Rule-Based Pricing Engines in Ecommerce

Pricing in ecommerce is a lot like playing chess against multiple opponents at once. Every move you make, every price you set, changes how your competitors, customers, and even your own teams respond.

You must defend your strengths (exclusive merchandise, key value items, and key value categories), attack your competitors’ weaknesses, and continually revisit your game plan. As your business grows, the board becomes increasingly complex, making it harder to price correctly at scale.

In chess, the most exciting games rarely hinge on a single “eureka” moment. They’re won by a series of smart, consistent decisions, with occasional bold sacrifices that pay off several moves later. Pricing works the same way. You’re making decisions with incomplete information, uncertain payoffs, and moving targets like demand, competition, costs, and customer expectations.

To win this game, retailers and brands increasingly rely on two main approaches:

- Rule-based pricing

- AI/ML-based price optimization

Most modern organizations combine both in a hybrid ecommerce pricing engine for price optimization. In this article, we’ll unpack what a rule-based pricing engine is, how it compares to machine learning–driven pricing, and how to design a rule-based strategy that balances control, flexibility, and speed.

Exploration vs. Exploitation: The Pricing Version of a Chess Trade-Off

A famous theme in chess is the trade-off between “exploration” and “exploitation”:

- Exploitation is doubling down on positions and patterns that have worked well before

- Exploration means trying new lines and ideas that may look risky in the short term but open up better winning chances later

Pricing is no different.

Do you keep prices where they are because they’ve always delivered decent margins (exploit)? Or do you test a new discounting strategy, bundle, or price point to unlock more volume, better inventory turns, or higher long-term customer value (explore)?

A good pricing engine must support both:

- Fast, repeatable decisions based on what is already known to work

- Smart experiments that help you learn and adapt to new information

This is where rule-based pricing and machine learning each bring something unique to the table, facilitating dynamic pricing.

What Is Rule-Based Pricing?

Rule-based pricing means setting and updating prices according to explicit rules that your team defines. A rule-based pricing engine applies those rules consistently and automatically across your catalog. These rules can incorporate factors like competitor prices, inventory levels, margins, and MAP constraints.

At a high level, you’re turning your pricing playbook into “if–then” logic. For example:

- If the competitor's price is lower by more than 5%, then match the price down to our minimum margin rule.

- If the remaining stock is below 10 units and demand is rising, then increase the price by 3–5%.

- If the product is part of a key value category, then keep the price within a tight range of the market average.

The rule-based pricing approach is built on domain expertise. You encode what your pricing managers already know, from MAP contracts and brand guidelines to category strategies and promotion calendars, into a structured, repeatable system.

How a Rule-Based Pricing Engine Works

A typical rule-based pricing engine has a few core components:

-

Knowledge base of rules: This is your library of business rules, often written as “if–then–else” statements.

-

Example: If competitor price < our price AND margin > 10%, then decrease price by 3%.

-

Data inputs: The engine consumes both internal and external data:

-

Internal: costs, inventory, historical sales, margins, customer data, product attributes, KVIs/KVCs

-

External: competitor prices, marketplace fees, seasonality signals

-

Inference engine: This part of the software decides which rules apply in a specific situation. It resolves conflicts, ensures priorities, and recommends the final price.

-

Execution layer: Once a rule triggers, the engine:

-

Calculates a new price

-

Checks it against guardrails (e.g., MAP, minimum profit margin)

-

Pushes the price to your ecommerce platform, POS system, or promotion engine across all relevant sales channels

In short, a rule-based pricing engine is like a tireless analyst who never forgets a rule, never misses a product, and always runs the same logic the same way, bringing structure and consistency to your pricing process.

Example: Season-End Overstock and Manual Intervention

Consider this scenario.

You are a retailer selling luxury brands online. These brands are part of your key value categories, and you have strict MAP contracts in place. At the beginning of the season, you set:

- Guardrail prices based on MAP

- Target margins by category

- Competitive position rules (e.g., “Never be more than 5% above the lowest marketplace price”)

Your rule-based pricing engine happily runs on these inputs throughout the season, adjusting prices within your guardrails as costs, competition, and market demand change.

