Table of Contents

- What is the Customer Retention Rate?

- What are the Benefits of Measuring Customer Retention Rate?

- How Do You Calculate the Customer Retention Rate?

- What is the Difference Between Customer Retention Rate and Churn Rate?

- What is a Good Customer Retention Rate for Retail?

- How Can You Develop a Winning Customer Retention Strategy?

- What Key Metrics Are Related to Customer Retention?

- What Role Does Technology Play in Improving Customer Retention?

- Conclusion

What is Customer Retention Rate?

The customer retention rate is the metric that reveals the percentage of customers who remain loyal to your brand over a given timeframe. It provides a clear snapshot of your business's ability to maintain its customer base without factoring in newly acquired customers.

In the competitive retail and e-commerce industries, a high customer retention rate signifies strong customer satisfaction and brand loyalty. It is a direct indicator of your company's health and its potential for sustainable, long-term profitability and growth.

- This metric precisely measures the percentage of customers who continue making purchases from you.

- It serves as a direct reflection of your brand’s customer loyalty and overall satisfaction levels.

- It helps you effectively assess the performance of your end-to-end customer service strategies.

- Tracking this rate offers crucial insights into the long-term financial stability of your business.

- It highlights your ability to cultivate and maintain valuable, lasting relationships with your customer base.

What are the Benefits of Measuring Customer Retention Rate?

Consistently tracking your customer retention rate is vital for building a profitable business and understanding the long-term revenue potential.

- Improved Profitability: Retaining an existing customer is significantly more cost-effective than acquiring a new one, which directly boosts your profit margins by lowering ongoing marketing and sales acquisition expenditures.

- Increased Customer Lifetime Value (CLV): Happy customers tend to spend more over a given time period and make more frequent purchases, which dramatically increases their total financial value to your business throughout their entire lifecycle.

- Powerful Word-of-Mouth Marketing: Satisfied repeat customers are far more likely to evolve into brand advocates, referring friends and generating powerful, trustworthy social proof that drives organic growth for your business.

- Valuable Customer Feedback: A loyal and engaged customer base provides a reliable and continuous source of constructive feedback that you can leverage to refine your products, services, and overall customer journey.

- Greater Business Resilience: A high retention rate creates a very stable and predictable recurring revenue stream, making your entire business more resilient to unexpected market fluctuations and intense competitive pressures.

How Do You Calculate the Customer Retention Rate?

You can calculate your customer retention rate with a simple and direct formula that accurately measures customer loyalty over a specific period, such as a month, quarter, or year.

The standard formula is:

Customer Retention Rate = (E−N)/S × 100

Where:

- S = The number of existing customers at the start of the defined period.

- E = The total number of customers at the end of the defined period.

- N = The number of new customers acquired during the defined period.

For example, an online fashion retailer begins a quarter with 2,000 customers (S). During that three-month period, they acquire 400 new customers (N). At the end of the quarter, they have 2,200 total customers (E).

The calculation would be:

(2200−400) / 2000 × 100=90%

This result indicates the retailer successfully retained 90% of its original customers.

