Table of Contents

- What is Dual Pricing?

- How Does Dual Pricing Work?

- Why Retailers Implement Dual Pricing?

- What are the Risks of Dual Pricing?

- Best Strategies for Dual Pricing Implementation

- Stop Guessing and Start Pricing with Precision

What is Dual Pricing?

Dual pricing is a strategic retail strategy in which businesses assign different price points to the same product based on the specific sales channel or payment method. Shoppers often encounter this approach when an item is priced lower on an e-commerce website compared to its cost in a brick-and-mortar store.

However, in recent years, the term has also become synonymous with a dual pricing program offered by small businesses to offset credit card processing fees. In this context, a customer sees a cash price (which acts as a cash discount) and a credit card price that covers the transaction costs.

This method allows retailers to adapt to local economic conditions and varying levels of competition. Whether you are adjusting for card processing costs or geographical markets, it targets the context of the sale rather than the individual attributes of a specific customer.

- Retailers often use this method to offset higher operational costs associated with maintaining physical storefronts or high payment processing costs.

- It enables businesses to stay competitive in aggressive online marketplaces while protecting profit margins in their brick-and-mortar locations.

- This approach requires careful management to ensure customer trust remains intact across various physical and digital sales touchpoints.

- Successful implementation relies on clear communication to explain price variances to customers who might shop across multiple channels or use different card networks.

How Does Dual Pricing Work?

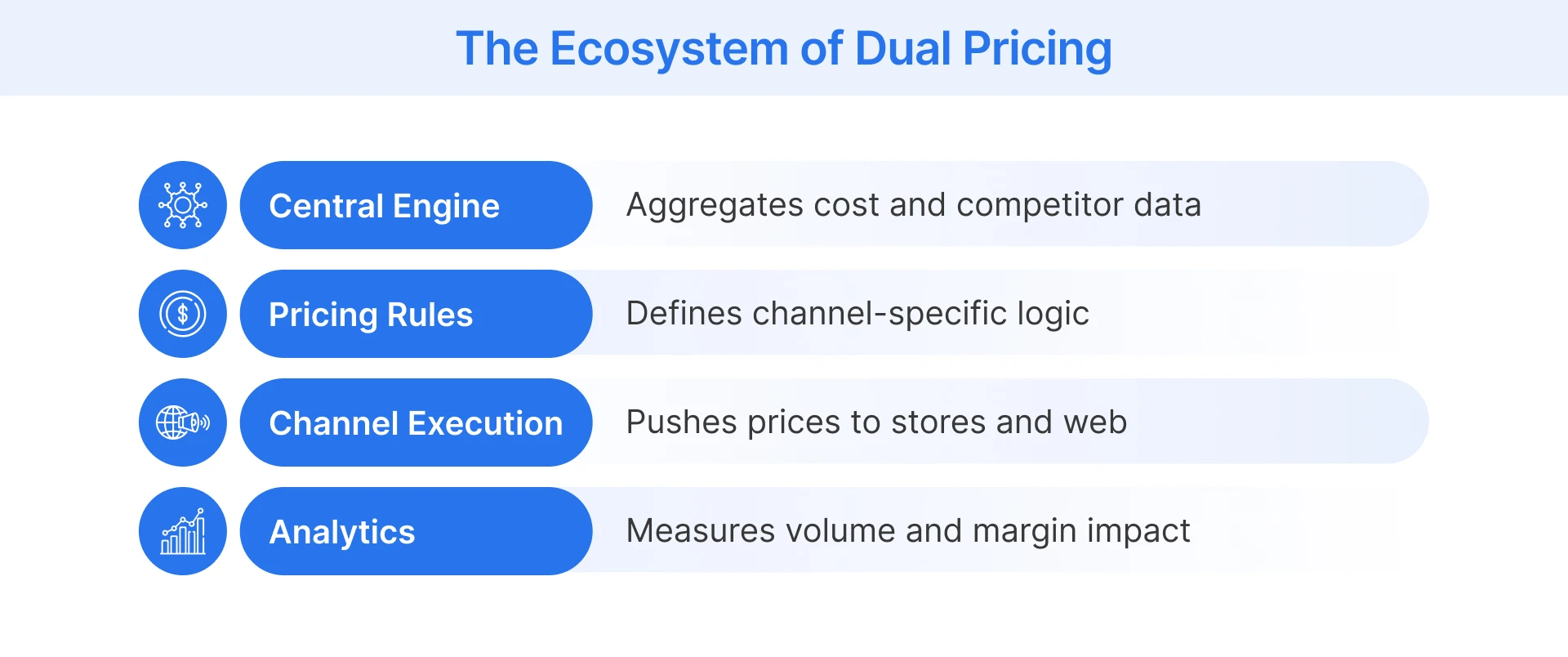

Dual pricing leverages technology and data to set distinct price points for different sales channels or customer segments. Here is how it works in practice:

- Step 1 - Set up a central pricing engine: You need a robust central system to manage base prices and calculate channel-specific adjustments automatically in real-time. This is where the advanced pricing solutions we provide in Flipkart Commerce Cloud become essential for centralizing data and ensuring consistency across all your platforms.