Now, fast forward to the end of the season:

- The inventory of several styles is still high

- New-season stock is about to arrive

- Shoppers are already migrating to fresh collections

The rules that worked all season now hold you back. The engine continues to respect MAP and margin targets, but the business reality has changed. You need to:

- Clear old inventory to free up cash and warehousing

- Make room for new collections

- Avoid resorting to last-minute fire-sale tactics

Here is where experienced ecommerce merchandisers step in. They may temporarily relax the rules for selected SKUs or categories, for example:

- Allow deeper markdowns below the standard margin for end-of-season items

- Permit prices to go closer to (or even slightly below) MAP where contracts allow

- Run clearance campaigns on the website and app

By adding or modifying rules, your team transforms the static rule-based pricing setup into a more responsive rule-based strategy. The engine still automates the heavy lifting, but human judgment steers it toward better long-term outcomes.

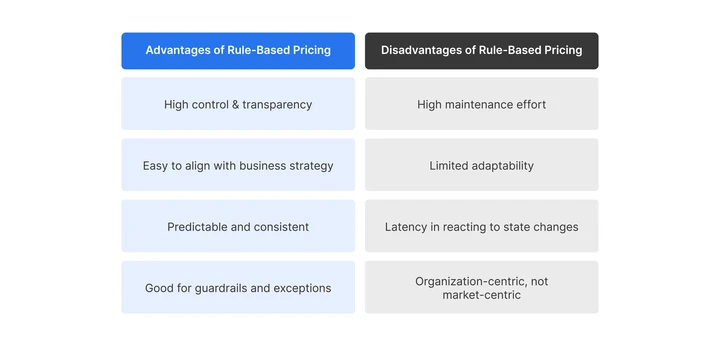

Rule-Based Pricing: Pros and Cons

Like any pricing approach, rule-based pricing comes with trade-offs.

Advantages of Rule-Based Pricing

- It offers control and transparency. Every price change can be traced back to a rule. This is invaluable when you need to explain price changes to finance, category teams, or brand partners, or when you must comply with MAP, contractual obligations, or internal policies

- You can encode your commercial strategy directly into the rule-based pricing engine, like protecting KVIs with aggressive pricing, maintaining premium positioning, or protecting margins on long-tail SKUs

- Because the logic is explicit, the outcomes are predictable. You don’t get “surprising” prices that confuse managers or upset partners.

- Even in very advanced setups, a rule-based strategy is ideal for defining floors and ceilings for prices, exceptions (e.g., don’t discount certain luxury brands), and safety checks (e.g., never change price more than X% in a day)

Limitations of Rule-Based Pricing

-

Rules don’t write or update themselves, so they necessitate maintenance. Over time, you end up with:

-

Hundreds of overlapping rules

-

Duplicates and conflicts

-

Legacy rules that no one remembers, but no one wants to delete

-

This makes pure rule-based pricing hard to scale, especially for online retailers managing large and fast-changing catalogs.

-

Because rules are manually defined, the system has limited adaptability. This may manifest as slow reactions to sudden market changes, struggles with new product launches with no history, or the inability to capture complex interactions between variables.

-

In a highly dynamic ecommerce environment, prices may need to change multiple times a day and across millions of SKUs, based on rapidly shifting demand and competition. So, implementing dynamic pricing with rule-based pricing, plus manual interventions in spreadsheets, quickly becomes unsustainable.

-

Rules are usually written from the company’s perspective. They may not fully reflect what’s happening in the market, how customers truly respond to prices, or how competitors behave in practice.

This is why most large retailers and marketplaces move beyond purely rule-based pricing and augment it with machine learning.

What Is Machine Learning–Driven Pricing?

A machine learning-driven ecommerce pricing engine uses statistical and AI models to learn patterns from large amounts of data, use those patterns to predict how customers and competitors are likely to respond, and based on these predications, recommend or set prices that optimize for chosen KPIs.

Where rule-based pricing encodes expert knowledge, ML-based pricing encodes learned knowledge from data.

How ML-Based Pricing Systems Work

An ML-powered ecommerce pricing engine typically:

-

Aggregates data at scale: It ingests data such as:

-

Historical transactions and prices

-

Product attributes and categories

-

Competitor prices and promotions

-

Inventory levels and supply constraints

-

Customer behavior (searches, clicks, add-to-cart, conversions)

-

External signals (seasonality, market trends, events, sometimes even weather)

-

Learns relationships and patterns: The model identifies:

-

How sensitive demand is to price changes (price elasticity)

-

Which attributes make customers more willing to pay

-

Which segments respond better to discounts vs. everyday low prices

-

Optimizes against business KPIs: The engine generates price recommendations aligned with target outcomes:

-

maximizing margin

-

maximizing revenue or GMV

-

optimizing inventory turns and reducing stock-outs

-

Balancing growth vs. profitability

-

Adapts over time: As new data comes in, the model:

-

Updates its understanding of demand and elasticity

-

Learns from promotions and experiments

-

Adjusts recommendations without rewriting rules

In other words, the ML engine focuses on continuous, data-driven state-wise optimization rather than manual rule tweaking.