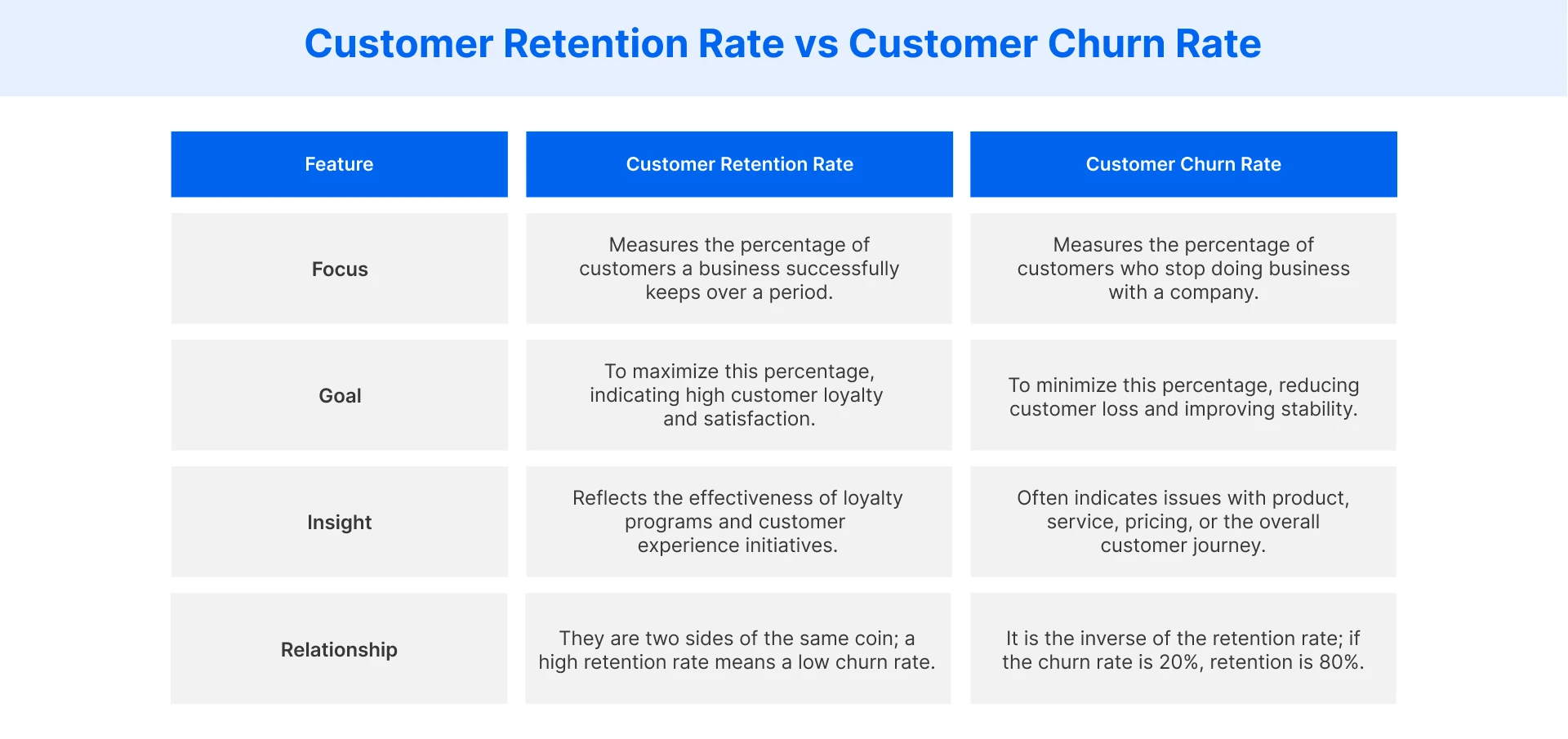

What is the Difference Between Customer Retention Rate and Churn Rate?

While the customer retention rate tracks the percentage of customers you successfully keep, the churn rate measures the exact opposite: the percentage of customers you lose. These two metrics are inversely related, providing a comprehensive view of customer base stability.

What is a Good Customer Retention Rate for Retail?

A "good" customer retention rate varies significantly across different retail sectors, often influenced by factors like purchase frequency and product lifecycles.

- Professional Services (84%): This sector has an exceptionally high rate, driven by long-term contracts, trust-based client relationships, and the significant costs and complexity involved in switching providers like legal or accounting firms.

- Consumer Services (67%): Industries like banking and insurance achieve strong retention through recurring subscriptions, bundled service packages, and the perceived hassle for customers who consider switching to a new competitor in the market.

- Retail Industry (63%): This healthy average customer retention rate for general retail is powered by a strategic mix of high-frequency purchases and effective, data-driven loyalty programs that successfully encourage repeat business from a loyal shopper base.

- Hospitality (55%): The travel industry’s rate is influenced by consumer price sensitivity and intense global competition, making loyalty schemes and personalized guest rewards programs crucial for retaining valuable, repeat travelers.

- Ecommerce (30%): This lower rate reflects the hyper-competitive digital marketplace where consumers can instantly compare prices and switch brands, demanding a flawless customer experience management to earn their continued loyalty.