- Step 2 - Set up Pricing Rules: Next, you must configure the specific criteria that determine when and where a price difference should occur based on your business goals. These rules might automatically trigger lower prices for online shoppers to match a competitor's price or raise store prices to cover physical overheads.

- Step 3 - Execute with a Strategy: The final step involves pushing these calculated prices to your electronic shelf labels and e-commerce storefronts simultaneously. You must monitor the results constantly to ensure the strategy drives sales volume without confusing your loyal customers or damaging your brand perception.

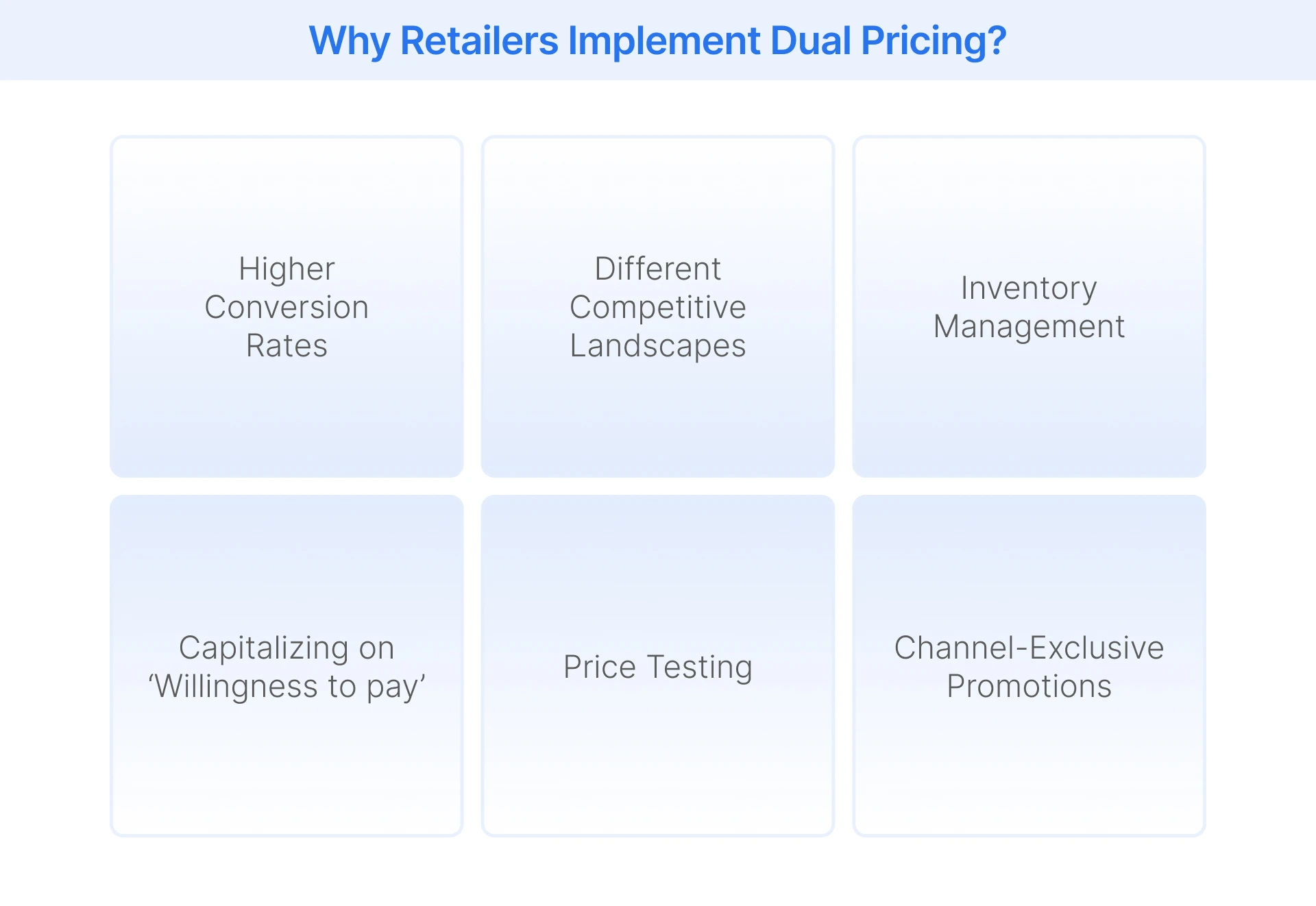

Why Retailers Implement Dual Pricing?

