Table of Contents

- What is Price Perception?

- Understanding Price Perception

- 5 Psychological Factors Influencing Price Perception

- 7 Strategies to Influence Price Perception (Without Killing Margins)

- How to Measure Your Store’s Price Perception

- Optimizing Price Perception with Flipkart Commerce Cloud

What is Price Perception?

In competitive retail segments, the numerical value on a tag often matters less than the number formed in the customer's head. Success depends on understanding how shoppers internalize costs relative to the benefits received.

Price perception represents the psychological assessment of whether a product is a financial burden or a valuable acquisition, regardless of market reality. It functions as the filter through which the consumer ultimately processes every purchasing decision.

- Retailers must realize that shoppers make split-second decisions based on subtle cues rather than logical analysis.

- A high price might signal superior quality to one buyer while appearing as a rip-off to another.

- Effective management of this concept allows businesses to protect their margins while simultaneously boosting conversion rates.

This guide explores how aligning costs with consumer psychology drives sustainable growth and strengthens brand loyalty.

Uderstanding Price Perception

Price perception defines the customer's feeling about a cost independent of the actual monetary expense or production value. It relies heavily on the context in which the offer is presented to the target audience. Shoppers rarely know the true market price of an item and rely on visual signals.

Cheap is rarely a fixed price point but rather a feeling derived from the shopping experience. Expensive represents a disconnect between the financial cost and the perceived value of a product. Retailers must bridge this gap to ensure the price positioning aligns with customer expectations.

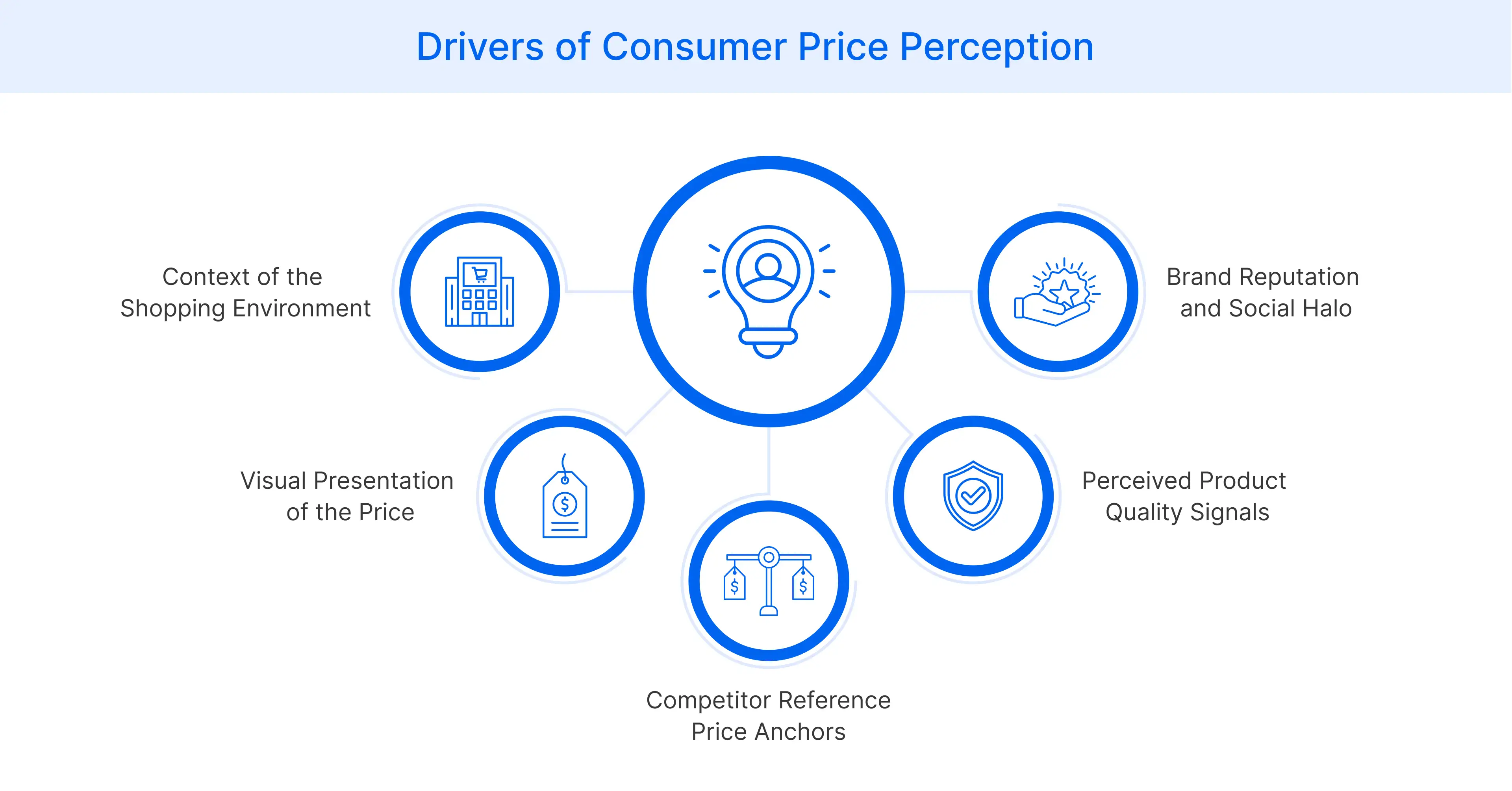

5 Psychological Factors Influencing Price Perception

Several distinct elements shape how a consumer views a price tag on a shelf. These factors determine if the cost feels justified or excessive in the consumer’s mind during the shopping journey.