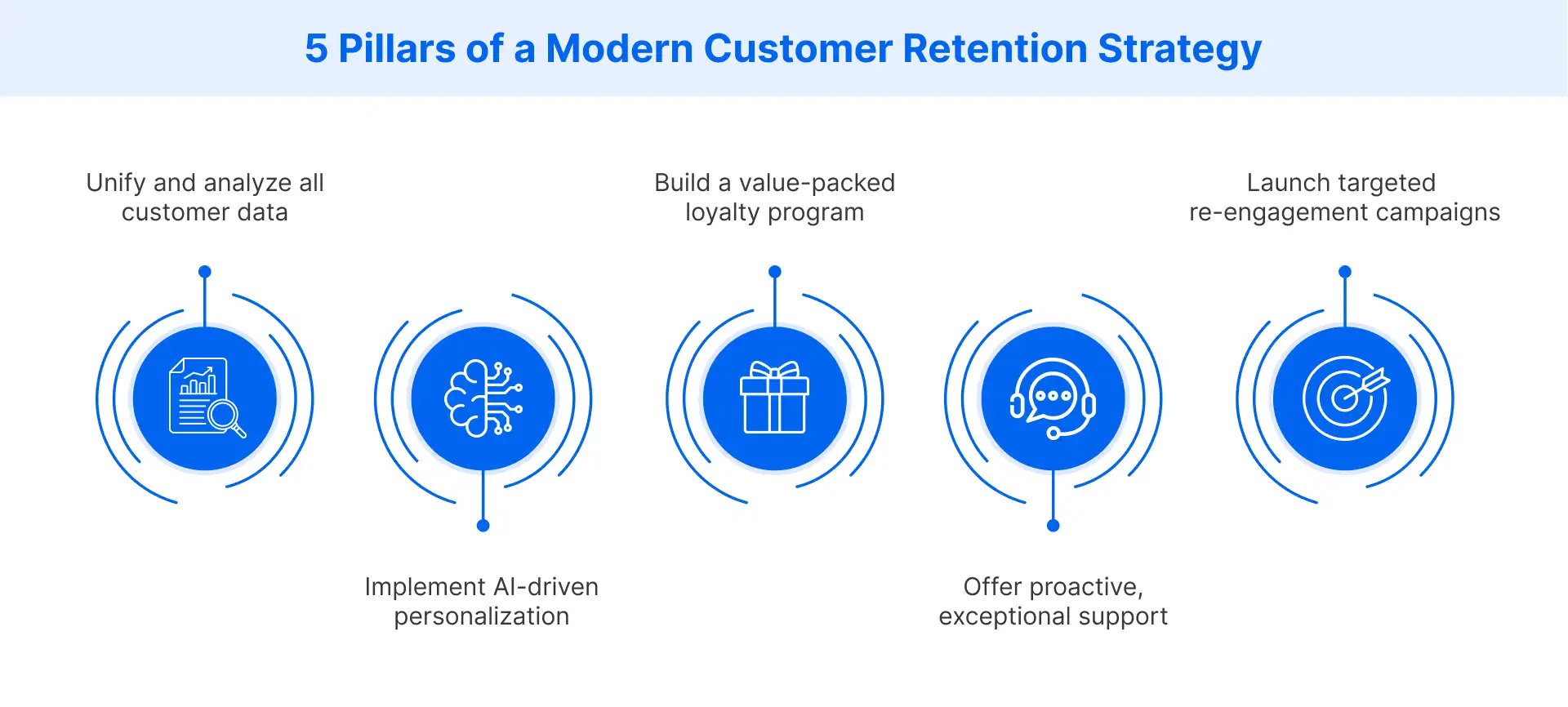

How Can You Develop a Winning Customer Retention Strategy?

Building a successful customer retention strategy requires a proactive, data-driven approach that is focused on understanding and anticipating your customers' needs.

Step 1: Analyze Customer Data and Feedback

Use a customer data platform (CDP) to create a single customer view by unifying data from all touchpoints. Then, apply sentiment analysis to reviews and surveys to pinpoint the precise friction points in the customer journey that are causing churn.