Key Capabilities of ML-Based Ecommerce Pricing Engines

Here are some of the capabilities you usually get from an ML-powered ecommerce pricing engine:

-

Granular customer and product segmentation: Cluster customers based on behavior, demographics, or willingness to pay; segment products by lifecycle stage, seasonality, or role in the catalog.

-

Multi-variable optimization: Consider dozens of variables simultaneously: competitors, attributes, cross-sell effects, seasonality, cost changes, and more.

-

Real-time or near-real-time pricing: Adjust prices quickly in real time in response to demand spikes, competitor moves, or inventory shifts.

-

Price elasticity estimation: Learn how quantity sold changes with price (globally, by category, or by segment) and use it to find the sweet spot.

-

Simulation and scenario analysis: Test the impact of different pricing strategies before deploying them at scale.

-

KPI-driven pricing: Directly encode target metrics (margin, turnover, profit, inventory health) into the optimization objective.

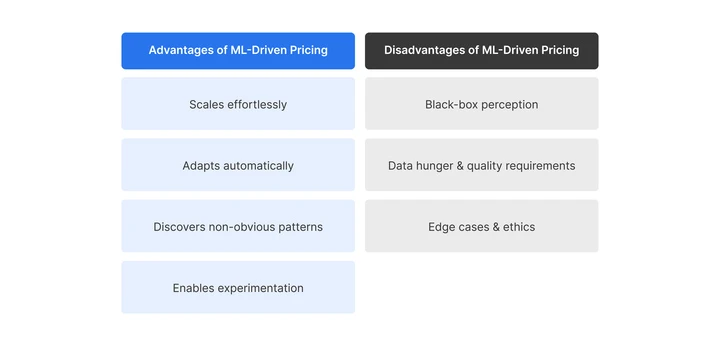

Advantages and Limitations of ML-Driven Pricing

Advantages

-

ML-based engines can scale effortlessly, handling millions of SKUs, billions of data points, and frequent price updates.

-

When customer behavior or competition changes, the ecommerce pricing engine learns and reacts without waiting for a human to write new rules.

-

Machine learning often picks up non-obvious patterns like hidden drivers of demand, cross-category interactions, and subtle seasonality effects. These would be almost impossible to encode manually in rule-based pricing rules.

-

You can run experiments like controlled price tests with it, and feed the results back into the model, improving accuracy over time.

Limitations

-

Stakeholders may find it hard to trust recommendations if they can’t easily see the “logic” behind them. This is quite different from the explicit rules in rule-based pricing.

-

ML models need large volumes of clean, granular data; good tracking of promotions, anomalies, stock-outs, and changes; and continuous monitoring to avoid drift

-

Models optimize what they’re told to optimize. Without guardrails, they may push prices too high during emergencies or disasters or create unfair or inconsistent prices across customer segments, ultimately damaging brand trust over the long term.

This is where rule-based guardrails become essential, even in the most advanced ecommerce pricing engine.

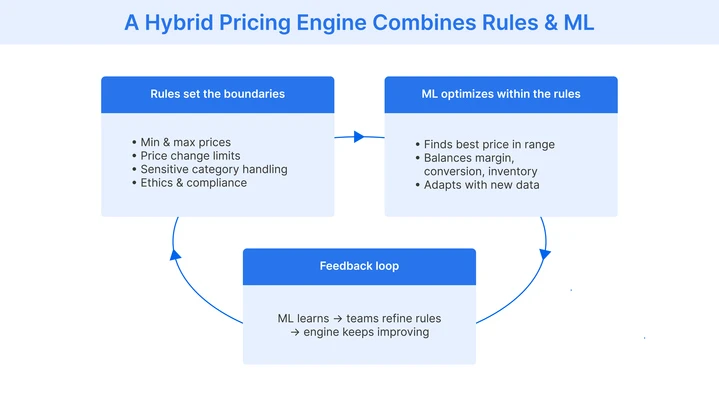

Why a Hybrid Model Wins: Combining Rule-Based Pricing and ML

The most effective approach for modern retailers is rarely “rules vs. ML.” It’s rules and ML working together in a hybrid model.