- The Context Effect: Selling a soda at a luxury hotel warrants a higher price than selling it at a corner store. The environment alters willingness to pay because the consumer perceives added value from the location. This context plays a fundamental role in shaping the perception of value.

- The Reference Price (Anchoring): This concept explains how the first cost a customer sees dictates their feelings about subsequent options. A high initial reference price makes later prices seem like a good deal by comparison. This acts as a mental reference point for the buyer.

- The Price-Quality Inference: A low price can sometimes backfire by signaling low product quality to skeptical buyers. Consumers often associate a higher price point with better materials or better quality in the absence of other information. Luxury brands leverage this to maintain exclusivity.

- Visual Cues: Elements like font size or color significantly impact how painful a price feels to the viewer. Removing the currency symbol reduces the psychological pain of paying and encourages a faster decision. This creates a better price perception without changing the actual number.

- Brand ‘Halo’: Established leaders like Apple can charge a premium because their brand image adds intangible value. The social status associated with the logo justifies the product's cost beyond its functional utility. It transforms a standard purchase into a premium product experience.

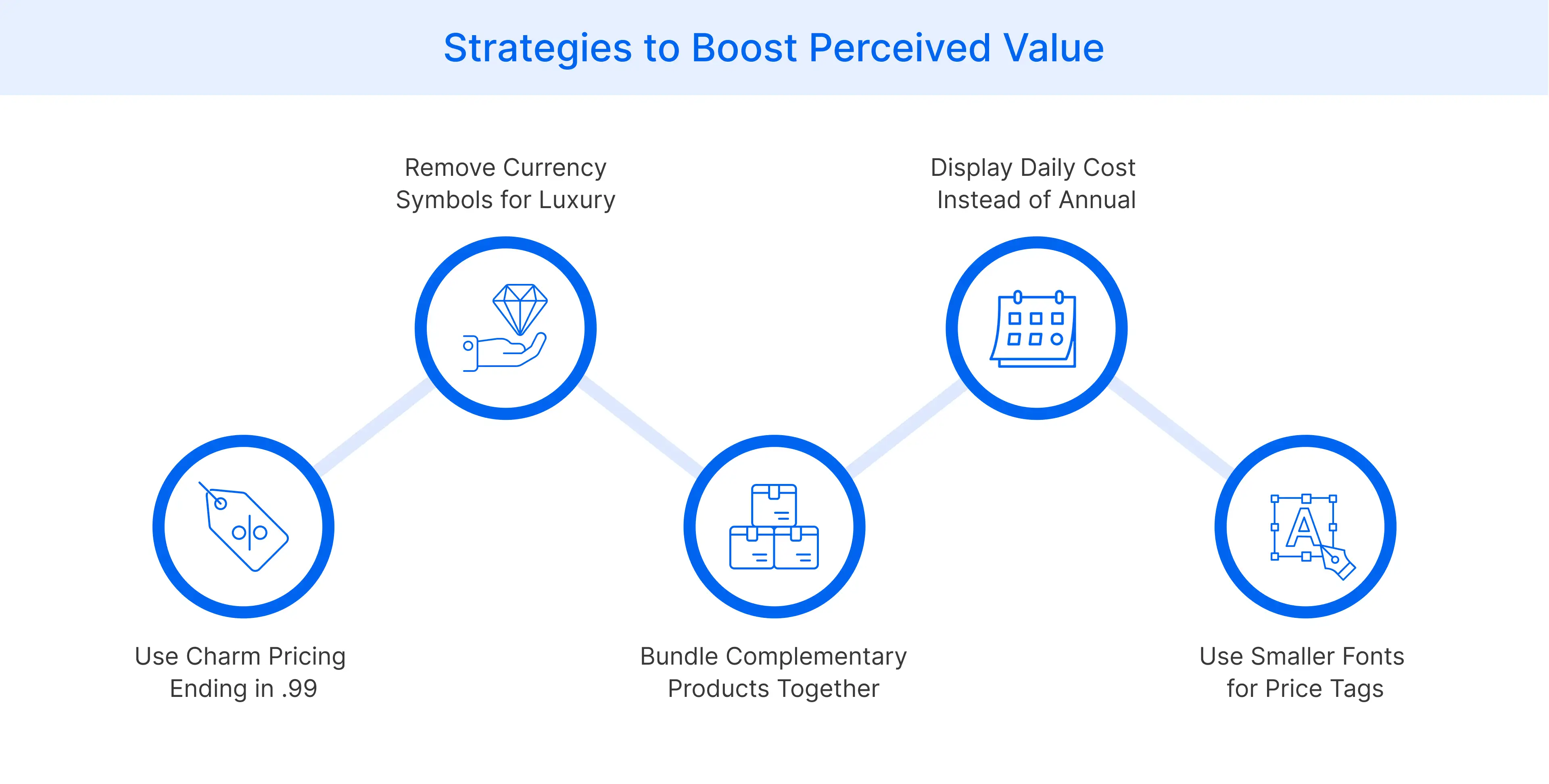

7 Strategies to Influence Price Perception (Without Killing Margins)

Retailers can implement specific tactics to shape value perception without sacrificing their profit margin. These strategies leverage consumer behavior to encourage spending while maintaining trust with the buyer.