Retailers adopt dual pricing to maximize profitability while accounting for the unique economic realities of operating across diverse sales environments.

- Varying Operational Costs: Physical stores incur significant overheads like rent and utilities that do not affect e-commerce operations to the same extent. You can offset these expenses by charging slightly more in-store, while offering competitive rates online, where your operating costs remain significantly lower.

- Different Competitive Landscapes: Online shoppers compare prices instantly, requiring you to offer aggressive rates to capture their attention and secure sales. Conversely, physical stores often face less immediate competition nearby, allowing you to maintain standard pricing without the immediate risk of losing customers to a rival.

- Inventory Management: If you hold excess stock in a specific warehouse, you need to move it quickly to free up valuable storage space. Lowering the price for that specific region helps clear inventory efficiently without impacting your standard pricing strategies in other unaffected areas.

- Capitalizing on ‘Willingness to pay’: Shoppers in affluent neighborhoods or convenience channels are often willing to pay a premium for immediate product access. You can set higher price points in these specific locations to capture additional revenue without alienating price-sensitive customers in other markets.

- Price Testing: Dual pricing allows you to experiment with different price points in a controlled environment to gauge real customer demand. You can test a higher price in a specific market to see if sales volume holds steady before rolling the change out globally.

- Channel-Exclusive Promotions: You can drive traffic to a priority platform by offering exclusive pricing not available in other sales channels. This strategy incentivizes customers to download your app or visit your website, helping you build a direct and valuable digital relationship.

What are the Risks of Dual Pricing?

While effective for revenue, dual pricing strategy carries potential downsides that can damage your long-term relationship with your customer base.

- The ‘Showrooming’ Effect: Customers might visit your physical store to inspect a product and then buy it online for a lower price. This behavior turns your expensive retail space into a mere display room and erodes the profitability of your brick-and-mortar operations.

- Erosion of Brand Trust: Shoppers may feel cheated if they discover they paid significantly more for an item than they would have online. This perception of unfairness can lead to negative reviews and cause loyal customers to abandon your brand for a competitor.

- Operational Complexity: Managing multiple price lists across various channels increases the risk of errors and inconsistencies in your billing or marketing. Your team must work harder to ensure that pricing data remains accurate and synchronized across all your digital and physical systems.

Best Strategies for Dual Pricing Implementation

You can mitigate risks by following proven tactics that effectively balance profitability, customer satisfaction, and operational efficiency.

- Offer Price Matching: You should allow in-store customers to match your online price if they bring it to the attention of staff. This policy saves the sale for the physical store and prevents the customer from walking out to order from a competitor.

- Use ‘Web Exclusive’ Labels: You must clearly mark lower online prices as special internet-only offers to manage customer expectations regarding in-store pricing differences. Transparency helps customers understand that the discount is tied to the lower cost of serving them through a digital channel.

- Leverage Dynamic Pricing Software: You need automated tools to adjust prices in real time based on demand and competition across all your channels. Manual updates are too slow to keep up with market changes and often lead to costly errors in your pricing execution.

Stop Guessing and Start Pricing with Precision

Pricing strategies determine your market position and directly influence the financial health of your retail or e-commerce business operations. Implementing a dual pricing model requires a deep understanding of your operational costs and customer behavior across all channels.

Managing these complexities manually often leads to errors that frustrate customers and cost retailers revenue. At Flipkart Commerce Cloud, we specialize in solving these challenges by providing intelligent technology that simplifies your entire pricing lifecycle management.

We offer a comprehensive Pricing Solution that uses machine learning to automatically recommend the optimal price for every channel. Our system analyzes competitor data and internal demand signals to help you set dual pricing rules that maximize margin without sacrificing volume.

You can also leverage our Retail Media Platform to promote these channel-specific offers to the right audience at the right time. We ensure your pricing strategy aligns with your marketing efforts to drive sustainable growth and customer loyalty.

FAQ

You need a centralized pricing engine or ERP system that supports multi-channel price management and real-time synchronization capabilities. It is essential to have software that can push updates to electronic shelf labels and web stores simultaneously to prevent data discrepancies. Advanced analytics tools also help you monitor performance across different markets.

No, dual pricing involves setting different base prices for the same product based on the channel or market. Surcharging adds an extra fee at the point of sale to cover specific processing costs, such as credit card transaction fees. While both affect the final cost, their fundamental purpose and application differ.

Dual pricing is generally legal as long as you do not engage in deceptive practices or discriminate based on protected classes. You must ensure that the price difference is clearly communicated and does not violate specific local consumer protection laws. Transparency is key to remaining compliant and avoiding potential lawsuits.

Yes, tracking revenue streams with different price points for identical SKUs can complicate your financial reporting and inventory valuation processes. You must have a robust accounting system that can handle multiple price lists and accurately attribute sales to the correct channel. Proper integration between sales and finance systems is crucial here.