FAQ

The most common market structure in the real world is often monopolistic competition, especially for consumer goods and services. This structure is characterized by numerous firms selling differentiated products that are close substitutes, allowing each firm some control over its price as consumers perceive brand differences, unlike the purely theoretical perfect competition.

The five market structures in economics are the four primary models: perfect competition, monopolistic competition, oligopoly, and monopoly, with the fifth frequently being considered monopsony, which is a market structure where there is only one buyer for a product or service. The first four models are defined by the number of sellers, product homogeneity, and barriers to entry.

A perfect market structure, or perfect competition, is an idealized model used as a benchmark in economic theory, defined by five strict characteristics: numerous buyers and sellers; all firms selling an identical (homogeneous) product; perfect information available to all participants; free entry and exit from the market; and all firms being price takers with no ability to influence the market price.

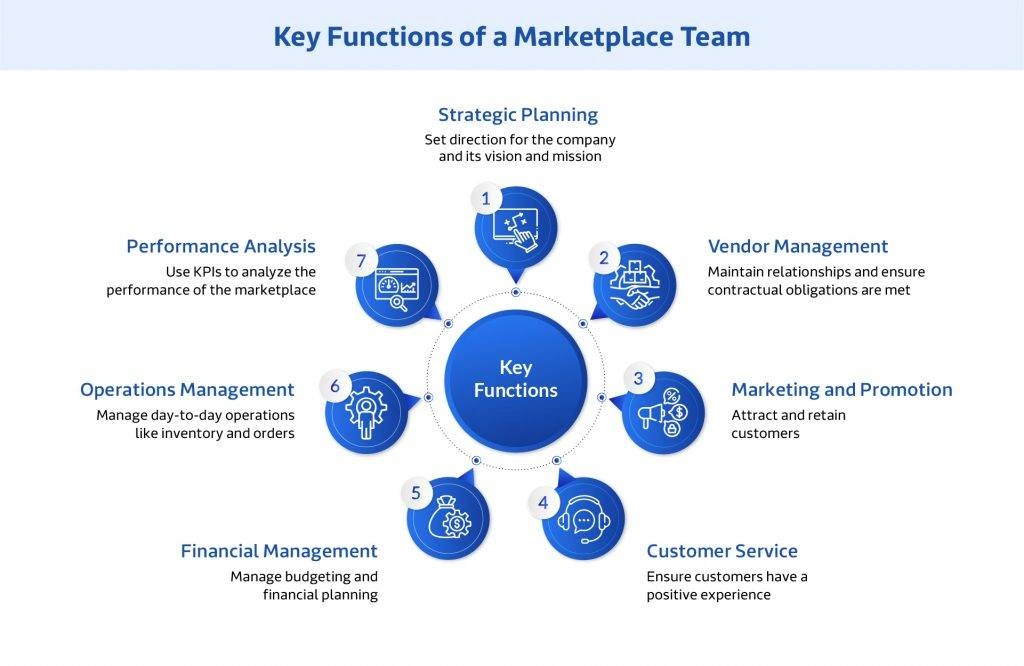

The KPIs that anchor the marketplace organizational structure revolve around the dual goals of attracting buyers and sellers, typically including Gross Merchandise Value (GMV) and Order Volume for measuring scale and sales performance. Crucial operational and quality KPIs include Seller Response Time and Customer Satisfaction Score (CSAT), along with financial KPIs like Profit Margin by Marketplace to ensure the platform is optimized and running profitably.

The three phases of the market structure often refer to the cyclical pattern observed in technical analysis of financial markets, which are the accumulation phase, the uptrend phase, and the distribution phase. The accumulation phase is a period of sideways movement where smart money quietly buys, followed by the uptrend phase where the price rises and public participation increases, and finally the distribution phase where the smart money sells, leading to another period of sideways movement before a potential decline.

The 7 key elements of organizational structure are work specialization (the degree to which tasks are divided into separate jobs); departmentation, (the basis on which jobs are grouped together e.g., by function, product, or geography); the chain of command (the line of authority and who reports to whom); the span of control (the number of subordinates a manager can efficiently and effectively direct); centralization or decentralization (dictates where decision-making authority lies); formalization (the extent to which jobs within the organization are standardized and governed by rules and procedures); and the overall culture of the organization, which influences how work is carried out and how employees interact.

The right marketplace organizational structure is fundamental for achieving scalability, operational efficiency, and sustainable growth in a two-sided business model. A well-designed structure aligns and resources critical functions—such as seller acquisition and demand generation—to efficiently match buyers and sellers and prevent silos. Without it, the marketplace risks slow decision-making, a poor customer/seller experience, and an inability to adapt or scale successfully. Platforms like FCC can help embed this efficiency from the start.

More Blogs

See how retailers and brands are winning with FCC

Everything About Price Skimming Strategy Explained

Read More

What is a High-Low Pricing Strategy?

Read More

Ultimate Guide To Dynamic Pricing Strategy In 2026

Read More

Retail Pricing Strategies: Winning with Promotion Pricing in Competitive Markets

Read More

Ad Tags: Enhancing Ad Serving Efficiency in Large-Scale Campaigns

Read More