Step 2: Implement a Personalization Strategy

Leverage AI and machine learning models to deliver hyper-personalized experiences that go beyond basic recommendations. Customize the entire user journey, from targeted marketing campaigns with dynamic content to predictive offers based on a customer’s past browsing behavior.

Step 3: Create a Compelling Loyalty Program

Design a tiered loyalty program that rewards customers for valuable engagements beyond just purchases, such as social shares and product reviews. Offer experiential rewards and exclusive access to build a genuine community and a strong emotional connection to your brand.

Step 4: Provide Proactive and Exceptional Customer Service

Integrate AI-powered chatbots and self-service portals to provide instant, 24/7 support for common queries. Use predictive analytics to identify customers at risk of churning and proactively reach out with targeted solutions before they have a reason to complain.

Step 5: Launch Targeted Re-engagement Campaigns

Develop automated, trigger-based marketing workflows designed to win back your inactive or lapsed customers. Segment this audience based on past purchase history and send highly relevant offers or content that reminds them of your brand’s unique value proposition.

What Key Metrics Are Related to Customer Retention?

To gain a holistic view of customer loyalty, you should track several key performance indicators alongside your primary customer retention rate.

- Customer Lifetime Value (CLV): This forecasts the total net profit your business can expect to earn from a single customer throughout their entire relationship with your brand.

- Repeat Purchase Rate: This key metric calculates the percentage of your existing customers who have returned to make more than one purchase from your business over time.

- Purchase Frequency: This important metric measures how often your average customer completes a purchase from your business within a specific and defined timeframe, like a year.

- Average Order Value (AOV): This tracks the average monetary amount a customer spends each time they complete a transaction, providing insight into their purchasing behavior and overall value.

- Customer Churn Rate: As the direct opposite of the retention rate, this metric calculates the percentage of customers who cease being customers during a given period.

- Net Promoter Score (NPS): This powerful score gauges long-term customer loyalty by asking how likely a customer is to recommend your brand to friends, family, or colleagues.

- Customer Satisfaction Score (CSAT): This measures a customer's short-term happiness by asking them to rate their satisfaction level with a very specific product, service, or brand interaction.

- Customer Effort Score (CES): This assesses the ease of a customer's experience by asking how much effort was required on their part to get an issue resolved or a need fulfilled.

What Role Does Technology Play in Improving Customer Retention?

Technology is the core engine that powers modern customer retention, enabling businesses to shift from reactive problem-solving to proactive, personalized engagement at a massive scale.

Platforms like Flipkart Commerce Cloud (FCC) are essential for unifying vast amounts of customer data from disparate sources like your e-commerce site, CRM, and marketing tools. With this unified data, our platform leverages advanced analytics and AI to uncover deep insights into customer behavior, predict churn risk, and identify key opportunities for re-engagement.

This allows you to create highly targeted strategies rather than relying on a one-size-fits-all approach. FCC automates the delivery of personalized experiences that foster loyalty, ensuring every interaction is both relevant and timely, helping you build meaningful customer relationships.

Conclusion

Mastering your customer retention rate involves deeply understanding your customers and consistently delivering exceptional value. By focusing on a data-driven strategy built on personalization, proactive service, and strategic engagement, your business can cultivate a loyal customer base that drives profitability and ensures sustainable growth.

FAQ

You should calculate your CRR monthly or quarterly. This frequency provides actionable, timely insights into the effectiveness of your strategies and allows you to identify and respond to negative trends before they can significantly impact your bottom line or brand reputation.

Retaining existing customers is significantly more cost-effective. Widely accepted industry data shows that acquiring a new customer can cost between 5 to 25 times more than retaining an existing one, making retention an exceptionally profitable business strategy for any company.

Customer segmentation allows you to analyze retention rates for different customer groups, such as high-value shoppers, first-time buyers, or geographical location. This helps you identify which segments are most loyal and tailor specific retention strategies to their unique needs.

Achieving a 100% customer retention rate is virtually impossible for any business. Natural customer churn will always occur for reasons outside of your control, such as changes in a customer's financial situation, location, or personal needs. The goal is to maximize retention.

Early warning signs include a noticeable decrease in purchase frequency or average order values. You may also see a drop in email engagement, an increase in customer support tickets, or a decline in positive online reviews and social media mentions.