- Master ‘Charm Pricing’: Prices ending in .99 trigger the left-digit bias, where $9.99 feels significantly cheaper than $10.00. This psychological pricing strategy makes the cost appear lower by reducing the leftmost digit that consumers read first. Charm pricing remains a staple in grocery store strategy.

- The ‘Decoy Effect’: Introducing a high-priced third option makes the middle option look like the best value. A movie theater uses a large popcorn to make the medium size appear as a sensible compromise for the buyer. This guides consumer perception toward higher-margin items.

- Change the Visual Magnitude: Research indicates that displaying prices in a smaller font size makes the numeric value feel smaller physically. This subtle visual trick reduces the perceived magnitude of the cost. It helps in presenting a better price visually to the shopper without changing the digits.

- Reframe the Value: Break down a large sum into manageable daily costs to make it seem affordable. Describing a service as pennies a day makes the total expense feel trivial compared to the annual fee. This is a great way to communicate a product's value.

- The Power of Bundling: Grouping items together obscures individual costs to create a feeling of a good value deal. This method increases the perceived value of a product mix while moving more inventory volume effectively. It is essential for efficiently managing key value categories.

- Ban the ‘Cents’: Removing decimals works well for high-end goods as it signals quality and sophistication. A flat $100 price tag looks curated, while $100.00 feels transactional or like a bargain-bin item. This tactic effectively supports a premium customer perception.

- Strategic Discounting: The Rule of 100 suggests using a percentage off for high-priced items and dollar amounts for cheaper goods. Saving $50 on a laptop sounds less impressive than 20% off, while $5 off works better for socks. This maximizes the perception of price savings.

How to Measure Your Store’s Price Perception

You must track how customers view your pricing to adjust your strategy effectively. Use these methods to gauge if your value proposition lands correctly with your target demographic.

- Surveys: Ask your customer base directly how they rate your prices compared to major competitors. Collecting this qualitative data helps you understand if you offer price fairness or if shoppers perceive you as expensive. This feedback is crucial for customer satisfaction.

- Competitor Benchmarking: Utilize tools to track price positioning rather than just the raw numbers across the market. This analysis reveals if your competitive pricing strategy aligns with the broader market demand. It helps you identify where you stand in a competitive market.

- Conversion Rate vs. Traffic: High traffic paired with low conversion often indicates a disconnect in price perception. Customers arrive interested but leave because the price does not match the perceived value of the item. This metric has a significant impact on sales volume.

Optimizing Price Perception with Flipkart Commerce Cloud

You cannot manually calculate the perfect psychological price for thousands of SKUs in a dynamic market. Attempting to manage this complexity without automation leads to missed opportunities, operational fatigue, and suboptimal margins for your business.

Enter FCC's Pricing Manager to revolutionize your approach. Our solution utilizes artificial intelligence to automate decisions. At Flipkart Commerce Cloud, help you find the sweet spot where volume meets profit without manual guesswork. You gain precision and speed in your strategy.

- ML-Powered Algorithms: The system uses game theory to analyze competitive prices and internal data simultaneously. It identifies the optimal price point that maximizes boost sales potential while preserving your brand integrity. It ensures sustainable growth through data.

- Real-Time Intelligence: Our platform adjusts to price changes instantly so your price perception never lags reality. It monitors competitor moves to ensure you always maintain a strong position. This is vital for managing price elasticity effectively.

- Dynamic Pricing Engine: The engine automatically tests various price points to determine what customers perceive as fair. This dynamic pricing strategy maximizes Gross Merchandise Value by aligning costs with real-time consumer psychology.

FAQ

The four main strategies include premium pricing, penetration pricing, economy pricing and skimming. Premium focuses on high value, while penetration aims for market share. Economy targets budget-conscious buyers, and skimming starts high and lowers over time. These align with psychological pricing strategies.

A classic example is selling popcorn at a cinema. The cost of production is low, but the perceived value is high due to the context. Customers pay a premium because the experience justifies the expense. It plays a crucial role in profitability.

Yes, a brand can alter its image through consistent marketing and improvements in product quality. Shifting from a budget option to a luxury player requires time. It demands a strategic overhaul of visual identity and price positioning.

The human brain processes numbers from left to right quickly. Seeing $19.99 registers as ‘19 and some change’ rather than 20. This small difference significantly impacts the purchasing decision by making the item feel cheaper. This drives a lower price perception.