduce decision fatigue, improve customer experiences, and guide shoppers naturally toward purchase.

When shelf placement aligns with consumer needs, it becomes a silent but powerful sales driver.

Successful Digital Retail Media Campaigns with Display Ads

In competitive retail environments, attention is limited. Brands that treat product placement as a strategic placement decision consistently outperform those that rely solely on ads.

While there is no silver bullet for success, there are some best practices that all successful digital retail media campaigns have in common:

Strategic Product Placement: Just like physical stores, online retailers also have limited space. The brands that can get their products in the most visible places are the ones that are more likely to be seen by consumers. It matters where you show up, as digital shelf space is typically limited, with multiple products vying for attention.

Clear Value Communication: Giving shoppers useful, relevant information about relevant products at the right time goes a long way. Creating a strong value proposition that speaks to the needs of your target audience is critical to success. For instance, using Image Extensions and Product Listing Ads can effectively showcase what searchers are looking for.

Seller Credibility: Getting the word out about your product is important, but it’s also important to ensure that you are seen as a reputable seller. Including seller ratings, customer reviews, and other social proof elements in your digital retail media campaigns can help build trust and credibility with potential buyers.

Shopper-Centric Thinking: Always put yourself in the shopper’s shoes. What would they be interested in? What kind of information would they find useful? By thinking like a shopper, you can create more effective digital retail media campaigns that are more likely to resonate with your target audience.

Leverage Ad Remarketing: Ad remarketing is an effective way to keep your brand top of mind with potential shoppers. By targeting consumers who have already shown an interest in your product, you can increase their likelihood of purchasing.

Strong Visual Merchandising: Just like physical products, digital products need to be well-packaged to stand out. Using high-quality product images is akin to having an amazing physical product display. Ensuring that your products are well-lit, in focus, and show all the important details that shoppers need to know can make a big difference in how well your products are perceived.

Together, these elements improve sales performance and protect market share.

Hotspots vs Coldspots in FMCG Product Placement

Not all shelf locations deliver the same results. In both physical and digital retail environments, certain areas naturally attract more attention and engagement. These areas are known as hotspots, while lower-performing zones are referred to as coldspots.

Understanding the difference between hotspots and coldspots allows FMCG brands to allocate products more intelligently, improve brand visibility, and boost sales without increasing marketing spend.

|

Placement Zone |

Hotspots |

Coldspots |

|

Visibility |

High-visibility areas that naturally draw attention |

Low-visibility areas are often overlooked by shoppers |

|

Typical Locations |

Eye-level shelves, end caps, checkout counters, and featured online listings |

Bottom shelves, top shelves, back corners, low-ranked listings |

|

Impact on Sales |

Strong sales performance and higher impulse buys |

Lower sales velocity and slower stock movement |

|

Best Use Cases |

Key products, new products, promotional displays, seasonal items |

Low-priority SKUs, bulk packs, niche or low-demand items |

|

Customer Behavior |

Encourages quick decisions and engagement |

Requires deliberate effort from shoppers to notice |

|

Role in Strategy |

Core to an effective product placement strategy |

Used mainly for inventory overflow or secondary products |

By prioritizing hotspots for high-impact FMCG product placement and minimizing reliance on coldspots, brands can significantly improve brand awareness, customer engagement, and overall sales performance.

Common Challenges in FMCG Product Placement

Even though product placement directly influences sales, many FMCG brands struggle to execute it consistently at scale. The most common challenges show up at the store level, where strategy meets reality.

1. Limited access to prime shelf space

High-visibility areas like eye-level shelves, end caps, and checkout zones are limited and often controlled by retailers. Securing these spots usually requires higher listing fees, strong retailer relationships, or proven sales performance, which can disadvantage newer or lower-margin brands.

2. Inconsistent planogram compliance

What’s agreed at headquarters doesn’t always translate on the shop floor. Products may be placed incorrectly, substituted, or pushed aside due to staff constraints, competing brands, or poor communication. Over time, this inconsistency weakens brand visibility and disrupts the intended shopper journey.

3. Overcrowded shelves and brand clutter

In many FMCG categories, shelves are packed with similar products competing for attention. When too many SKUs fight for the same space, even well-positioned products can get lost, reducing visual impact and making it harder for shoppers to make quick decisions.

4. Poor inventory visibility and stock gaps

Strong placement loses its effect when products are out of stock or inconsistently replenished. Limited real-time inventory visibility can lead to empty shelves, misplaced items, or excess stock in low-performing locations, all of which hurt sales and shopper trust.

5. Variation across store formats and locations

A placement strategy that works in a supermarket may fail in a smaller convenience store or high-traffic urban outlet. Differences in layout, shopper behavior, and available space make it difficult to apply one uniform placement approach across all retail environments.

Brands that address these challenges through better data analytics, closer retailer collaboration, and disciplined execution gain a competitive edge, improving customer satisfaction, protecting brand perception, and driving sustainable sales growth across both physical and virtual shelves.

How Flipkart Commerce Cloud Transforms FMCG Product Placement Strategy

Product placement on shelves, whether physical or digital, continues to be one of the most decisive factors in FMCG performance. As retail environments become more fragmented and consumer journeys more complex, success increasingly depends on a brand’s ability to manage visibility, availability, and execution with precision.

This is where commerce infrastructure begins to matter as much as strategy. Flipkart Commerce Cloud (FCC), for example, brings together decades of retail expertise into a cloud-native technology suite that helps retailers and brands manage digital commerce infrastructure, streamline catalog management, optimize pricing, and build retail media capabilities.

Platforms like FCC make it easier to connect strategic placement decisions from virtual shelf visibility to personalized storefronts with the operational tools needed to execute them. They showcase how the future of FMCG product placement is not just about visibility, but about the ability to act on real-time data, tailor product discovery, and enhance customer experiences across channels.

Book a demo to access powerful tools that will enhance your product placement strategies.

FAQ

The difference between CPG and FMCG lies mainly in sales velocity and purchase frequency. FMCG products are fast-moving consumer goods bought frequently with short shelf lives, such as milk or snacks, whereas CPG covers all packaged goods, including slower-moving items like cleaning supplies or household products.

Examples of FMCG goods include high-frequency purchases like carbonated soft drinks, dairy products such as milk or yogurt, snacks like chips, personal care items like toothpaste and soap, and over-the-counter medicines. These are everyday essentials that consumers buy regularly with minimal decision-making effort.

Digital platforms transform product placement strategies by shifting the “shelf” to virtual spaces. Algorithms, search rankings, and sponsored listings replace physical aisle positioning, allowing brands to influence visibility, placement priority, and customer engagement in ways that mirror traditional retail but leverage data-driven insights.

Yes, product placement can impact brand loyalty by consistently reinforcing brand visibility and recognition across retail spaces. Strategic placement, repeated exposure, and alignment with consumer needs help build trust and transform one-time purchases into habitual buying behavior.

Product placements influence consumer behavior by guiding attention and reducing decision fatigue. Well-placed products, whether on eye-level shelves, end caps, or digital hotspots, encourage impulse buys, cross-selling, and repeat purchases, leveraging consumer psychology to shape shopping decisions.

More Blogs

See how retailers and brands are winning with FCC

Everything About Price Skimming Strategy Explained

Read More

What is a High-Low Pricing Strategy?

Read More

Ultimate Guide To Dynamic Pricing Strategy In 2026

Read More

Retail Pricing Strategies: Winning with Promotion Pricing in Competitive Markets

Read More

Ad Tags: Enhancing Ad Serving Efficiency in Large-Scale Campaigns

Read More