Think of it this way: Machine learning handles high-frequency, high-volume optimization at scale, while rule-based pricing provides strategic direction, safety rails, and human judgment.

How the Hybrid Model Works

In a typical hybrid ecommerce pricing engine:

-

Rules set the boundaries: A rule-based strategy defines:

-

Minimum and maximum prices

-

Maximum daily or weekly price changes

-

Special handling for sensitive categories or brands

-

Ethical and compliance guardrails

-

ML optimizes within those boundaries: Machine learning models:

-

Propose the best price within the allowed range

-

Balance margin, conversion, and inventory

-

Adjust as new information flows in

-

Feedback loops refine both: Over time:

-

ML models learn which rules are too strict or too loose

-

Pricing teams refine rules to reflect long-term strategy and brand positioning

In other words, rule-based pricing ensures the engine never violates your brand or business constraints, while ML ensures the engine doesn’t get stuck in outdated or suboptimal configurations.

Real-World Guardrail Example: Surge Pricing Gone Wrong

A classic example of why guardrails matter comes from algorithmic surge pricing.

Imagine a city facing a sudden crisis. An algorithm, seeing a spike in demand and limited supply, raises prices sharply, sometimes several hundred percent higher than normal. From a pure optimization standpoint, the model is “right.” But from a brand and ethics standpoint, it’s disastrous.

In such situations, you want rule-based pricing constraints like:

-

If a price change exceeds X% inside Y minutes, then cap the increase.

-

If external events meet certain criteria (public emergencies, disasters), then disable surge rules and switch to a different rule-based strategy.

These are not patterns you want your model to “learn” by trial and error on real customers. They should be encoded explicitly through a rule-based pricing engine.

Designing a Rule-Based Pricing Strategy to Boost Profitability

If you’re building or upgrading your pricing capabilities, here’s how to think about your rule-based strategy in a hybrid world that demands a flexible approach.

1. Start from Business Goals and KPIs

Before you write a single rule, get clarity on:

-

What are your primary pricing goals?

-

Margin maximization?

-

Market share and growth?

-

Inventory optimization?

-

How do goals differ by category?

-

Some categories may be traffic drivers (KVIs) with low margins.

-

Others may be margin drivers with less price sensitivity.

Your rule-based pricing should reflect these priorities.

2. Define Guardrails and Non-Negotiables

These become the backbone of your rule-based pricing engine:

-

Minimum margin thresholds by category, brand, or product type

-

Maximum discount limits outside major campaign periods

-

MAP and contractual restrictions

-

Rules for key value items and categories

These guardrails fully support an ML-based ecommerce pricing engine by carving out a safe space in which it can optimize.

3. Identify Where Rules Add the Most Value

Not every scenario needs explicit rules. Focus on areas like:

-

Compliance (MAP, contracts, regulatory requirements)

-

Brand positioning (luxury vs. mass segments)

Customer fairness (limits on dynamic pricing swings) -

Exceptional events (pandemics, natural disasters, major news events)

-

Sensitive verticals (healthcare, essentials, financial products)

In these areas, rule-based pricing is often better than pure optimization.

4. Let ML Handle the Heavy Analytical Work

For the rest, lean on your ML systems to:

-

Estimate elasticity at scale

-

Recommend price points for promotions and events

-

Identify which products should be marked down and by how much

-

Suggest bundle prices and cross-sell opportunities

Then layer rule-based pricing on top to ensure recommendations are aligned with your long-term strategy.

5. Keep Rules Simple, Hierarchical, and Maintainable

A common failure mode of rule-based pricing is complexity creep. To avoid it:

-

Group rules by objective (e.g., margin protection vs. traffic growth)

-

Create clear priorities and conflict-resolution logic

-

Review rules periodically to remove outdated ones

-

Document the intent of each major rule so new team members understand why it exists

This makes your rule-based pricing engine resilient as the organization and catalog grow.

Where Flipkart’s Experience Comes In

At Flipkart Commerce Cloud, we’ve spent over fifteen years operating in one of the world’s most price-sensitive markets. With 300+ million users, 80+ categories, and 150+ million product listings, we’ve seen firsthand how hard it is to scale pricing decisions with spreadsheets alone.

Our pricing solution is a hybrid one:

-

ML-driven ecommerce pricing engines that work at massive scale and speed

-

A flexible rule-based pricing layer that lets category and pricing teams apply domain expertise, brand positioning, and long-term thinking

This combination has helped us navigate:

-

Festive seasons with huge spikes in demand

-

Highly competitive categories with razor-thin margins

-

Sensitive situations where customer trust matters more than short-term margin

If you are a retailer, marketplace, or omnichannel brand, our hybrid approach can help you turn pricing from a manual bottleneck into a strategic lever with significant benefits. Book a demo to see how.

FAQ

Rule-based pricing is most frequently applied in industries where companies need strong control, transparency, and compliance in pricing, such as retail and ecommerce, travel and hospitality (basic fare rules), utilities and telecom, insurance underwriting, and B2B manufacturing or distribution. In these sectors, rule-based pricing lets teams encode contracts, discounts, MAP policies, and margin rules into a rule-based pricing engine so the business can scale decisions while still following a clear, auditable rule-based strategy.

Attraction operators—like theme parks, museums, zoos, and entertainment venues—use rule-based pricing to set structured ticket prices based on clear conditions (day of week, season, holidays, age groups, group size, advance purchase, etc.), often as a base layer compared to more dynamic or AI-driven models. While advanced operators may add dynamic or demand-based pricing on top, rule-based pricing gives them predictable, easy-to-explain tiers (e.g., weekday vs weekend, peak vs off-peak) that can then be refined with more sophisticated models if needed.

A rule-based pricing engine differs because it is prescriptive and static, operating strictly on human-defined logic and rules that do not learn or evolve. In contrast, dynamic or ML-driven pricing systems are predictive and adaptive, using complex algorithms to analyze massive datasets, forecast demand, and autonomously determine the optimal price point to maximize profit or revenue, adjusting the logic itself as they learn from outcomes.

A pricing engine needs several key data sources for effective operation: Cost data (COGS) to establish a profit floor; Inventory data (stock levels, days of supply) to drive markdowns or price increases; Competitor data (real-time prices and stock of key rivals) for competitive matching; and Demand data (sales velocity, website traffic, conversion rates) to understand customer willingness to pay. These inputs ensure rules are applied to achieve specific business goals like margin protection or stock liquidation.

Conflicting rules are prioritized and resolved in a rule-based engine through a predefined hierarchy or priority scoring system established by the user. Typically, rules are executed in a specific order, often with the most critical constraints—such as the margin floor rule—given the highest priority to ensure they are always met. For example, a "beat competitor by 2%" rule might run, but if the resulting price violates the higher-priority "margin floor" rule, the price will be capped by the floor rule instead.

Yes, the engine can run pricing on predefined schedules (e.g., repricing all SKUs nightly or every hour) and upon specific event triggers. Event triggers are crucial for timely reactions and include real-time events like a competitor's price change, a stock change (hitting a low inventory threshold), or a cost update from the ERP system, ensuring that prices reflect the latest operational realities.

The engine should reprice different categories or SKUs based on their demand volatility and competitive intensity. Highly competitive, fast-moving items like electronics or best-selling books should be repriced hourly or even more frequently. Slower-moving or less competitive items, like niche tools or clearance stock, can be repriced daily or weekly to save computational resources while still responding to major market shifts.

The engine prevents margin erosion and price wars primarily by strictly enforcing price floor rules, which are set based on the product's COGS plus a minimum desired profit margin, ensuring a transaction is never unprofitable. Additionally, some engines use minimum uplift rules to prevent endless back-and-forth price matching (ping-ponging) and can be configured to price-match only a specific, limited set of trusted competitors.

You should move from a pure rule-based engine to a hybrid (rules + ML) approach when your product catalog complexity, transaction volume, or competitive landscape exceeds human manageability, or when your focus shifts from simply reacting to competitors to proactively maximizing profit. The hybrid model uses ML to suggest or set the optimal price, while retaining the rule layer to enforce necessary guardrails, such as margin floors and competitor match policies, which is a feature often offered by advanced platforms like FCC.

More Blogs

See how retailers and brands are winning with FCC

Everything About Price Skimming Strategy Explained

Read More

What is a High-Low Pricing Strategy?

Read More

Ultimate Guide To Dynamic Pricing Strategy In 2026

Read More

Retail Pricing Strategies: Winning with Promotion Pricing in Competitive Markets

Read More

Ad Tags: Enhancing Ad Serving Efficiency in Large-Scale Campaigns

Read More